Tax cuts will be stepped up

Proactive fiscal policy to continue, conference agrees

China's annual tone-setting Central Economic Work Conference concluded on Friday, with participants agreeing to step up tax cuts and keep monetary and fiscal policies more accommodating to support growth, according to a statement published by Xinhua News Agency.

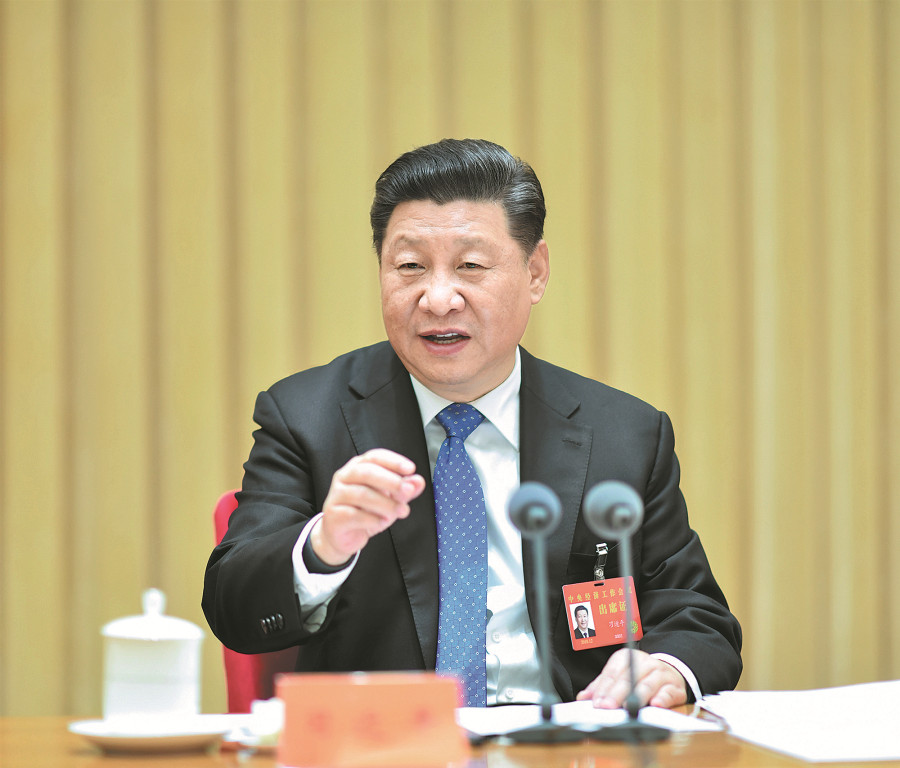

Policymakers at the meeting, which was presided over by President Xi Jinping, also agreed to continue to push all-around opening-up next year and protect the legitimate interests, especially intellectual property rights, of foreign enterprises.

Analysts said the tax cuts and more proactive fiscal and monetary policies will help stabilize GDP growth of the world's second-largest economy next year.

The meeting said the authorities should implement reductions in taxes and fees on a "larger scale" and substantially increase the size of local government special bonds.

The country's fiscal policy will remain proactive next year but should be stronger and more efficient, the conference said.

Bai Jingming, vice-president of the Chinese Academy of Fiscal Sciences, told China Daily that a more aggressive tax- and fee-cut plan will focus on both the corporate sector and households, which will improve business sentiment and increase individual incomes.

"The measures listed by the meeting will improve confidence of entrepreneurs, encouraging them to increase investment, as well as encourage consumption of individuals," he said. "The fiscal policy will be very significant in boosting domestic demand and stabilizing economic growth in the next year," Bai said.

As local governments are encouraged to issue more special bonds next year, financing for infrastructure construction will speed up, which will be a key measure in implementing the proactive fiscal policy, he added.

Monetary policy should be "prudent" and strike an "appropriate" balance between tightening and loosening, according to Xinhua.

The term "neutral", which appeared in the wording of previous high-profile meetings describing monetary policy, was dropped from Friday's statement — a change that analysts said signals moderate loosening of the monetary policy stance.

The loosening would help maintain sufficient liquidity in the financial sector, which could keep corporate financing costs at a lower level, said Guan Tao, a researcher at the China Finance 40 Forum and a former senior official with the State Administration of Foreign Exchange.

Policymakers should keep liquidity reasonable and sufficient, improve monetary policy transmission, boost the ratio of direct financing and address funding difficulties for companies, according to the statement.

Guan told China Daily that the monetary policy will play a large role in offsetting economic slowdown risks as liquidity is kept at an appropriate and reasonable level.

To anchor growth, participants at Friday's conference vowed to support jobs, trade and investment and resolve financing difficulties for small and private companies, while curbing risks and financial market volatility, according to the statement.

China will also continue to pursue high-quality development, expand the domestic consumption market, boost rural development, promote balanced regional development, accelerate economic system reforms and improve people's livelihood, the meeting agreed. The country will also take measures to support growth of private enterprises and allow foreign companies to operate independently in more fields, the statement said.

Contact the writers at chenjia@chinadaily.com.cn

- Tianjin launches youth program to cultivate university talent for tech market

- Local farmers combat desertification in Moyu county of Xinjiang

- N China's Hohhot launches winter amusement programs to boost local economy

- Viral app bares 'safety anxiety' among solo dwellers

- Research suggests causes of moon's two different 'faces'

- AI software under lens for facilitating porn talk