Shipbuilder closing down three sites

COSCO Shipping Heavy Industry Co, China's third-largest shipbuilder by output, plans to cut the number of shipyards that are able to manufacture offshore engineering products from five to two by 2020, its senior executive said on March 3.

The move is the company's latest effort to cut overcapacity, as the global market is unlikely to see a notable upturn anytime soon.

Under the plan, its shipyards in Nantong, Jiangsu province; Zhoushan, Zhejiang province; and Dongguan, Guangdong province, will be shut down. The company will keep its manufacturing bases in Qidong, Jiangsu province; and Dalian, Liaoning province, as they are capable of producing high-end offshore engineering products such as polar ships, oil-drilling platforms and cattle carriers.

Liang Yanfeng, general manager of the state-owned company, says the move will optimize valuable resources, cut overcapacity and avoid defaulting on orders made by unstable foreign ship owners. It will also prevent price competition between its subsidiaries, Liang says.

The Shanghai-based company will also cut its delivery capacity in offshore engineering products from 18 to 9 by the end of 2020, as demand for these types of products has notably dropped in the past three years.

Offshore engineering products include functional vessels that can float in deep water for oil drilling platforms. Offshore gas and oil companies use them to process natural gas and crude oil pumped up from beneath the ocean floor.

"In addition, declining international oil and shipbuilding prices, growing costs for materials and labor have become factors squeezing shipyards' earning ability globally," Liang says.

It is common for shipyards to finance a project in advance after receiving an order in the current market setting. However, affected by falling demand, many ship owners now delay delivery and payment, and sometimes even abandon their orders, Liang says.

Dong Liwan, a professor specializing in shipbuilding at Shanghai Maritime University, says it makes matters worse that prepayments have also dropped from 80 percent of the total cost to between 30 percent and 20 percent in shipyards - not only in China but in South Korea, Singapore and Germany.

"Many ship owners from Europe, the US and South America come up with many different excuses to delay payment, such as a change of design or implementing stricter quality checks," Dong says. "They know they have no work for the ships or oil rigs, so they would rather not take delivery. This puts a heavy burden on Chinese shipyards."

Established in December 2016, the company was formed out of the previous COSCO Shipyard Group Co, COSCO Shipbuilding Industry Co and China Shipping Industry Co.

COSCO Shipyard and China Shipping Industry all reported financial losses last year.

zhongnan@chinadaily.com.cn

| 'Hope Six', a high-end multifunctional oil rig manufactured by COSCO Shipping Heavy Industry, at its sailing ceremony in Qidong, Jiangsu province. Xu Congjun / For China Daily |

(China Daily Africa Weekly 03/10/2017 page29)

Today's Top News

- Foreign ministers of China, Egypt call for Gaza progress

- Shield machine achieves Yangtze tunnel milestone

- Expanding domestic demand a strategic move to sustain high-quality development

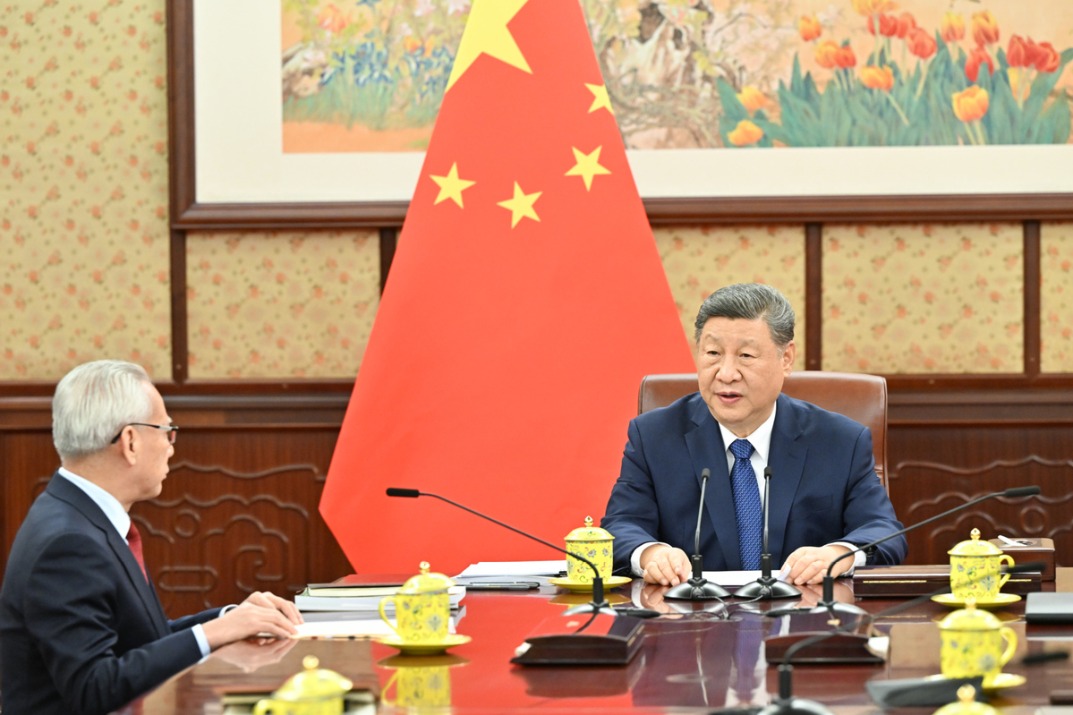

- Xi hears report from Macao SAR chief executive

- Xi hears report from HKSAR chief executive

- UN envoy calls on Japan to retract Taiwan comments