A new era of investment opens in Africa

As market prospects become clear, Chinese enter real estate sector with major city project

Recently, Chinese people owned few assets in East Africa. This is despite their growing presence in the booming construction sector, with Chinese firms building 42 percent of regional mega projects in 2016.

However, the situation has changed.

In a recent report on construction trends by Deloitte, reviewing projects worth more than $50 million, a real estate project was noted for the first time in the region. The project, valued at $200 million, involves two Chinese companies in a consortium investing a total of $70 million for a 38.9 percent stake.

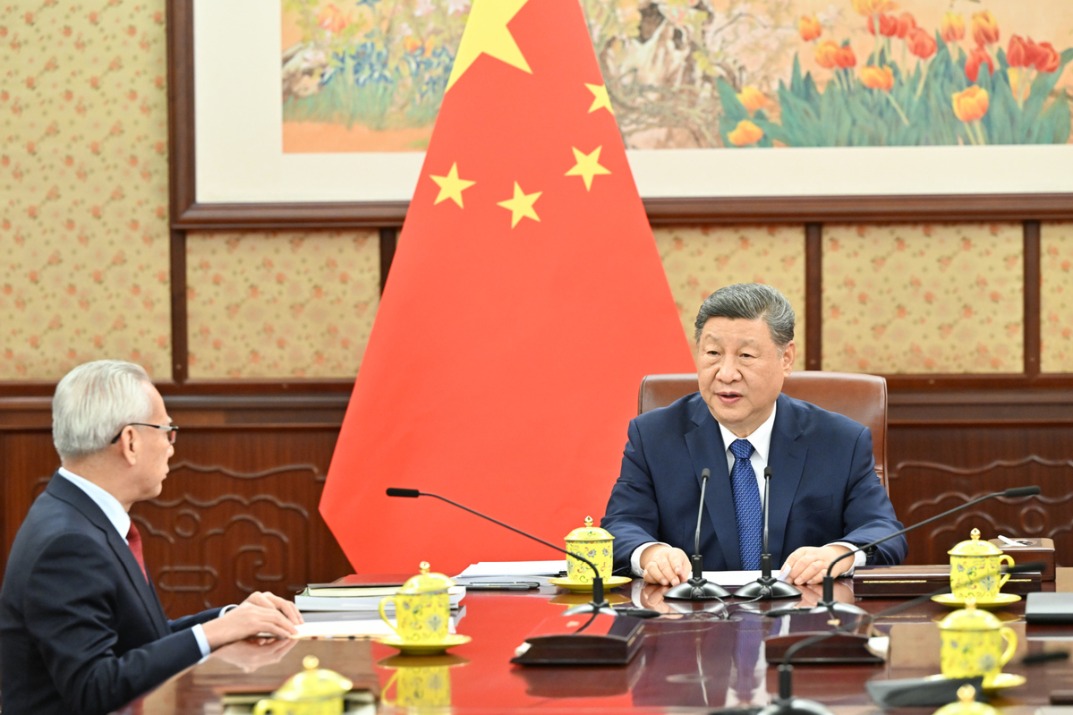

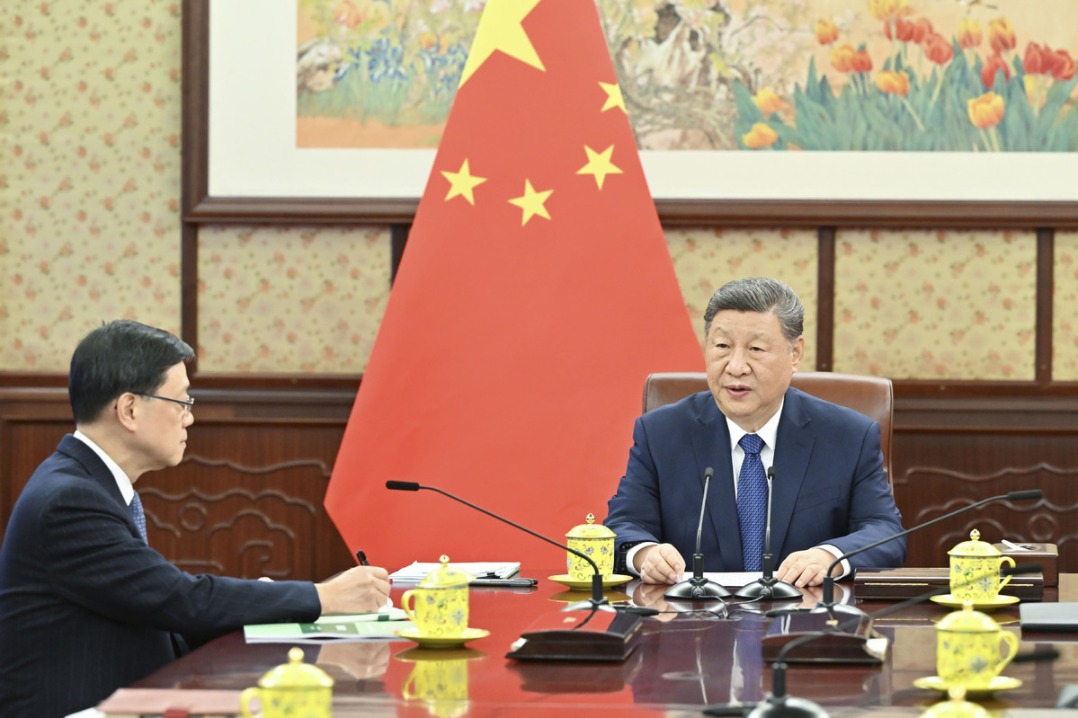

| Huang Zhengmin (right), deputy general manager of Jiangxi Water and Hydroppower Construction Co, accompanies visitors from headquarters on an inspection of the Two Rivers project. Photos by Rao Zhenhan / For China Daily |

"There is an increasing demand for high-end real estate retail space in Kenya. Market research shows that rapid urbanization and a burgeoning middle class is driving the need for sophisticated products and thus the need for malls," says Huang Zhengmin, director and deputy general manager of Jiangxi Water and Hydropower Construction.

According to the Oxford Business Group country report, years of robust GDP growth, a rising middle class, increased purchasing power and shifting consumer habits are driving demand for new shopping malls and e-commerce activities.

"Kenya's retail market is poised for considerable expansion in coming years," says the report, released last year.

Although informal sellers and local chains remain the dominant market forces, a rising number of high-end shopping centers and international chains demonstrate the considerable potential for foreign investment in the retail sector," the report says.

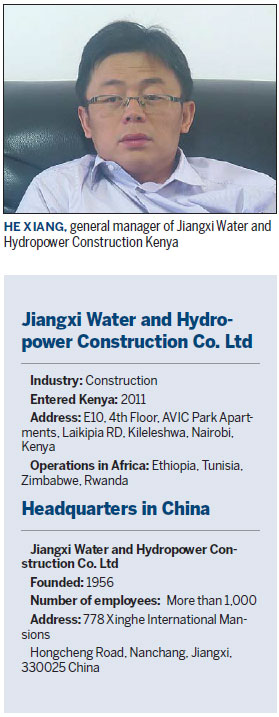

The Chinese developer was established in 1956 and is a renowned hydropower construction enterprise in Jiangxi province, East China. It entered the Kenyan market in 2011.

"Nairobi is the biggest city in the region and is rapidly growing. Many Chinese companies have set up branches here as a launching pad to other regional economies. The business environment is stable and political disruptions are minimal," says He Xiang, general manager of Jiangxi Water and Hydropower Construction Kenya.

He also attributes the booming market to the labor force and open market.

JWHC has won government contracts to build hydropower projects in a power-starved region. Besides entering an engineering, procurement and construction agreement to build three hydropower stations in eastern Kenya, the firm is also behind the construction of the Kuraz Dam Project in Ethiopia, valued at $150 million. A second undertaking is the $40 million Tendaho Spillway Project in the same country.

"These projects have given us a fairly good understanding of the business climate in this region. We know the local players and how we can leverage our skills and technology to complete projects fast and cost-effectively," says He.

It is this knowledge that strengthened JWHC's confidence in investing in the Two Rivers project. Huang says additional qualities such as the design concept - which advocates a smart city, including essential services such as hospitals and schools - made the investment more attractive. The first phase was launched in mid-February by Kenya's president.

When completed, the project will have more than 65,000 square meters of lettable space sitting on 41 hectares. It is located in the most affluent neighborhood of Nairobi, 5 kilometers from the United Nations offices that are the headquarters of UNEP, the world body's environmental agency. It will consist of medium-density residential homes, office blocks, a shopping mall and three-star and five-star hotels.

The smart building, partly powered by solar panels and featuring an intelligent surveillance system, has attracted high-end retail brands such as French retailer Carrefour, which has more than 12,000 supermarkets globally. Turkish luxury fashion line LC Waikiki, South Africa's Woolworth, Hugo Boss and Nike are also tenants.

Pundits agree that the project clearly signifies the entry of previously elusive Chinese private investment in the region. It also shows the scale of projects that Chinese investors are interested in.

According to Edwin Chui, a senior analyst at Dyer and Blair, a regional investment bank, Centum Group, the local investor in the project is a listed company with sound management, culture and finances. It has diversified its portfolio by dabbling in nascent but lucrative sectors of real estate, retail and power, among others, and has a good understanding of solving difficulties such as land ownership. It therefore offered the Chinese companies a clean proposition.

"There is a rising preference for mixed-use developments to capitalize on customer footfall. This is the same trend witnessed in developed and emerging economies," Chui says.

According to a 2015 survey by Nielsen Holdings, a global information, data and measurement company headquartered in the United States, 30 percent of Kenyans now shop in formal outlets compared to 4 percent in Ghana and 2 percent in Cameroon and Nigeria.

The trend has fueled the development of malls in Kenya, with 27 facilities currently operational. In 2015, a $250 million facility was launched, financed by London-based private equity firm Actis. Garden City mall has 33,000 sq m of retail space.

He is pleased with the response the new project has had so far, with more than 120,000 visitors recorded on the third day after the official launch. This is far more than the 40,000 visitors daily predicted by market analysts.

"We have a bigger space, a great location and an attractive proposition. We are happy with this investment," He says, though he is reluctant to disclose when the company expects to break even.

Market analysts believe that the entry of Chinese private funds is an endorsement of the attractiveness of the Kenya's growing economy. Moreover, it is also an indication that local investors are stepping forward and fronting big projects. Previously, poor inflows of foreign investments were blamed on a lack of bankable projects.

"This is also an opportunity to exchange knowledge and technology. We have learned about local construction concepts by interacting with local consultancy firms and so we are confident about bidding for more regional projects," says He.

The firm has worked with around 10 consulting firms in engineering and construction, project operation and marketing.

This will fundamentally expand the capacity of local companies in handling huge projects while increasing the talent pool. Two Rivers has generated at least 2,000 jobs.

"We rarely witness the entry of Kenya-listed companies into the real estate sector because of a lack of capital. But Centum Group's collaboration with Chinese companies will be a catalyst for more and bigger projects that we believe will drive regional economic growth," says Chui, of Dyer and Blair.

He notes that Chinese companies have been able to win big government projects because of their competitive pricing and this is an advantage that will trickle down to the private sector too.

"We are entering exciting times that will force Kenya's private companies to seriously re-examine their strategies and develop better propositions that will attract Chinese private firms. We also believe that this is the beginning of a long relationship with the Chinese private sector. It is long overdue."

The Chinese construction companies is making its presence felt. The shareholders in the Two Rivers Mall have pledged to improve the community bordering the development by investing about $1.7 million to build a new primary school next to the old Mathare primary school.

Contact the writer at lucymorangi@chinadaily.com.cn

(China Daily Africa Weekly 03/17/2017 page29)

Today's Top News

- Xi hears report from Macao SAR chief executive

- Xi hears report from HKSAR chief executive

- UN envoy calls on Japan to retract Taiwan comments

- Innovation to give edge in frontier sectors

- Sanctions on Japan's former senior official announced

- Xi stresses importance of raising minors' moral standards