Why corporate shoppers are taking a breather

Overseas M&As coast on Belt and Road Initiative but hit bumps in rising valuations, stricter regulations

After the euphoria over outbound mergers and acquisitions last year, Chinese companies believe it's time to get back to their senses this year and stage a recovery next year.

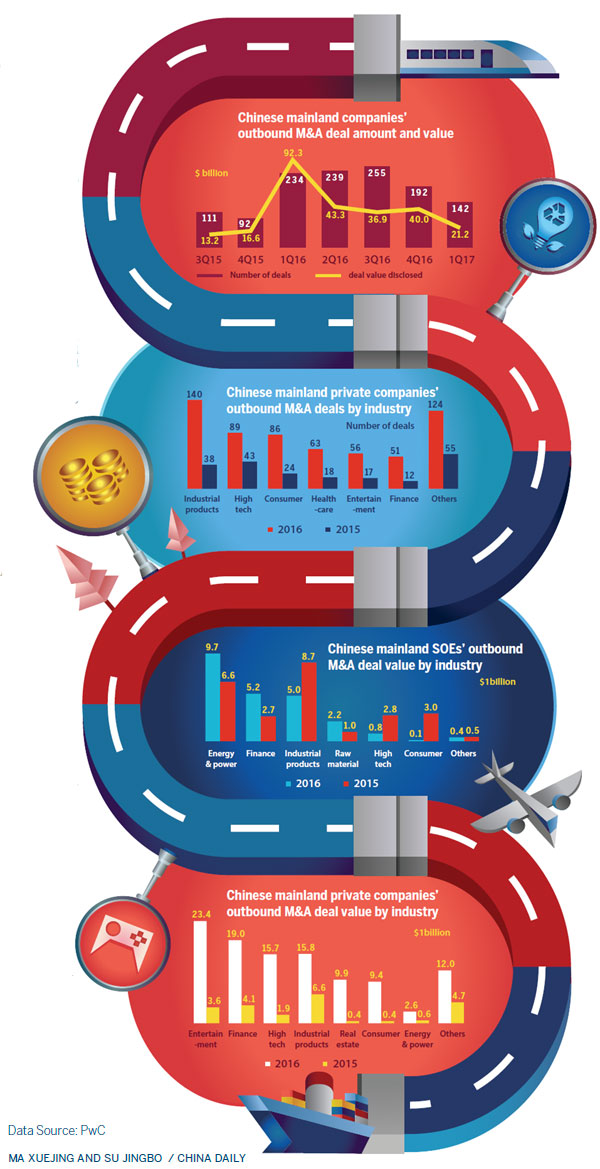

Chinese companies never had it so good in M&A as they did last year. They spent $212.5 billion (190 billion euros; £166 billion), almost 3.5 times that of 2015, to merge with, or acquire, companies overseas in 920 deals, up by 142.1 percent from 2015, according to accounting firm PricewaterhouseCoopers.

An abundance of capital and cheap debt, pursuit of growth outside a slowing economy and efforts to meet the standards of a more affluent and brand-conscious middle class are still giving momentum to outbound M&As, are port by global law firm Clifford Chance says.

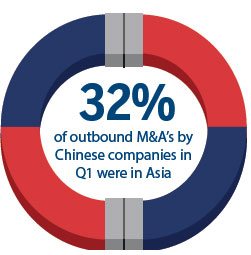

The first quarter of this year extended the record run of 2016, coasting on opportunities presented by the Belt and Road Initiative. Mainland companies announced 142 outbound mergers and acquisitions with a combined value of $21.2 billion.

The PwC report said 32 percent of overseas M&As by Chinese companies in the first-quarter of this year were in Asia, a key region for the Belt and Road Initiative.

One of the prominent M&A deals this year involved leading Chinese automaker Zhejiang Geely Holding Group. Geely picked up a 49.9 percent stake in Malaysian carmaker Proton Holdings from DRB-Hicom, a Malaysian conglomerate.

Geely will also buy a 51 percent share in Lotus, the British sports-car maker owned by Proton.

Malaysia is one of the many economies participating in the Belt and Road Initiative. Geely and Lotus are expected to sign a final agreement before the end of July, the company said at the end of May.

"With Proton and Lotus joining the Geely Group portfolio of brands, we strengthen our global footprint and develop a beachhead in Southeast Asia," says Li Donghui, executive vice-president of Geely.

Guan Qingyou, research director of Minsheng Securities, says that "the Belt and Road Initiative will promote China's merger and acquisition tide", since companies can decrease deal costs and risks with State financial support.

Chen Chao, director of transaction services at PwC China, says that "cross-border deals with strategic significance, especially industrial upgrading and the Belt and Road-related projects, will dominate the overseas merger and acquisition market this year".

Given the surge in the number of M&As, Chinese authorities moved to step up supervision in December.

The National Development and Reform Commission, the Ministry of Commerce, the People's Bank of China and the State Administration of Foreign Exchange have declared that they will pay closer attention to overseas investments in hotels, sports clubs, film studios and property.

In January, SAFE released a guideline to tighten review procedures for overseas direct investments.

Meanwhile, Chinese corporate buyers are facing stricter regulatory hurdles and security reviews overseas.

There is another twist in the tale. The volume and value of first-quarter deals dropped by 39 percent and 77 percent year-on-year, respectively, from record highs, according to thePwC report.

The report attributed the year-on-year slump in first-quarter M&As to the slower pace of going abroad by State-owned enterprises and private companies. The deal value by financial investors in the first quarter plunged by 91 percent year-on-year.

"Besides tougher requirements by the regulatory authorities, the global political and economic landscape has been undergoing a new round of rebalancing, with increasing external uncertainties," says Chen of PwC.

"After the blistering growth in 2016, there will be an obvious decrease in overseas acquisition deals this year, and the recovery will come in 2018."

Toby Gibb, investment director of European equities at Fidelity International, says the rise of populism has caused many national governments to be much more sensitive to foreign investments, especially in key industries.

This is proving to be a limiting factor for global investors, including those from China, looking for overseas M&As. So, Europe and the United States will continue to be their key destinations because of their advanced industry, technology and brands, says Wang Peng, a partner at PwC China.

caixiao@chinadaily.com.cn

(China Daily Africa Weekly 06/23/2017 page28)

Today's Top News

- The farmer, the snake and Japan's memory hole

- Crossing a milestone in the journey called Sinology

- China-Russia media forum held in Beijing

- Where mobility will drive China and the West

- HK community strongly supports Lai's conviction

- Japan paying high price for PM's rhetoric