Setting the standard for precision

Chinese takeover proved a blessing for British machine tool manufacturer, enabling it to move forward with renewed success

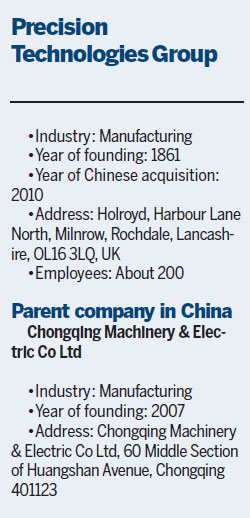

Seven years after China's Chongqing Machinery & Electric acquired the century-old British machine tool manufacturer Precision Technologies Group, healthy synergy has been achieved through technology-sharing, joint factory building and market expansion.

CQME's continued investment in PTG has also allowed the manufacturer - based in Rochdale, near Manchester - to increase its international market share and become the world-leading machine tools company that its management had always envisioned. PTG is celebrating some key achievements this year, including the completion of a new joint venture machine tools factory in South Carolina in the United States, and is looking forward to the next big project - the renovation and retooling of its over 150-year old factory in the UK, using state-of-the-art technology and automation.

| A worker at Chongqing Machinery & Electric Co Ltd's UK subsidiary PTG, in Manchester, makes machine tools. Provided to China Daily |

Tony Bannan, chief executive of PTG, who has been with the company since 1999, says: "At the time of the acquisition by CQME, we were already a strong manufacturer of machine tools and precision screw and rotor components, but our vision was to become one of the largest independent global manufacturers of compressor rotors for a wide range of original equipment manufacturing customers."

Although no hard statistics can be used to assess whether PTG has today achieved Bannan's grand goal, he believes his team has made significant strides since CQME's acquisition.

"The thing we admire and respect most about the Chinese parent is that they often take a long-term view on the business. For a technology company, this is ideal, as it brings many new growth opportunities," says Bannan.

CQME, a State-owned machine tool company, acquired PTG for £20 million ($26 million; 22.3 million euros) in 2010. Since then, it has invested an additional £15 million in increased capacity, new product technology development and market development. Such strong investment has also allowed PTG to continue investing about 15 percent of its annual revenue into research and development, which is vital for a high-tech company.

Bannan says CQME's continued investment and long-term vision are valuable.

"European and American investors often expect full return on their investments after one or two years. However, Chinese investors take a different approach: Your target is three years, but if it takes five they'll still consider supporting you if the business case is compelling."

CQME's investment in PTG has also translated into fast-growing revenue. PTG was listed as one of the UK's top 25 fastest-growing Chinese-owned companies by revenue in the Grant Thornton Tou Ying Tracker 2013, compiled by the London-based accountancy firm in collaboration with China Daily.

The tracker showed that the 25 fastest-growing Chinese companies are making a strong contribution to the UK economy - collectively employing more than 2,600 people and generating revenues of more than £17 billion in 2012, an increase of 27 percent year-on-year.

Meanwhile, PTG has taken its expertise to China, creating a joint company with CQME's sister operation Chongqing Machine Tool. The two partners then established a high-end screw rotor production line in Chongqing to manufacture machine tools.

Establishing a new factory may sound simple, but to create it to the same high standards that PTG has always employed in the UK means Bannan's team has had to work hard to invest in the Chongqing factory's training and to create detailed process controls to achieve best practices.

Bannan says one part of ensuring high standards was to use international standard auditing. The team asked BSI (formerly the British Standards Institute) to be the auditor of the production line, even though Chinese regulations did not require international audits for its manufacturing sector.

"Our insistence on standards has allowed Chongqing Machine Tool to see the benefits of having these higher quality requirements, and very recently they made a decision to use BSI as official auditor for their machine tool products," Bannan says.

This joint venture business then used the same strategy to establish the new production line in South Carolina, which supplies PTG's US customers.

"One major benefit of having three factories around the world is being close to the market. This enables us to rapidly respond and accommodate customer needs in a totally flexible way. In particular, as an integrated part of the supply chain, we are able to deliver orders to customers more quickly and accommodate their order changes with minimum disruption to schedules," Bannan says.

PTG has come a long way since CQME's acquisition and, looking back, Bannan speaks fondly of the deal, highlighting the mutual trust and respect between the two sides.

The company was established in 1861 as John Holroyd, a manufacturing company for machine tools and textile equipment. Over the years, it has pioneered the design and manufacture of complex machine tools, having sold more than 2,000 milling and grinding machines around the world.

Its name has also become synonymous with the concept of high precision in the industry, and the group has been awarded three Queen's Awards, highly regarded honors in the UK.

Despite the company's strong technology, its finances were not great. In 2006, it was sold to a private equity company. To generate returns on its investment, the private equity company wanted to sell the group to a Chinese buyer, since it felt that was the best way to get value for the business. To achieve this, the private equity firm conducted several roadshows in China in 2007 and 2008 to look for a buyer.

Eventually, potential acquisition contenders were narrowed down to two, and Bannan realized that CQME was the preferred buyer, although he was nervous about the future, especially for older colleagues.

"When news of the acquisition first emerged, many UK employees were worried about their own jobs, as they are often people who had been with the company for a long time and might not easily find jobs elsewhere. Many of our employees were industry veterans who were apprehensive about the perceived damage that would arise from shifting the business to China," he says.

These fears proved to be groundless. Instead of relocating the business to China, CQME supported PTG's continued expansion in the UK. The partnership between the CQME and PTG teams also won several accolades, prominent among them being the Chinese Investor of the Year Award for CQME at the British Business Awards in 2012.

Awards and recognition aside, Bannan has developed great friendship with his Chinese colleagues, thanks to spending an average of one week every two months in China, especially during the years when he was working intensively to get the Chongqing factory up and running.

In addition, as he has since become a member of Chongqing's senior management team, he also makes the most of opportunities to meet with other team members to discuss possible improvements across its business operations.

"I always have enjoyed visiting China and have learned a great deal throughout my years working with Chinese colleagues," Bannan says.

But he also acknowledges that some cultural differences cannot be completely bridged. In his view, one example is the Chinese culture of showing absolute "upward" respect for managers, which tends to discourage younger engineers from challenging established ideas and methods.

His strong belief in an innovative system's advantages prompted him to enthusiastically encourage his Chinese colleagues to implement changes. After his presentations and speeches, his colleagues would typically thank him for his great suggestions - but the same corporate culture continues.

However, Bannan says he is not deterred: "I will keep pushing to encourage this cultural shift. This is a 'long game', because deference and respect are hugely important behavioral characteristics that are valued and deeply embedded in Chinese society, and change in business approaches will take time. I am committed to the cause, however, and will not give in."

cecily.liu@mail.chinadailyuk.com

(China Daily Africa Weekly 08/11/2017 page30)

Today's Top News

- Foreign ministers of China, Egypt call for Gaza progress

- Shield machine achieves Yangtze tunnel milestone

- Expanding domestic demand a strategic move to sustain high-quality development

- Xi hears report from Macao SAR chief executive

- Xi hears report from HKSAR chief executive

- UN envoy calls on Japan to retract Taiwan comments