Financing the new investment frontier

Banks step forward to oil the wheels of exploration in Africa

The potential of Africa's oil and gas sector has not only attracted local private companies that want to partner with their Chinese counterparts, but financial institutions as well. Standard Bank Group, Africa's largest bank by assets - trading as Stanbic Bank - sees it as a new growth frontier.

In partnership with the Industrial and Commercial Bank of China, the bank is looking at enabling private Chinese companies to jointly invest with African companies in oil and gas.

Wang Lubin, chief representative officer for ICBC and a board member of Standard Bank Group, says the two institutions are well placed to play a leading role in the development of the sector.

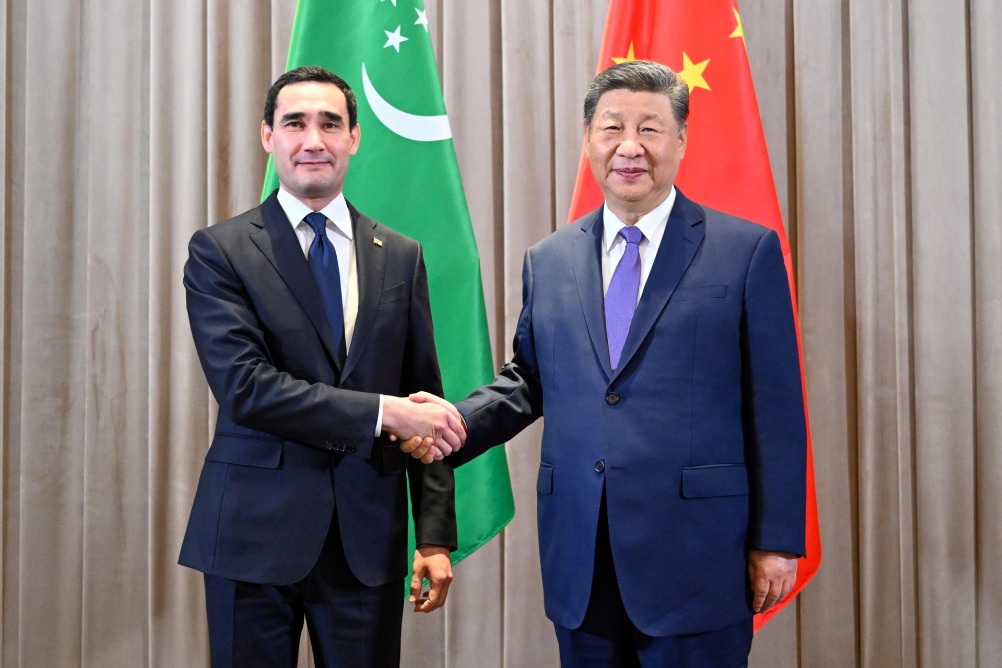

| Wang Lubin, the chief representative officer for ICBC and board member of Standard Bank Group, participates in an oil and gas conference in Uganda on August 18. Provided to China Daily |

"We have been working with government and the companies that are executing a number of critical oil-related infrastructure projects and have vast experience working together on large-scale projects across the continent," he says.

To date, Standard Bank and ICBC have jointly financed deals worth around $15 billion between Africa and China.

In Uganda, which claims East Africa's largest oil and gas reserves, Stanbic Bank Uganda is strategically placed to play an active role in the new investment frontier.

Uganda's oil and gas sector is expected to attract investment of about $14 billion, with the majority directed toward infrastructure development.

This includes the Uganda-Tanzania crude oil pipeline, for which Stanbic Uganda was recently appointed alongside Japanese bank Sumitomo Mitsui as a joint financial adviser for the 1,445-kilometer project.

The two are expected to raise capital amounting to $3 billion for the project. Ugandan President Yoweri Museveni and Tanzanian President John Magufuli commissioned the construction of the $3.5 billion pipeline last month.

According to Patric Mweheire, chief executive of Stanbic Bank Uganda, many projects are underway, several tenders are being submitted and expectations are that the final investment decision for the pipeline project will be made in the first quarter of next year.

"Stanbic Bank is best placed to unlock the potential of Uganda's oil and gas sector because we have the largest network coverage in Uganda in terms of branches and ATMs. We also have the biggest deposit book (2016 market share of 19.6 percent) and the biggest loans and advances book (2016 market share of 19.7 percent)," he says.

Mweheire says Uganda is at a critical point for its economic future, and the confirmation of commercially viable quantities of oil and gas has created great interest. It could be a game changer for the transformation of the country's economy, he says.

According to a Stanbic Bank statement, the institution's international reach comprises a network of specialist oil and gas teams spread across the world's key financial centers and the major oil producing countries in Africa.

These teams provide financial solutions to businesses in the oil and gas value chain, from upstream through to midstream and downstream. This and the bank's strategic focus and in-depth local knowledge, it says, uniquely position it to be the investor's ideal financial partner in Uganda.

"We have strong sector and product knowledge, and we understand the unique character of business in Uganda, from banking, transaction and regulatory requirements, to the players and opportunities," the statement says.

Oil and natural gas are expected to be in particularly high demand by 2025, with global oil consumption demand projected to rise by 57 percent, according to the African Development Bank.

Stanbic Bank Uganda is a member of the Standard Bank Group, Africa's largest bank by assets. The group reported total assets of $128 billion as of December 31, 2015, while its market capitalization was about $11.8 billion.

edithmutethya@chinadaily.com.cn

(China Daily Africa Weekly 09/29/2017 page8)

Today's Top News

- Multifaceted partnership has entered a new stage

- Global firms optimistic about China's market potential

- Xi calls for de-escalation of tensions in Middle East

- China-Central Asia Spirit forged

- 'China-Central Asia Spirit' drives pursuit of harmony, unity, happiness and prosperity

- Xi says China ready to work with all parties to play constructive role in restoring peace, stability in the Middle East