Bridging cooperation with advantages

For 10 years, the China-Africa Development Fund has adhered to principles of sincerity, real results, affinity and good faith

The China-Africa Development Fund, sponsored by China Development Bank, will mark its 10th anniversary on June 26. This fund, the first Chinese private quity fund focusing solely on foreign investment, is an important measure within the framework of the Forum on China-Africa Cooperation.

For a decade, the CADFund, guided by development financing, has been serving national development strategy as the top priority and has made use of advantages in comprehensive investment and financing. It has contributed to China-Africa economic and trade cooperation in a market-oriented way and invested more than $4.4 billion in 36 African countries.

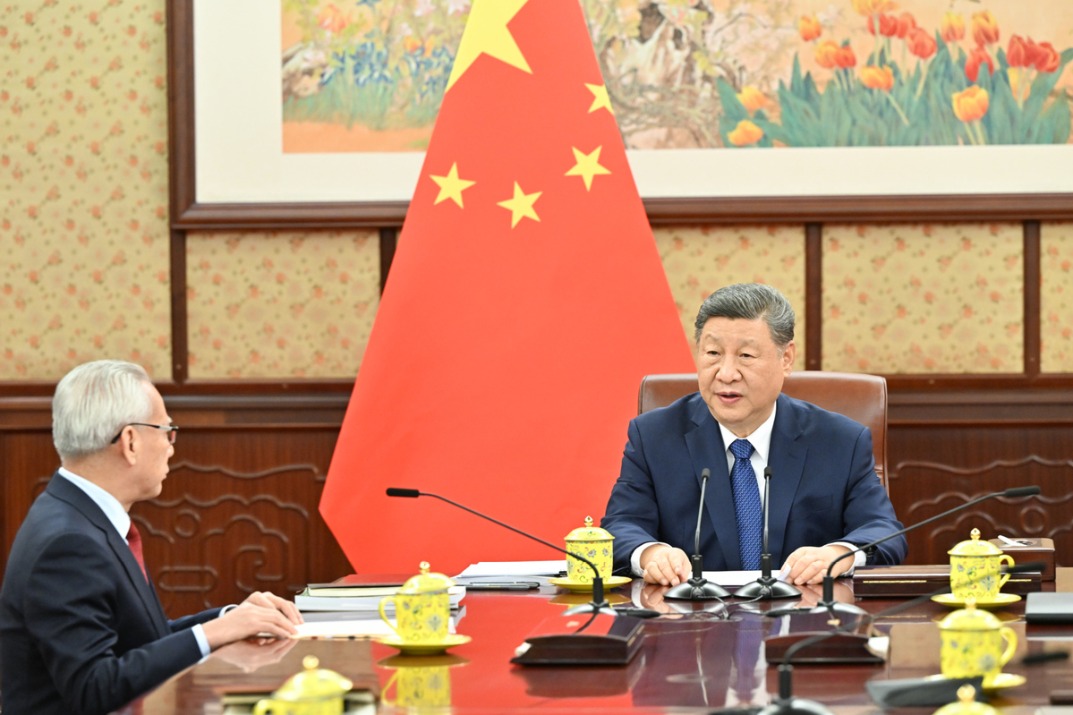

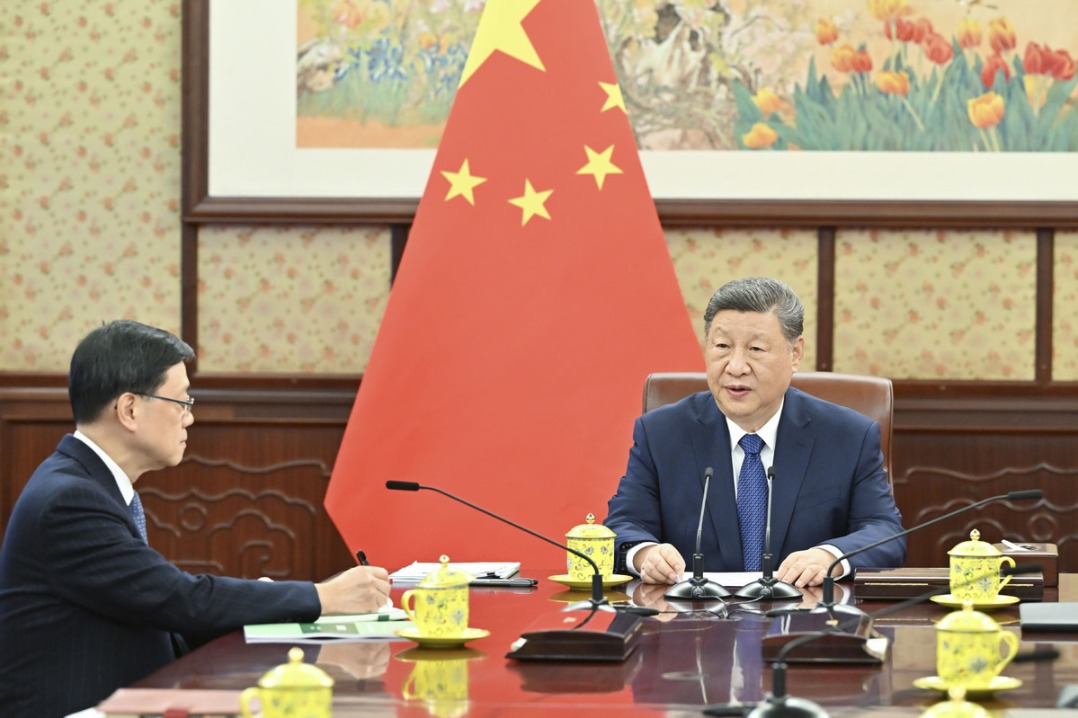

| Hu Huaibang, chairman of China Development Bank, says that financing is of great importance for the Belt and Road Initiative, especially in some key projects. Provided to China Daily |

The fund may encourage Chinese enterprises to invest more than $20 billion and become the main platform for Chinese investment in Africa. It has also gained valuable experience in accelerating Africa's industrialization process through investment and by promoting the Belt and Road Initiative. In an exclusive interview with China Daily, Hu Huaibang, chairman of China Development Bank, says that CADFund should take its advantage and promote the Belt and Road Initiative.

Africa plays an important role in the Belt and Road Initiative. What do you think of the relationship between them?

The Belt and Road Initiative is a "China Solution" for the purpose of promoting the long-term development of the whole world and economic globalization. Countries involved in the Belt and Road will gather to build an open, inclusive, balanced and mutually beneficial economic cooperation framework. It is conducive to promoting the orderly flow of goods, allocating resources efficiently and deepen market integration. This will, therefore, create positive financing outcomes and bring new impetus to the world's economic growth and also contribute to a more balanced global economy. The Belt and Road runs through Europe, Asia and Africa. Within the framework of the Belt and Road Initiative, China mainly focuses on infrastructure connectivity and productive capacity cooperation, and also pushes forward the development of the countries involved.

As China's biggest foreign investment and financing cooperation bank and the world's largest development financial institution, what role has China Development Bank played in supporting China-Africa economic and trade cooperation, as well as in implementing the Belt and Road Initiative in Africa?

Financing is of great importance for the Belt and Road Initiative, especially in some key projects. Many major projects require a large amount of funds and long investment cycles, but their return on investments is low. Thus, we should provide them with long-term, sufficient, stable and low-cost funds for support. Meanwhile, the countries involved in the Belt and Road, particularly in Africa, are mostly emerging economies and developing countries. These nations have suffered from insufficient development experience and inadequate fiscal capacity. Similarly, their market mechanisms and credit environments have yet to be perfected. As a result, the entry of financial capital was restricted and financing methods are needed for market and credit system construction.

Over the years, China Development Bank has taken advantages of comprehensive financing to proactively expand international cooperation, encouraged and supported Chinese enterprises to "go global". Africa is one of the key areas in international business of China Development Bank. By the end of 2016, China Development Bank had already invested and financed more than $55 billion in 43 African countries, in such areas such as agriculture, electricity, manufacturing, resource exploitation, communication, roads, aviation, ports, urban public facilities and people's livelihoods. We pledged an investment of $4.4 billion to encourage Chinese companies to invest over $20 billion in Africa.

In the practice of development-oriented finance, the CADFund is our first fund in cooperation with Africa and has been operating for 10 years. How do you evaluate the role that the CADFund plays in the construction of the Belt and Road Initiative?

The CADFund is one of the "Eight Measures" announced by the Chinese government at the China-Africa Cooperation Forum in Beijing. It aims to encourage and support investment in Africa by Chinese enterprises. The CADFund was inaugurated as a subsidiary of China Development Bank in June 2007.

At the Johannesburg Summit of the FOCAC in December 2015, President Xi Jinping announced an additional $5 billion for the CADFund, which makes CADFund reach a designed total capital of $10 billion. For the past 10 years, the fund has been providing capital financing for investment projects in Africa, sharing risks with partners. It realized sustainable operation of those projects and formed an advantage in loan business of China Development Bank. The influences exerted by CADFund on the construction of the Belt and Road initiative are illustrated as follows:

First, it has created new innovative models, set good examples and strengthened policy communication. As the first multilateral foreign investment cooperation fund established between governments, the CADFund upholds the philosophies of "strategically required, financially balanced and developmentally sustained".Hence, it links the investment and financing model to economic and social development plans of African countries in a positive way. It explores and forms an effective model for China-Africa strategies in a market-oriented way. This sets a standard for establishing similar foreign cooperative institutions under the Belt and Road Initiative.

Second, it solves bottlenecks that Africa faces in its course of development and enhances facilities connectivity. The CADFund has invested in the fields of ports, aviation and electricity under the Three Networks and Industrialization strategy. The total installed capacity of the Ghana power plant project, for example, accounts for over 20 percent of national electricity in Ghana. This has alleviated the power shortage of the country and won high praise from the president of Ghana. The Africa World Airlines project, the first passenger air project invested in by Chinese enterprises in Africa, has also fostered the connectivity between western African countries. We jointly established the China Overseas Infrastructure Development and Investment Corp with domestic engineering giants to promote infrastructure construction in Africa.

Third, it implements productive capacity cooperation first to ensure a free flow of trade. Based on the demands of industrialization in Africa, the CADFund encourages domestic high quality production capacity-ranging from the automobile, electronics and machinery sectors to the cement and glass industries - to invest there. Every year, we provide the African market with 11,000 middle-heavy trucks, 300,000 air conditioners, 450,000 refrigerators, 560,000 televisions and 1.6 million tons of cement to continuously boost economic growth in Africa.

Fourth, it supports development of Africa by financing and intellect raising and by promoting its capital financing. Up till now, the CADFund has decided to invest in 90 projects in 36 African countries at a price of $4.4 billion, and $3.2 billion was actually invested in areas such as equipment capacity, infrastructure, energy minerals, industrial parks and agriculture. This will bring Africa more than $20 billion in investment. Over the past 10 years, China's direct investment stock in Africa surged from $2.56 billion in 2006 to $34.69 billion in 2015.

Fifth, it stimulates the development of people's livelihoods and strengthens people-to-people connectivity. Based on the actual development of African countries, the CADFund plays an active role in supporting the development of local industrial projects, especially in some weak areas such as agriculture, forestry and small and medium-sized enterprises. This effectively activates the vitality of a substantial economy, creates job opportunities and improves people's livelihoods. Cotton planting projects in Malawi, Mozambique and Zambia, for instance, allowed 200,000 farmers to increase their income by adopting a "company+farmer" pattern. Similarly, the Suez project in Egypt has attracted a total of $950 million in investment and created nearly 2,000 job opportunities locally.

In the process of China-Africa investment, how has the CADFund pursued both righteousness and benefits and fulfilled its social responsibilities?

Since it was founded, the CADFund has been adhering to the cooperative principles of sincerity, real results, affinity and good faith and implementing proactively the brand-new cooperative concept of righteousness and benefits. We have been emphasizing social benefits generated by investment in Africa. Meanwhile, to promote mutual-benefit partnership with Africa, we also are devoted to reinforcing cultural exchanges with African countries and guiding the locals to form a rational cognition toward investment coming from China.

First, it has improved the economic "blood-making" capability of African countries through investment and financing. For a decade, conbining the developmental demands of African countries, the CADFund has encouraged Chinese enterprises to invest in Africa and helped to solve the three bottlenecks - inadequate infrastructure, lack of professional and skilled personnel, and funding shortage. This speeded up the process of industrialization and agriculture in Africa.

Second, it insists on responsibility-oriented investment and fulfills social responsibilities by investing in projects in Africa. Once put into operation, all investment projects will create additional income of $2 billion in exports and $1 billion in tax revenue. This will benefit the locals directly. According to incomplete statistics, the projects involved have provided local communities with a growing body of public facilities, including nine highways (approximately 800 kilometers), four hospitals and nine schools.

Third, it makes joint efforts with government agencies, partners and social forces to fulfill social responsibilities. For example, the CADFund has worked with organizations including the China International Poverty Reduction Center to alleviate poverty in Africa. It also has organized public benefit activities such as "Increasing Love for Decreasing AIDS" to build a platform for cultural exchanges between young people. In 2014, it donated $450,000 on behalf of China Development Bank to Liberia, Guinea and Sierra Leone-areas most affected by the Ebola crisis-to meet their emergency needs and support their efforts to overcome the epidemic and rebuild their homes as early as possible.

(China Daily Africa Weekly 06/23/2017 page31)

Today's Top News

- The farmer, the snake and Japan's memory hole

- Crossing a milestone in the journey called Sinology

- China-Russia media forum held in Beijing

- Where mobility will drive China and the West

- HK community strongly supports Lai's conviction

- Japan paying high price for PM's rhetoric