Report: China FDI in US saw large drop in 2017

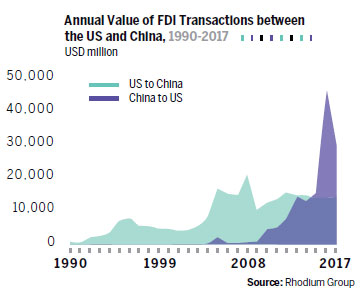

Chinese foreign direct investment (FDI) in the United States dropped precipitously in 2017, according to a new report.

The value of completed Chinese FDI transactions declined by more than a third, and that of newly announced deals fell by more than 90 percent last year, according to the report, "New Neighbors", released by the National Committee on US-China Relations (NCUSCR) and the Rhodium Group on Tuesday in Washington.

The decline was mostly the result of policy shifts in the US and China rather than commercial dynamics, the report concluded.

The increasing politicization of the US business environment led to the drop, said Zhao Zhenge, general representative of the China Council for the Promotion of International Trade (CCPIT) USA.

"The (Section) 301 investigations and the tightening of CFIUS scrutiny made it more difficult for Chinese companies to invest in the US," Zhao said.

In March, the US trade representative's Section 301 decision threatened unspecified action on Chinese investment in high-tech sectors.

The Committee on Foreign Investment in the United States (CFIUS) has enhanced its scrutiny of Chinese acquisitions in the US, which has led to an estimated $8 billion in deals being abandoned, according to the report.

CFIUS rejected about 20 deals from China last year, citing national security concerns, according to Zhao.

"It's a false choice that we have to compromise between national security and large numbers of deals. We can have both," said Daniel H. Rosen, founding partner of New York-based Rhodium Group.

Looking ahead, CFIUS reviews may become even more complicated. The Foreign Investment Risk Review Modernization Act (FIRRMA) is advancing on Capitol Hill and appears likely to come to a vote this year.

China epitomizes one of the "countries of special concern" that the bill is concerned with; the measure would expand the types of transactions subject to screening, the report said.

"The US side needs to make sure their markets remain open. The threats that we are making, to impose tariffs, to close investment, to restrict students, hurt the US. They are not good policies," said Stephen Orlins, NCUSCR president. "The US should deregulate policies on high-technology transfer and export."

Meanwhile, the US should leave a more open environment with less political or national security concerns for foreign investment, including Chinese investment, Zhao said.

Only under such circumstances can trade and investment between the US and China maintain a healthy and mutually beneficial development, he said.

"As the Chinese economy integrates into the global economy, Chinese enterprises have expanded and upgraded their visions to a global level. Chinese enterprises have also become more rational in conducting overseas investment," Zhao said.

In August 2017, China's State Council released guidelines to promote the healthy growth of overseas investment and prevent risks.

According to the guidelines, China will support eligible domestic enterprises to make overseas investments and join the construction of projects in the Belt and Road Initiative.

Overseas investments that run counter to peaceful development, win-win cooperation and China's macro control policies will be restricted.

Investments on the restriction list include real estate, hotels, entertainment, sports clubs and outdated industries.

Investment in "real economy" sectors, on the other hand, held up well or even increased in 2017.

For example, information and communications technology, along with the health and biotech sectors received significant Chinese investment, the report said.

The impact from the reduced FDI activity was felt on the local level, with planned greenfield projects delayed and fewer jobs added, the report said.

In all, there were up to 160,000 American jobs associated with Chinese business ownership in the US, according to Thilo Hanemann, director at Rhodium Group.

The 2018 outlook is uncertain. The new policy approaches in the US are unlikely to be reversed anytime soon, suggesting that lower levels of investment will persist in the near term, the report said.

Guo Fengqing and Yian Ke in Washington contributed to the story.