The next big name in beauty

It seems only a matter of time before a truly global premium cosmetics brand emerges from China.

The face of the Asian beauty industry is changing. Cosmetics counters used to be chock-full of US and European brands. Then Japanese and South Korean companies began to cash in on the region's growing beauty needs.

Now Chinese brands are making moves to be the next big thing in beauty.

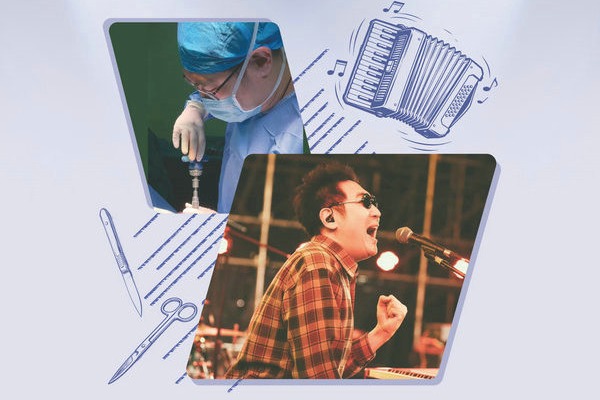

The direct sales company Yofoto recently tapped the Canadian biotech company RepliCel Life Sciences' cell therapy technology for skin rejuvenation products and dermal injectors in a deal worth millions.

As the middle class in China continues to expand and the country moves from a factory-based to innovation-based economy, "the demand for aesthetic treatments is growing exponentially", said Lee Buckler, president and chief executive of RepliCel, which had previously worked with the Japanese brand Shiseido on developing hair loss products.

"The concept of regenerative medicine and autologous cell therapy resonate well with traditional Chinese medicine, creating industry demand for these kinds of products," Buckler said.

Yofoto is also putting its hopes on RepliCel's advances in injection devices that could boost beauty consumerism in China.

"Because the device promises to enable new treatments for fine wrinkles, it has the potential to trigger an increase in the sale of more dermal fillers for use in these procedures, resulting in a boon to the suppliers of those products," Buckler said.

It is these kinds of deals that drive Chinese brands to stake their claim in the beauty industry, and some say they are already seeing strong numbers.

Pascal Martin, partner at OC&C Strategy Consultants, cited Herborist, Chando and Proya among Chinese brands already starting to taste success.

Chinese brands made up 23 percent of the total sales in China in 2011, Martin said, and this rose to 35 percent in 2015 and eventually 37 percent in 2016.

Chinese beauty brands now mostly focus on gaining a foothold in the mid-level and entry-price range markets, he said. The premium sector is now dominated by French, South Korean, US and Japanese brands.