Chinese investment targets trade routes

Belt and Road areas will be 'hot places' this year, analyst says

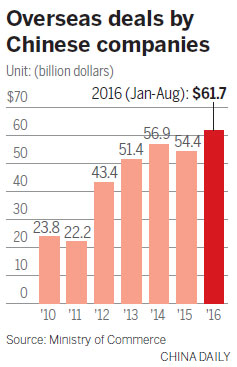

China's overseas acquisitions may press on this year, with new impetus from the Belt and Road Initiative and international expansion of major Chinese companies, analysts say.

"As China has tightened its foreign exchange controls to tackle illegal and reckless activities in overseas markets, the development in countries and regions along the Belt and Road Initiative will become hot places for Chinese investment this year," says Zhang Jianping, director of the Commerce Ministry's research center for regional economic cooperation.

A number of big-ticket infrastructure projects have been launched on the two trade routes, including Sri Lanka's Colombo International Financial City project, the 40 billion yuan ($5.8 billion; 5.4 billion euros; 4.6 billion) China-Laos railway construction project that kicked off in December and the China-Thailand railroad project to be carried out later this year.

Zhang's comments follow a Financial Times report that said $75 billion in overseas mergers and acquisitions involving Chinese enterprises were called off last year. The United States led, with $59 billion in deals scrapped.

Although China's overseas investment hit a record high last year, the total number of mergers and acquisitions that fell through also surged. More than 30 in the US and Europe were halted as a result of regulatory clampdowns. The total value of the canceled deals increased more than sevenfold from 2015, the report said.

The ministry's Department of Outward Investment and Economic Cooperation said on Feb 7 that the $75 billion cited by the Financial Times was much too high and added that it will clarify the situation this week.

Wang Zhile, a senior researcher at the Beijing-based Chinese Academy of International Trade and Economic Cooperation, says many Chinese companies will have advantages in conducting finance and investment activities in global markets this year. The country's overseas direct investment volume will remain stable and diversify this year, Wang says.

"Chinese conglomerates such as Shanghai-based Fosun Group, Dalian Wanda Group and Haikou-based HNA Group have already built financing platforms, including an insurance company in the United States and listed companies in Hong Kong's stock exchange via merger and acquisition," says Wang.

Chinese outbound mergers and acquisitions rose globally by 114 percent to $208.6 billion last year compared with 2015. Chinese investment surged by 201 percent in Europe and 412 percent in North America, according to the annual M&A Trends report by the London-based law firm Clifford Chance.

Elaine Lo, head of China practice at Mayer Brown JSM, a global law firm, says the US has already shown its concern about China's rapidly growing investment momentum in overseas markets, especially in the high-end technology and military-related sectors.

"The Trump administration may be even more conservative on China's ODI activities. It won't be changed within a short period," says Lo. "It will also lead to trade protectionism measures. The United Kingdom and Germany may also follow the steps of the US government."

Peter Batey, chairman of Vermilion Partners, a global investment bank, says: "As the volume of Chinese outbound acquisitions rises to record heights, it is inevitable that some foreign governments will eventually begin to feel obliged to likewise raise their own levels of scrutiny of such deals."

Ren Xiaojin contributed to this story.

Contact the writers at zhongnan@chinadaily.com.cn

(China Daily Africa Weekly 02/10/2017 page15)

Today's Top News

- UN envoy calls on Japan to retract Taiwan comments

- Innovation to give edge in frontier sectors

- Sanctions on Japan's former senior official announced

- Xi stresses importance of raising minors' moral standards

- Coordinated reform key to country's growth

- Shandong gives new life to traditions