BRICS faces new reality: Protectionism

Much more difficult for emerging markets to export their way to prosperity, says best-selling author

Ruchir Sharma says one of the major problems facing emerging nations is an increasing retreat from globalization across the world.

The head of emerging markets and chief global strategist at Morgan Stanley Investment Management says they had all been beneficiaries of the opening up of world trade before the global financial crisis.

"Many of these countries had export growth of 20 percent or more every year, and they were able to export their way to prosperity.

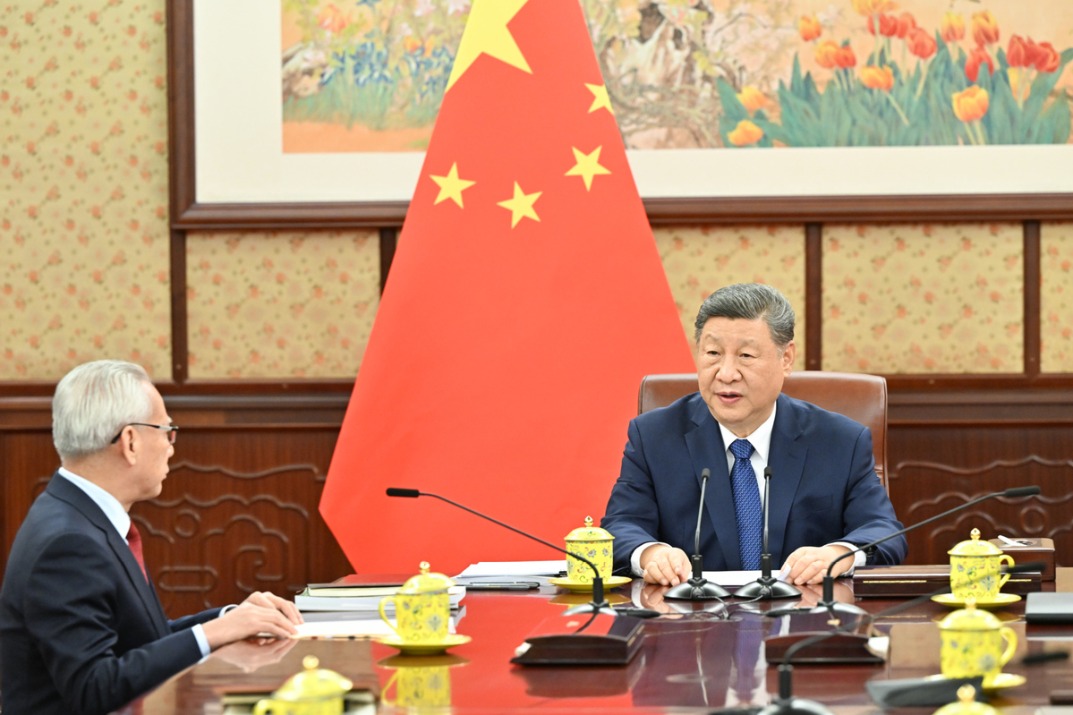

| Ruchir Sharma, head of emerging markets and chief global strategist at Morgan Stanley Investment Management, says the growth models of many of the BRICS nations have changed dramatically since the global financial crisis, with many of them now driven by companies in new industry sectors. Bloomberg via Getty Images |

"They can no longer do this. Even though global trade volumes picked up a bit last year, the era of hyper globalization of the 1980s, 1990s and the last decade is over."

Sharma, author of The New York Times international best-seller The Rise and Fall of Nations, which is now published in Chinese, was speaking from New Delhi ahead of the China-hosted 9th BRICS Summit in Xiamen, Fujian province.

He believes one of the challenges facing the leaders of Brazil, Russia, India, South Africa and China, which make up the BRICS grouping, will be this new reality.

"The protectionist compulsion is here to stay. I do feel in that environment, it will be much more difficult for emerging markets now to export their way to prosperity," he says.

Sharma, however, argues that the growth models of many of the BRICS nations have changed dramatically since the global financial crisis, with many of them now driven by companies in new industry sectors. This is particularly the case in China, with its tech giants such as Alibaba, Tencent and Baidu increasingly dominant.

"If you look at some of the emerging market indices, the weight of technology companies in them is comparable with that of the United States. This is the reality of the new sort of emerging market that has emerged after the downturn."

The economics guru, who is also a regular New York Times columnist, says the leaders of the BRICS nations, who begin their discussions on Sept 3, face a very different economic world than when the organization was formed in 2006.

"With countries like Brazil and Russia, there is no longer talk of growing at 4 or 5 percent. They have resigned themselves to the fact that if they can get to, you know, 2 or 3 percent, it's a pretty good achievement.

"And despite there once being talk of India being the next China and growing at even 10 percent a year, there is a new realism setting in, and if it can achieve 7 percent that would be OK."

The organization's most notable achievements are the establishment of the Shanghai-based New Development Bank, the so-called BRICS Bank, which signed its first loan agreement last year; and the Contingent Reserve Arrangement, a financial mechanism that protects members against fluctuations in their currencies.

"I think the problem for BRICS is that it is all over the map with its members so geographically dispersed. China is also in a different league to the other members, with its economy five times larger than India, the next biggest economy.

"We are living in a G2 world with only two economic superpowers, the US and China, that can really determine the shape of the global economy."

Sharma, 43, who was born in Jaipur, India, and studied at the Shri Ram College of Commerce in Delhi, began his career working as an economist at Prime Securities, a securities trading company, in the Indian capital.

He combined this with writing a column for the Economic Times of India, drawing the attention of Morgan Stanley, which hired him to work in Mumbai in 1996. He switched to the New York office six years later, where he has remained ever since.

His first book, Breakout Nations: In Pursuit of the Next Economic Miracles, which was published in 2012, and became an international best-seller, concluded that despite the hype around them, many of the emerging market economies would fail to break out of the middle-income trap.

The one exception he cited was China, which he believed would be the one that would make the grade as a high-income economy. The Chinese government has set itself the target to achieve this by 2020, before the 100th anniversary of the founding of the Communist Party of China.

Sharma says the one thing that has changed since the last BRICS Summit in Goa has been renewed confidence in the Chinese economy.

"All the concerns then were about the Chinese economic slowing down too much. Since then, the narrative has changed because the Chinese economy has once again stabilized and is now slightly accelerating."

He says China's growth has been against a backdrop of a much-improved global outlook.

"One of the biggest stories this year has been the comeback of Europe, with growth of 2.5 percent in the second quarter. Germany is doing really well and there is confidence in places such as France, particularly following the election.

"Europe is essentially doing better because it has suffered two recessions in the past seven years, which is highly unusual for any economy, so there is a lot of catching up to do."

Sharma, who was named as one of the top 50 most influential people in the world by Bloomberg Markets in 2015, says the BRICS Summit is taking place when the distinction between developed and emerging countries is no longer that clear.

"There is a blurring that is happening and it is becoming country by country specific. You have got countries like South Korea, and Slovakia and Poland in Europe, that are on the cusp of being classified as developed markets. Some people already consider them that way.

"What we should be interested in from now on is which are the faster growing economies rather than whether they are developed or emerging. I think it is irrelevant."

Sharma says one of the problems BRICS faces is that it is a grouping that excludes many key emerging nations.

"It is a concept based on a sort of cute acronym and is made up of all the emerging markets that were doing well a decade ago. You have many other countries that could legitimately claim to be part of such a group.

"These would include Mexico and in Africa, Nigeria and Kenya would be very much in contention, as would Malaysia, Indonesia and Turkey in other parts of the world."

He says emerging markets are no longer the driver of the global economy as they were when BRICS was created.

"In the last decade there were about 70-odd emerging nations that were growing at a pace of more than 5 percent. Now there are only about 20 to 25 that are now growing above that pace."

As he argues in his latest book, The Rise and Fall of Nations, one of the brakes on global growth is demographics and, in particular, a decline in the number of people of working age.

"The world population increased very sharply in the post-war period everywhere, from China and India to the United States. Now the demographic surge is fading, with about 40 economies around the world today where the working age population is shrinking, with China obviously being one of them."

Despite the political turbulence in the United States, Sharma says the country's economy remains strong.

"The economy is getting on fine. That is one of the beauties of the American economy. It shows you what being a developed economy is really all about. Politics may impact on the dinner party conversations, but it has a very limited impact on the economy."

He says that anti-globalization is not just rhetoric coming from Donald Trump's White House, but a much wider trend that will affect emerging markets and, in particular, the BRICS nations.

"Exporting has been the biggest mantra for success for these countries, but this will no longer be the case. They will have to deal with this new reality."

andrewmoody@chinadaily.com.cn

(China Daily Africa Weekly 09/01/2017 page7)

Today's Top News

- China accelerates push for autonomous driving

- Opening of new gateway can help foster global economic and trade cooperation

- The farmer, the snake and Japan's memory hole

- Crossing a milestone in the journey called Sinology

- China-Russia media forum held in Beijing

- Where mobility will drive China and the West