Buy-back amendment aims to buoy stock market

China is expected to make it easier for listed companies to buy back shares, another policy measure to shore up market confidence after stocks declined more than 20 percent this year.

The revision mainly applies to Article 142 of China's Corporation Law, which regulates share repurchases.

In the latest version, two new allowable reasons for stock repurchases were added-"to avoid significant damage to the company and safeguard company value and shareholders' equity" and "to convert stocks into convertible bonds".

The government will streamline the process of obtaining approval for buybacks, according to a draft version of the Corporation Law submitted for revision on Oct 22.

The draft also includes terms refining details regarding the repurchase of shares.

The National People's Congress Standing Committee, China's top legislative body, was expected to introduce draft amendments to a number of laws during its five-day session.

"The revision regarding regulations on share repurchases has become essential, as it is expected to provide strong legal support for the establishment of a long-term incentive mechanism and the improvement of the quality of listed companies," says Liu Shiyu, chairman of the China Securities Regulatory Commission. "Such efforts are essential under the current situation, and will be helpful in stabilizing market expectations."

The latest revision to the law, which follows a number of coordinated moves by the nation's top financial regulators, is another step that is expected to boost the stock market amid concerns over pledged-share risks, which could lead to further declines.

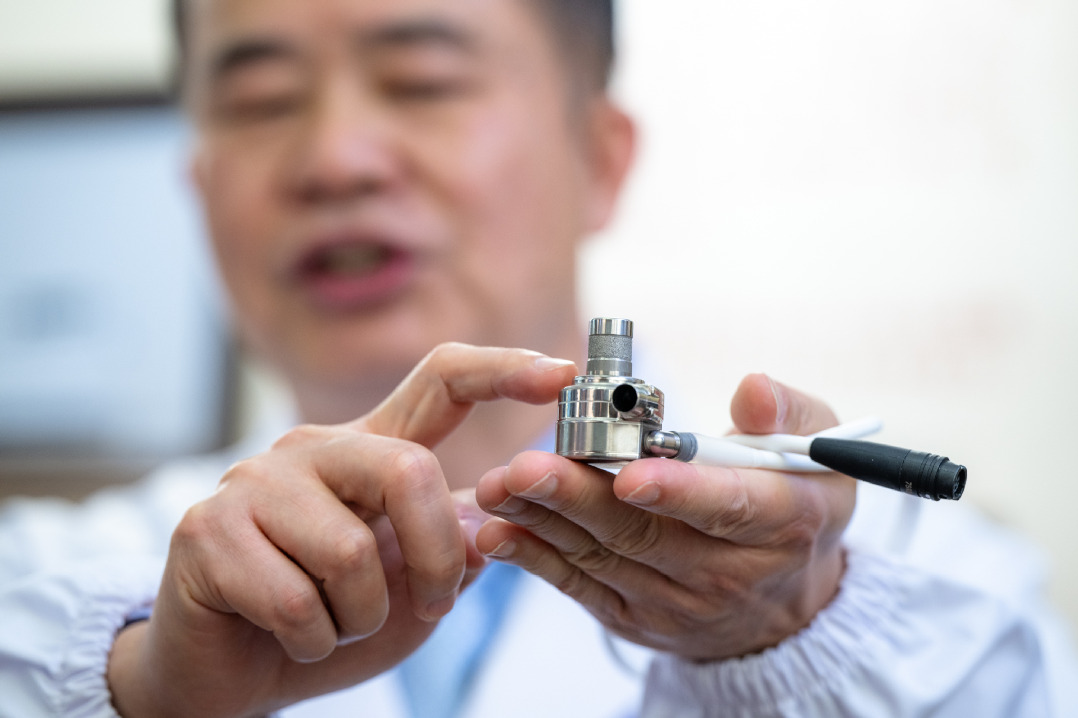

Buying back stock, which reduces the number of shares outstanding, is expected to improve the earnings per share ratio because the company's annual earnings are then divided by a lower number of outstanding shares.

The revision comes at a critical moment, as the repurchase of shares plays an important role in improving the quality of listed companies and the revision is expected to further protect the rights and interests of listed companies and investors, says Li Daxiao, chief economist at Yingda Securities

Meanwhile, the government will use multiple tools to provide more policy support to promote the healthy development of the financial market, Liu said at China's Fund Industry 20th Anniversary Forum held by the Asset Management Association on Oct 22.

For instance, the government will further encourage private equity and venture capital funds to participate in corporate mergers and acquisitions, debt-to-equity swap programs and equity financing. The government will improve the financing facilities of listed companies, improve the governance structure of listed companies and effectively prevent pledged-share risks, Liu said.

Today's Top News

- Compromise, retreat will only embolden bully: China Daily editorial

- Trade unions mobilizing workers for modernization

- Xi urges all-out efforts to treat the injured in restaurant fire in Liaoning province

- Xi visits New Development Bank

- Xi inspects AI industry in Shanghai, calling for its development

- US to heed the voice of business for stable economy