Signal economics

China Reform and Opening – Forty Years in Perspective

Signal economics

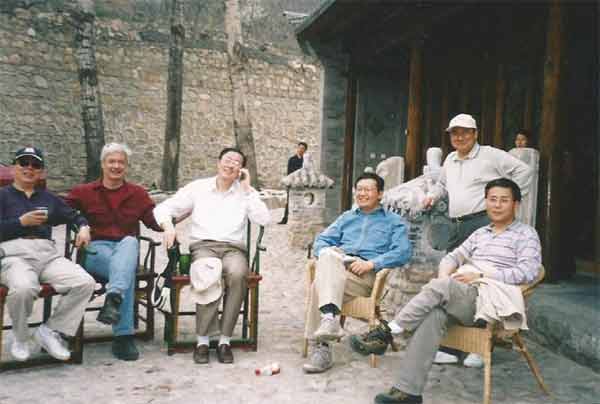

Editor's note: Laurence Brahm, first came to China as a fresh university exchange student from the US in 1981 and he has spent much of the past three and a half decades living and working in the country. He has been a lawyer, a writer, and now he is Founding Director of Himalayan Consensus and a Senior International Fellow at the Center for China and Globalization.

He has captured his own story and the nation's journey in China Reform and Opening – Forty Years in Perspective. China Daily is running a series of articles every Thursday starting from May 24 that reveal the changes that have taken place in the country in the past four decades. Keep track of the story by following us.

Crisp autumn leaves whirled as I walked through the tranquil yet stoic garden walkways of the Zhongnanhai complex leading to the 1950s era building that housed offices of the State Council Office for the Reform of Economic Systems (SCRES). During the critical reform years of the late 1990s entering into the first part of the new century, key strategic policies concerning the restructuring of China’s economic system were blueprinted here.

Premier Zhu Rongji oversaw the reform process throughout the critical transition years of transition. Interestingly, Zhu’s own background was in state planning having helped establish the early state-owned enterprise system in the Northeast during the 1950s. His oversight of the transition to market was assisted by a dream team of economists, who all came from the SCRES offices and would each in turn become a key figure in the marketization of China’s economic structure, and hold minister rankings in their own right.

There I was received by vice minister Li Jiange of the State Council Office for Reform of Economic Systems, who had served as chief monetary policy advisor to Premier Zhu Rongji from the time Zhu was entrusted with economic and financial matters as vice premier in the early 1990s. Li Jiange was in fact one of the key architects of Premier Zhu’s hallmark "macro-control system" for reforming and opening China’s economy. He was one of the master architects drawing up the blueprints.

Li explained how the tools of the market economy are essential to open up the arteries of free-flowing capital, free-floating prices, and the circulation of commodities and the financing required for an economy to really grow. But at the same time, China was cautious of the market fundamentalism that had become known to the world as "shock therapy" or the "IMF medicine." Where extreme market policies were applied to shock an economy, outcomes resulting could be inflation, debt, economic collapse and with it social disorder. These events had played out consistently in most countries adopting policies of market shock as dictated by Washington based institutions such as the World Bank.

So in order to introduce the market economy, Li explained, the Chinese government had adopted a strong hand of planning to rebalance the market reforms when the market became overheated or out of control. Managing the psychology of Chinese people was as important as the actual theoretical restructuring of the economy as the question of how people react, or moreover, how to make them react in certain ways to the policies introduced, played a key role in the decision-making process of policies coming out from the SCRES offices in Zhonghanhai.

The model that had emerged for a managed marketization of China's economy has involved was called the "macro-control system" and involved the following key mechanisms:

introducing the tools of monetary and fiscal intervention

accepted and applied in developed-market economies, while at

the same time using the old command tools of planning to make

the new tools work in a transitional setting;

anticipating "mass-movement economics" or patterns of aggregated social reaction to new economic opportunities arising from the reforms and applying "signal economics" at the key critical time to send the hard messages required to make popular reaction to the market shift direction or in short calm the market;

maintaining a vision, observing changes in the situation carefully, moving consistently toward critical objectives, having change as a constant, though not disruptive, force in the system, and sometime setting targets higher than reachable, with the intention of getting half way.

From the time of its implementation in the mid-1990s, this fusion economic approach had the effect of: controlling inflation, untangling triangle debts, rationalizing the banking and financial sectors, steering China through the Asian financial crisis, shifting the export-based economy towards a growth model that will rely also on domestic consumption.

But the question remained, how do you define "signal economics"? Li Jiange explained by using Beijing's road system as an example. Li pointed out that Beijing's roads are all new, modern paved roads with bridges and connecting off-ramps and on-ramps. The signage is clear, green and white, just like major highways and roads in America. In fact, Beijing has effectively copied the same style of signage, traffic lights and pedestrian walkways. To boot, there are special paths for bicycles, which sometimes overwhelm the streets in China. Yes, the hardware seems to be nearly perfect. There are very clear and precise laws and regulations on how everybody should drive and behave on the road.

The problem is that nobody follows the rules. Despite the clarity of road rules, signage and delineated road structures and arteries, anybody driving down the streets of Beijing at any time of the day will find themselves hit by an onslaught of bicycles, motorbikes, crossing the street where they should not, zig zagging across the roads, often against the traffic. Adding to the problem are the pedestrians who do not follow the rules of crossing and the drivers who couldn't care less about the pedestrians. The drivers weave in and out, cut each other off, speed wherever they can, and generally behave like 16-year-olds who have just learned to drive and want to let everyone know this. If there is an accident, everybody stops to watch or join in the ensuing arguments, causing further traffic jams and chaos.

This is how the economy has evolved during the transition period, Li explained. While the rules and regulations, which should free up the arteries of a market economy have been put in place, nobody wants to follow them. For historical reasons, following the rules is not part of the new business consciousness, which is often trying to outsmart the rules. So, as with Beijing's traffic, at every circle, crossroad and intersection of economic life there must be officials to manage the traffic flows, to ensure that people follow the signs, to enforce the rules and penalize those wanting to go their own way. Later CCTV cameras had to be added to every intersection, pointing in every direction to record traffic demeanors.

Such is the model that evolved in managing China's economy in transition. The command tools of planning had to be applied with free-flow market economics; otherwise the rules would just not be followed. Anybody who has spent any time in Beijing traffic will understand this analogy. That is why in economies of transition, planning is needed to manage the market.

Please click here to read previous articles.