Mild price rises point to monetary stability

Country may keep its financial policy steady, analysts say

China's consumer price inflation remained mild in July, while its producer prices rose moderately, providing a boost to the industrial sector.

Analysts say the country may keep its monetary policy stable, given the expected stable price trends this year.

The consumer price index growth stood at 1.4 percent in July from a year earlier, compared with 1.5 percent in June, the National Bureau of Statistics said on Aug 9.

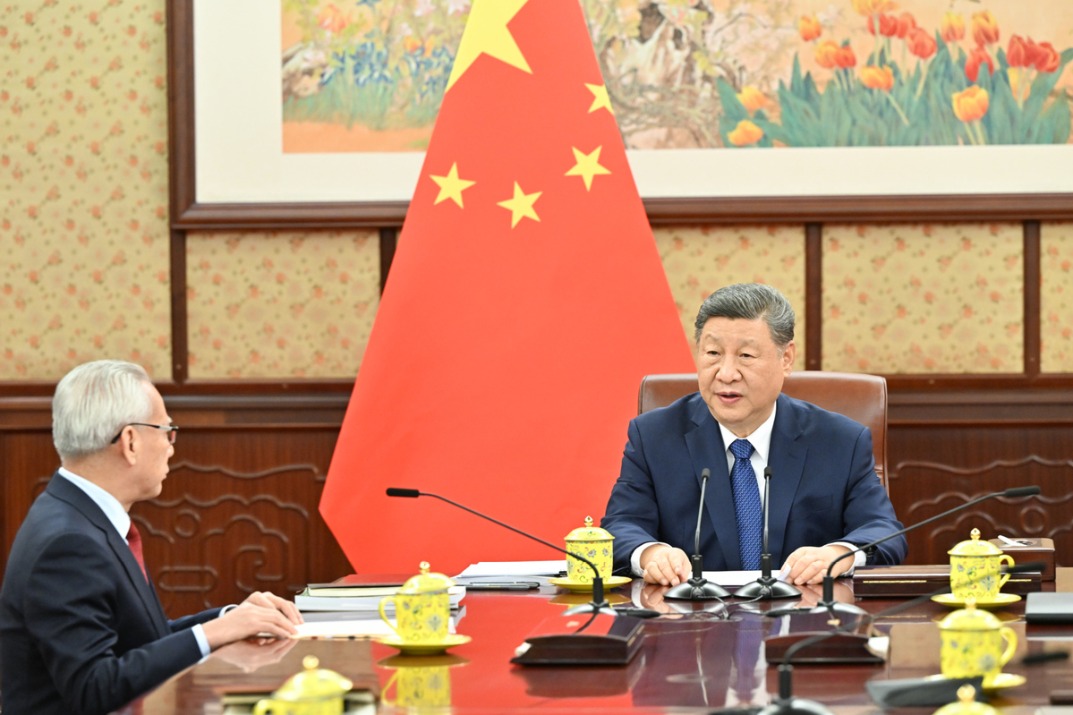

| People at a supermarket in Hangzhou, Zhejiang province. The consumer price index growth stood at 1.4 percent in July from a year earlier, the National Bureau of Statistics said on Aug 9. Provided to China Daily |

China's CPI has been kept at or below 2.5 percent since the start of 2016, well below its annual CPI growth target of 3 percent this year.

"China's consumer price inflation this year will be significantly lower than that of last year (which was 2 percent)," says Yan Ling, an analyst at China Merchants Securities.

"The low level of inflation will not have a major impact on the country's monetary policy."

China is not expected to face serious consumer inflation pressure in the year's second half, says Lian Ping, chief economist at the Bank of Communications.

"Considering the relatively high bases in the second half of last year, the CPI reading could ease in the coming months."

With consumer inflation remaining mild, China can keep its monetary policy stable, says Deng Haiqing, chief economist of JZ Securities.

Although China's economic growth picked up to 6.9 percent year-on-year in the first half, given the mild consumer inflation, "there's little possibility that the central bank will tighten monetary policies", Deng says.

The producer price index, which gauges factory-gate prices, rose by 5.5 percent year-on-year in July, unchanged from June and May, according to the NBS. On a month-on-month basis, it rose by 0.2 percent.

The PPI increase last month was mainly caused by rising raw materials prices, such as for steel and nonferrous metals, Sheng Guoqing, a senior official of the NBS, says in a statement on the bureau's website.

China's ongoing supply-side structural reform has led to reduced production capacities and rising prices in steel, nonferrous metals and some other products. Prices of commodities futures, such as steel rebar, started to rise in June through early this month, contributing to corporate profits.

Given high bases for the second half, China's PPI might ease in the coming months, says Deng of JZ Securities. "The possibility is high that it will continue to decline."

Contact the writers at xinzhiming@chinadaily.com.cn

(China Daily Africa Weekly 08/11/2017 page14)

Today's Top News

- Crossing a milestone in the journey called Sinology

- China-Russia media forum held in Beijing

- Where mobility will drive China and the West

- HK community strongly supports Lai's conviction

- Japan paying high price for PM's rhetoric

- Japan's move to mislead public firmly opposed