Europe should pay heed to trade dispute

It will have a far-reaching impact beyond the geographical scope of the Asia-Pacific region

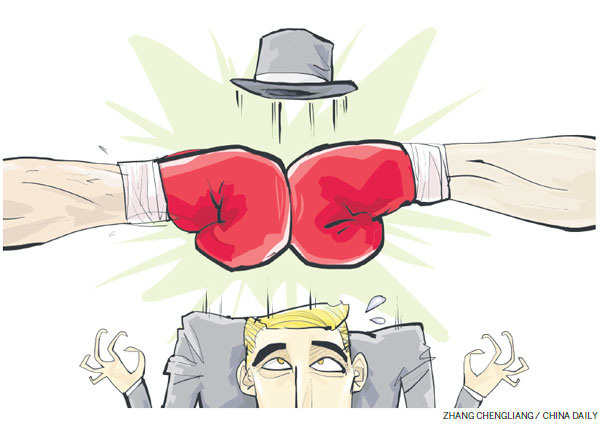

In August, the Office of the US Trade Representative formally initiated a Section 301 investigation into China's intellectual property practices. According to the USTR, the investigation will last up to 12 months and could lead to certain retaliatory actions against China, depending on its conclusion.

The unilateral move by the US government is widely regarded as President Donald Trump's first shot at China, which is also the second-largest economy in the world and the largest trade partner with the United States. International observers should not be surprised at this decision of the USTR, given that Trump has waved a big stick of trade war for a long time. Indeed, it is reported that the investigation would have come a little earlier if Trump hadn't sought China's cooperation for the recent UN sanctions against the Democratic People's Republic of Korea.

It is noteworthy that the investigation is based on Section 301 of the Trade Act of 1974, an outdated legal weapon for the US to solve disputes with its trade partners. After its inception, Section 301 was frequently used in the 1980s and 1990s before the creation of the World Trade Organization. However, after the WTO established its multilateral solution mechanism for trade disputes, the US government seemingly shelved Section 301, due in part to its trade partners' strong opposition. As one of the leading founders of the WTO, the United States refrained from applying Section 301 in its trade disputes with other countries while subjecting these disputes to the WTO for resolution.

Moreover, it is reported that Trump is seeking to impose punitive tariffs on steel imports from China, despite China's pledge to voluntarily cut production capacity of its domestic steelmaking sector over the next few years. The attitude of Trump toward this case is discouraging, since China has already started a 100-day trade negotiation with the US, which has born some early fruit such as the lifting of the decade-old ban on beef imports from the US and further opening China's domestic financial market to US investors. Now it seems that China's efforts in this respect failed to stop Trump from raising his asking price again.

This grand dispute between China and the US has a far-reaching impact beyond the geographical scope of the Asia-Pacific region. Across the Atlantic Ocean, the European Union is warily watching the wrestling between the world's two largest economies. Indeed, Europe has good reason to heed the Sino-US trade dispute.

First, China and the US are the EU's two largest trade partners. If the trade dispute between them escalated to a trade war, it would generate a strong spillover effect to Europe. According to traditional international trade theory, a trade war between two countries could lower the income of both, which, as a consequence, tends to weigh on their imports from the rest of the world, especially for large trade partners such as the EU.

Complicating the situation is the pivotal role of the global supply chain in today's international trade and China's central position along the global supply chain. Indeed, a considerable amount of China's imports are intermediate goods and capital goods, with which Chinese domestic manufacturers produce final goods and then export to other countries, in particular to the US.

If China's exports were to decline substantially due to punitive measures from the US, it is expected that China would have to reduce its imports of intermediate goods and capital goods proportionally. For some EU countries such as Germany and France, capital goods (for example, high-quality mechanical equipment) account for a bulk of their exports to China due to their comparative advantages in these areas. As such, a significant decline in China's exports to the US caused by any US unilateral punitive measures would lead to adverse second-round effects on the EU's exports to China. Things would become worse if China retaliated against the US with similar punitive measures on US exports to China.

Second, the European countries will not be able to breathe a sigh of relief even if the US and China compromise to avert a worse trade war scenario. It is more likely that China's authorities would make more concessions to the US demand for opening China's domestic market to US investors. Indeed, China had been negotiating for a bilateral investment treaty with the United States for several years before Trump took office and showed his lack of interest in such an agreement. Ironically, currently increasing pressures from the US side could accelerate the realization of some items sought under a Sino-US BIT.

However, such an outcome could put European enterprises at a disadvantage compared with their US competitors in tapping China's vast domestic market. For a large market like China, the first-mover advantages can be enormous.

Last but not least, although China is set to become the first victim of Trump's belligerent trade policies, the EU could be the next. By reactivating Section 301, Trump has demonstrated his tendency to target those countries to which the United States has large trade deficits. Taking the EU as a whole, it has the second-largest trade surplus with the US after China. In particular, a number of EU members are among the top 10 countries with the largest surplus with the US, namely Germany (the third-largest after China and Japan), Ireland (the fifth-largest) and Italy (the seventh-largest).

European countries also have bitter memories of Section 301. Before creation of the WTO, the United States frequently used Section 301 against European countries. In particular, among the 116 cases of Section 301 cases during the period of 1974-97, 38 were against the European community and its member countries. If Trump insists on his bilateral (or, more, precisely unilateral) way to solve trade disputes, the EU and its member countries are very likely to fall prey to the notorious Section 301 again.

In conclusion, Europe should pay due attention to the current trade dispute between the United States and China, given its potentially strong impact and implications for other countries. Trump's trade policy has posed a serious threat to the existing global trade system and its institutions that have successfully generated the prosperity of international trade over the past two decades. Europe should proactively manage the risks associated with this new uncertainty in international trade. In this respect, it looks like a wise idea for the EU to accelerate a bilateral investment treaty with China to contain potential damage.

The author is chief economist for Asia at BBVA Research and a senior research fellow at Renmin University of China's International Monetary Institute. The views do not necessarily reflect those of China Daily.

(China Daily Africa Weekly 09/08/2017 page12)

Today's Top News

- Opening of new gateway can help foster global economic and trade cooperation

- The farmer, the snake and Japan's memory hole

- Crossing a milestone in the journey called Sinology

- China-Russia media forum held in Beijing

- Where mobility will drive China and the West

- HK community strongly supports Lai's conviction