UK house prices edge up despite slowdown in the capital

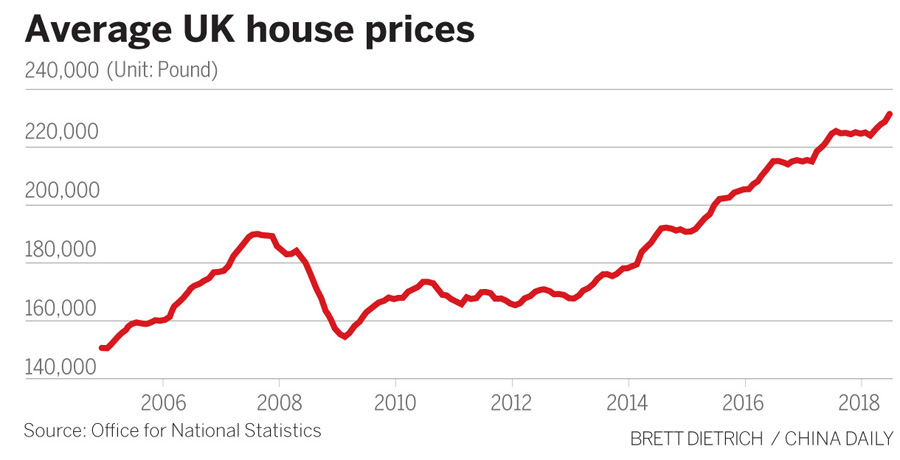

Average house prices in the United Kingdom increased by 2.8 percent in the year ending November, in spite of a slowdown in house price growth nationwide during the past two years.

The latest UK House Price Index shows London, where houses are much more expensive than the national average, experiencing a 0.7 percent fall in prices in the year to November.

The Office for National Statistics said the average UK home cost 231,000 pounds ($302,550) in November. The price tag was 7,000 pounds more than it was in November 2017. When the numbers are not seasonally adjusted, average house prices in the UK fell by 0.1 percent between October and November. That compares favorably with a decrease of 0.3 percent year-on-year between October 2017 and November 2017.

On a seasonally adjusted basis, average house prices in the UK increased by 0.1 percent between October and November, according to ONS.

The index shows house prices in England grew more slowly than prices in other parts of the UK. They rose by 2.6 percent in the year ending November, which was an improvement on the 2.3 percent growth in the year ending October. The average home in England now costs 247,000 pounds.

As for prices in other parts of the UK; in Wales they rose by 5.5 percent during the past 12 months to reach 161,000 pounds. In Scotland, the average price increased by 2.9 percent throughout the year to reach 151,000 pounds. And the average house in Northern Ireland now costs 135,000 pounds, which is 4.8 percent more than a year earlier.

Within England, at the regional level, the West Midlands saw the biggest growth, with prices increasing by 4.6 percent in the year to November. This was followed by a 4.4 percent rise in the East Midlands.

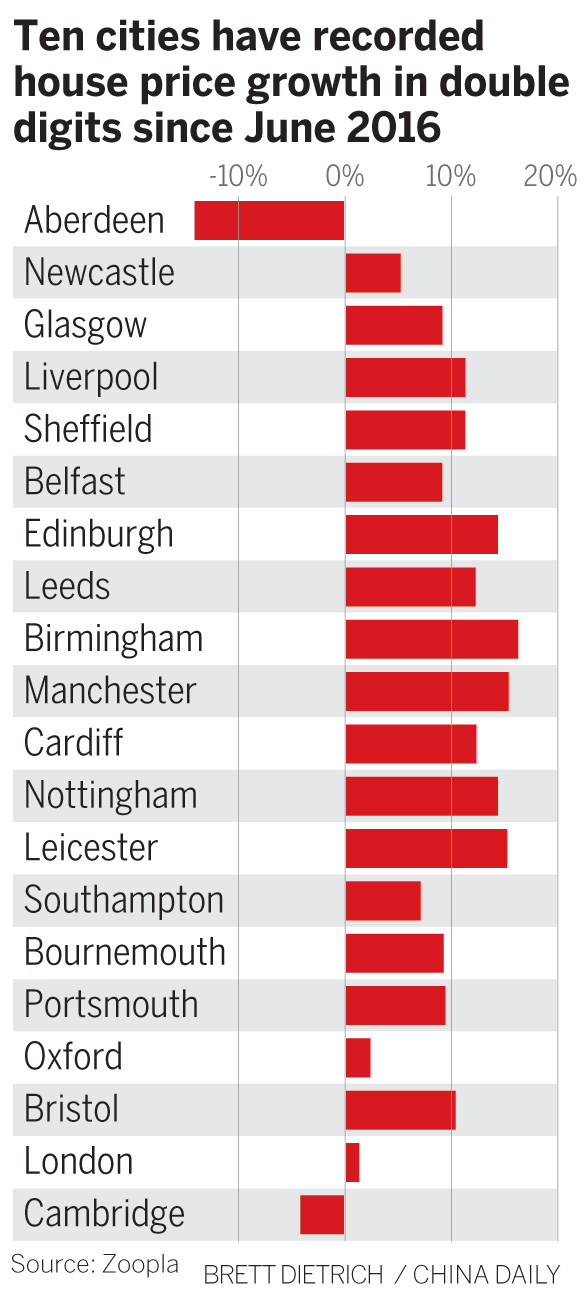

In London, prices fell by 0.7 percent during the year, and have now shrunk each month since July 2018. The Bank of England says in its November inflation report that the slowdown in London that began in the middle of 2016 is likely down to the area being disproportionately impacted by regulatory and tax changes, and also by lower net migration from the European Union.

While London house prices have fallen, the UK capital is still the most expensive part of the UK to buy a home, with average homes selling for 473,000 pounds. The second and third most-expensive regions, the South East and the East of England, have average homes selling for 324,000 and 295,000 pounds respectively. The North East continues to be more affordable, with homes selling for an average of 132,000 pounds. It was the only English region to report selling prices that were higher than they were before the peak of the economic downturn.

Shaun Church, a director at mortgage broker Private Finance, told the BBC: "House price performance remains incredibly varied across the UK. London is the only UK region experiencing falling prices, as buyers increasingly look to the commuter belt for more affordable properties."

Richard Donnell, the research and insight director at Zoopla, told the Guardian: "House prices in London have been falling for almost 12 months while the rate of growth has slowed in cities across southern England, a result of growing affordability pressures, higher transaction costs and increased uncertainty. The strongest performing cities are outside south-eastern England where affordability remains attractive and employment levels are rising. We expect current trends in price growth to continue across the rest of this year, with prices rising in line with earnings for much of the UK but lower growth and some house prices falls in London and the south.

Donnell predicted London will continue to see house prices fall, with shrinking prices concentrated in inner London, where they have grown the most during the past decade.

"Prices continue to increase slowly in the more affordable outer and commuter areas of London," he added.