Will investment boom follow US tax bill?

The largest tax cut bill introduced by US President Donald Trump and passed by the Senate by a 51-49 margin on Saturday will remodel multinational taxation rules and temporarily reduce personal income tax. The proposal to reduce the corporate tax to 20 percent, if implemented, will have profound global economic repercussions, as it could lead to a "tax reduction war" among economies, especially among Western countries that have similar corporate taxation structures.

The bill aims to lower US companies' tax burden and sharpen their competitive edge in the global market. It is also expected to help many global corporations, including those from China, to invest and operate in the United States. And it could encourage foreign companies which are already operating in the US to consolidate their presence there.

In the short term, the proposed tax cut will benefit small and medium-sized businesses in the US, and thus increase employment and stimulate economic growth.

But in the long run, the US tax bill carries significant risks, and one of them is the fear of the economy spiraling downward. Companies and individuals alike have always welcomed a tax cut. In contrast, governments always prefer to increase the tax rates, at least in certain areas, in the long run, because lower tax revenues mean a "poorer" government that would have to reduce its expenditure. And once a government reduces its expenditure, especially on public amenities and welfare, it will have a huge impact on the companies' operations, which will further reduce the tax revenues. This in turn could reduce personal incomes as well as employment opportunities.

However, it is anticipated that the proposed tax cut will prompt more multinational companies, including those from China, to invest and operate in the US. Still, such a conclusion needs further scrutiny.

First, the 20 percent corporate tax cut is not attractive enough. Many multinational companies have for years preferred to register their businesses in "tax havens" such as the Cayman Islands, British Virgin Islands and Bermuda, where tax rate, whether it is income or corporate tax, is de facto zero. In these so-called tax havens, the provision for dividend distribution is highly flexible, allowing the registered companies to distribute the dividends and profits among shareholders. Such a provision is preferred by major as well as minor shareholders.

Some 80 percent of the controlling shareholders of Chinese multinational companies, including giants such as Alibaba, Tencent and Baidu, are registered in the Cayman Islands. Hence, the high taxes in the US even after the proposed tax cuts and its relatively stringent company laws will not induce Chinese companies that are registered in the so-called tax havens to shift their base to the US.

Second, a number of European countries, such as the Republic of Ireland, whose 12.5 percent corporate tax would still be lower than the US' even after Trump's tax cut and which has more flexible tax laws, would be more attractive to multinational companies. This is one of the reasons why in the past several years Ireland has attracted more than 1,000 companies to invest in the country, and about 700 of them, including tech-giants such as Google, Microsoft and Facebook, have made Ireland their European headquarters.

When the US' 20 percent corporate tax is compared with Ireland's 12.5 percent tax, how many US companies would return to their home country is anybody's guess. Given this fact, we can conclude Trump's tax bill is essentially a reward for those foreign companies that have already invested and are operating in the US, or for those US companies that never left the homeland. It could also be an incentive for US companies operating in foreign countries to return to the home country.

Perhaps the most important message the US tax bill conveys is that in the 21st century, when almost all economies are interconnected, an action taken by one government without considering its global impact, such as Trump's tax cut bill, could have "unintended consequences".

Feng Dahsuan is a senior advisor to China Silk Road iValley Research Institute and former vice-president for research at the University of Texas, Dallas, and Liang Haiming is chairman and chief economist of China Silk Road iValley Research Institute.

Today's Top News

- Xi calls for better synergy with Russia

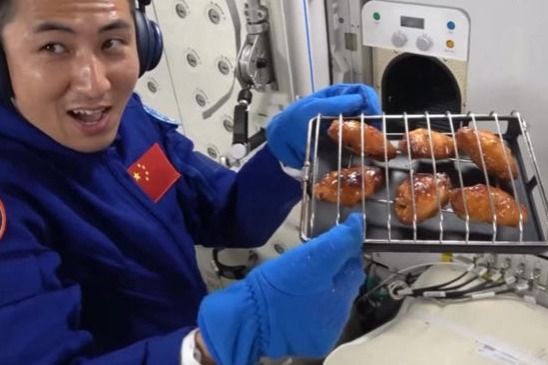

- Chinese astronauts savor grilled chicken, beef in space

- Synergy of blueprints with Russia stressed

- CIIE a platform for cooperation and innovation-driven growth: China Daily editorial

- 'Microphone diplomacy' should be shunned: China Daily editorial

- China urges Netherlands to responsibly resolve Nexperia issue