Barclays' Kenyan network growing

Preferential policies and partnerships with Chinese banks established to bolster growth amid election-year instability

Chinese investors have been invited to explore and take advantage of the numerous business opportunities in Kenya as the relationship between the two countries continues to grow.

Speaking at a Chinese New Year celebration dinner organized by Barclays Bank in Nairobi on Jan 20, Chris Kiptoo, principal secretary at the Ministry of Industry, Trade and Cooperatives, said Kenya was open and safe for business and the government had put in place friendly reforms aimed at attracting foreign investment.

"Convening this event is timely due to the paradigm shift on international engagement which is anchored on trade and investment. It is paramount to ensure that our nation moves up the economic value chain, creates a sustainable economy and attracts foreign investment with the view of enhancing its competitive edge in the global marketplace," he said.

To attract foreign investors, Kiptoo said, the Kenyan government had taken steps to improve the trade and investment climate by implementing key policy initiatives like enactment of the Public-Private Partnership Act and rolling out e-procurement.

This was in addition, he said, to enactment of investor protection, initiatives to ease business, establishment of a 'one-stop shop' for all licensing and legal procedures for investors and reduction of power costs.

Kiptoo said Kenya presented investment opportunities in energy, construction, manufacturing, agriculture, water and irrigation, transport and infrastructure, ICT, mining and tourism.

"We invite Chinese business people to invest in these sectors," he said.

Jeremy Awori, Barclays Bank managing director, said his institution was committed to designing products and services aimed at improving the experience for Chinese customers.

Recently, the bank launched a partnership with China Union Pay to allow Union Pay cardholders to make transactions at a network of over 200 Barclays ATMs and point-of-sale devices through its 4,200 merchants throughout the country.

China Union Pay is the preferred payment method for Chinese nationals and boasts more than 5 billion cardholders globally.

Currently, Kenya is receiving 30,000 Chinese tourists annually, hosting more than 40,000 Chinese nationals and 400 state and privately-owned organizations spread across various sectors, hence the need for financial solutions to meet the growing use of cards.

Awori said plans are underway to launch a Chinese yuan account in the near future, to enable Chinese nationals in Kenya to transact money back home.

"We are looking forward to getting more business from the Chinese community as well as opening more accounts," he said.

Awori noted that the bank was in the process of translating its website information into Chinese to better serve the community.

Business people at the event said they were optimistic for business in the new year, despite this being an election year characterized by slow economic growth.

According to a Nation Newsplex news site analysis, the polarizing and violent nature of Kenyan election politics and uncertainty about the outcome are among the causes of economic slowdown.

Jonson Lee from New Sky Ltd, a Chinese company based in Kenya, says he is optimistic that business will be good in 2017. He predicts turnover growth of Ksh 500 million ($4.8 million) by the end of the year.

Kenya and China enjoy cordial trade relations. Overall bilateral trade volumes between the two countries have grown in the past decade to reach Ksh 255.2 billion in 2014 from Ksh 172.6 billion in 2012, for an average annual growth rate of 15.4 percent.

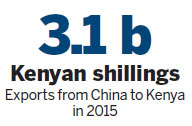

Exports from China to Kenya rose exponentially from Ksh 12.1 billion in 2004 to Ksh 320 billion in 2015. Over the same period, the value of Kenya's exports to China rose from Ksh 836.4 million in 2004 to Ksh 8.47 billion in 2015.

edithmutethya@chinadaily.com.cn

(China Daily Africa Weekly 01/27/2017 page29)

Today's Top News

- Foreign ministers of China, Egypt call for Gaza progress

- Shield machine achieves Yangtze tunnel milestone

- Expanding domestic demand a strategic move to sustain high-quality development

- Xi hears report from Macao SAR chief executive

- Xi hears report from HKSAR chief executive

- UN envoy calls on Japan to retract Taiwan comments