Growth driver

Belt and Road impact likely to go way beyond infrastructure investment as connectivity boosts trade

One of the major initiatives of modern times involving huge investment in infrastructure and fostering an unprecedented increase in global connectivity could be a key driver of economic growth for decades to come, according to experts.

Twenty-nine heads of state and government will attend the Belt and Road Forum for International Cooperation in Beijing on May 14 and 15. The forum is expected to give further shape to China's Belt and Road Initiative, which was launched by President Xi Jinping in 2013.

The initiative has the support of more than 130 countries and international organizations, 40 of which have signed cooperation agreements with China.

China itself has already committed $50 billion (46 billion euros; £39 billion) in projects related to the initiative - which consists of the Silk Road Economic Belt - which links China to Europe through Central Asia - and the 21st Century Maritime Silk Road - which links Asia to Africa by sea.

Many economists and experts believe that its impact is likely to go way beyond the value of infrastructure investments, which include roads, railways, port facilities, power plants and many other projects, but also provide a major boost to trade with markets being opened up by better connectivity.

Nathan Hayes, an economist at Construction Intelligence Centre, part of the London-based Timetric research consultancy, argues the initiative could unlock development for many countries that are held back by a lack of infrastructure.

"In many countries there hasn't been a lot of development in recent years. There can be bad disparities in the state of infrastructure even between neighboring countries that can hinder trade, particularly in Central Asia.

"You need the physical infrastructure in place in order to generate broader economic growth. To get from farm and factory to market you need to have good quality roads and other facilities. The initial investment in infrastructure itself will have a sizable impact on a country's GDP, but the ripple effects will be much greater."

Yue Su, economist at the Economist Intelligence Unit in Beijing, says the investment could radically alter the business environment of many countries connected to the initiative.

"Investments in infrastructure and, especially, power generation will have a positive effect on these countries because most of them have power shortage problems and a lack of transportation connectivity," she says.

Brock Silvers, managing director of Kaiyuan Capital, a Shanghai-based investment advisory firm, however, says investment in infrastructure alone should not be seen as an automatic route to long-term economic development.

"Belt and Road is designed as a growth driver, but that should only be seen as a long-term result. If an emerging or frontier market doesn't already have sufficient economic growth to warrant a specific infrastructure project that project simply isn't economically viable."

He says that State-led infrastructure projects can generate development, but there can be limits to how effective this is.

"In most cases, growth leads to investment, which then leads to renewed growth. Private capital is usually unwilling to jump start that process. The devil is always in the details, and initiative projects and locations have yet to be determined."

Tom Miller, senior Asia analyst at Gavekal Research and author of China's Asian Dream: Empire Building Along the New Silk Road, says the success of Belt and Road will partly depend on how well it dovetails with the development strategies of other countries, such as Kazakhstan's "Bright Road" initiative.

"The mistake many make about Belt and Road is to assume it is purely a Chinese project. It can't be because whatever China is doing over its borders, it is doing so in cooperation with other enterprises in these countries, so it is about joint development," he says.

"Kazakhstan has its own development plan and it fits in very well with Belt and Road."

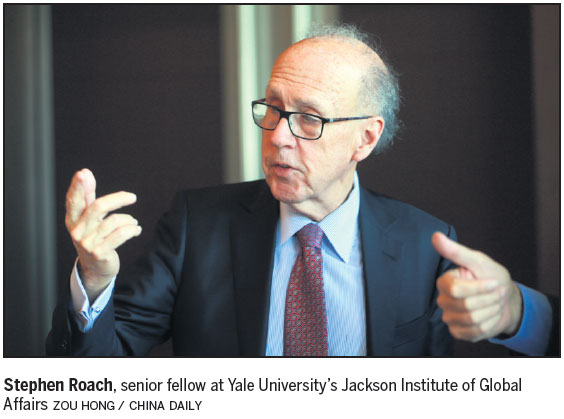

Stephen Roach, senior fellow at Yale University's Jackson Institute of Global Affairs, says Belt and Road could be what the world now needs while it is still battling with anemic growth nearly a decade after the onset of the global financial crisis.

Trade as a proportion of global GDP has fallen over the past five years - from 60.7 percent in 2012 to 58.2 percent last year.

"The trend is flat, and compared with the pre-crisis trend, which was going up sharply, there is an enormous shortfall, so globalization has lost its oxygen."

The former Asia chairman of Morgan Stanley, who is also author of Unbalanced: The Codependency of America and China, says Belt and Road is China's own globalization initiative.

"China is certainly taking a lot of strides and building more global institutions and initiatives. Should we be defending globalization? The answer is yes, but the real question is how. The lesson of history in the demise of the first wave of globalization between World War I and World War II suggests if we answer the question poorly, there are grave and lasting consequences."

Hayes at CIC draws a parallel between Belt and Road and the creation of the European Union - this year marking the 60th anniversary of the signing of the Treaty of Rome.

"If you look at Europe's history, the big driving factors of greater European unity in the 1940s and 1950s was increasing economic ties to reduce the risks of war. With Belt and Road, China is trying to create greater ties and pushing forward its soft power," he says.

With China's economy now slowing despite GDP growth rising to 6.9 percent in the first quarter, the Belt and Road Initiative could provide an economic boost to declining sectors of the Chinese economy.

Traditional heavy industries in China's northeast, in particular, have been hit hard by the slowdown in the construction sector.

"Among China's most intractable economic problems is industrial overcapacity," adds Silver at Kaiyuan Capital.

"It's an issue that could reverberate through the banking industry and threaten overall economic stability. One of China's primary objectives for Belt and Road is to partially resolve that issue by creating an initial spike in demand for industrial output such as steel and cement and thereafter establish permanent new Chinese export markets."

Hayes at CIC, however, says there is also a lot of excitement among Western construction companies about working on Belt and Road projects.

"Belt and Road is very good news for the construction industry because it has been faced with governments wanting to cut back on investment in a lot of countries. The real opportunities come in the countries where there isn't a lot of domestic (construction) capacity, and it may involve them working alongside Chinese companies."

One of the areas of discussion at the forum is almost certainly to be how funding of the various Belt and Road projects fits in with existing funding provided by the World Bank, the International Monetary Fund and foreign aid from various governments.

Su says countries that are the recipients of Belt and Road funding will also have to make sure they still comply with IMF guidelines in terms of not exceeding fiscal deficit criteria.

"Any concessional loans from China will only be part of the funding, with countries having to raise some of the finance through fiscal deficits. Some of the countries in Central Asia are oil exporting countries so are vulnerable to commodity price fluctuations and don't always find it easy to borrow."

Susan Lain, a researcher at The Royal United Services Institute, the London-based independent think tank concerned with defense and security issues, says one of the most interesting aspects of Belt and Road is how the Central Asian countries of Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan and Uzbekistan fuse with western China.

"There is a lot of evidence of genuine investment going into business. It is not just about how the Chinese invest but how the Central Asian states respond to that investment and how it is all managed," she says.

"The linking of western China to Central Asia could actually be one of the major development stories of the next few decades."

Some economists see the Belt and Road as the right initiative at the right time, with many parts of the world having desperate infrastructure needs.

"You can see the enormous potential for this," says Hayes at CIC. "You get the initial push that starts industrial growth and you get more investment on the back of that to create economic clusters, which then creates a momentum of its own."

andrewmoody@chinadaily.com.cn

| The first freight train service linking Xi'an, capital of Northwest China's Shaanxi province, with Moscow, is ready for departure in Xi'an, on Dec 6. The train of 41 containers, mainly carrying consumer durables, passed through Kazakhstan before reaching Moscow, and the trip took 11 days, compared to the traditional land/sea route, which takes over 45 days. Tang Zhenjiang / Xinhua |

(China Daily Africa Weekly 05/12/2017 page1)

Today's Top News

- China warns about Japan's intended military buildup

- China urges EU to halt anti-subsidy probes

- Experts: Lai not freedom fighter, but a pawn of the West

- Hainan evolves as gateway to global markets

- Opening up a new bridge between China and world

- Tour gives China-Arab strategic trust a boost