Share prices of SOEs expected to 'bounce back'

Restructuring and recombining promises to grow profits in steel, coal

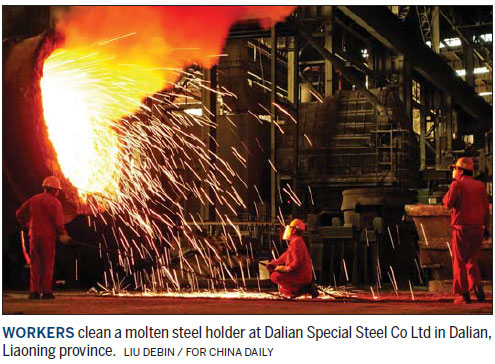

The share prices of China's giant state-owned enterprises in the steel, coal and power sectors are expected to rebound this year as the country recombines resources to create more Fortune Global 500 companies to compete with foreign rivals, an expert said on Jan 16.

The opportunity came after the State-owned Assets Supervision and Administration Commission said recently that the SOE reform will no longer focus only on cutting the number of groups or their subsidiaries. Industrial upgrading, global market diversification and resource optimization are main focus of the reform this year.

Listed companies such as Hunan Valin Steel Co, Jizhong Energy Group Co, Beijing-based Huaneng Power International Inc, Shanghai Electric Power Co and another 10 companies from these three industries all announced that they have been involved in asset reorganization since 2016.

He Jingtong, a professor of economics at Nankai University in Tianjin, says that because the steel, coal and power businesses can notably affect SOE profits, the government is keen to integrate these commodity-based sectors to support profit growth, as international commodity prices are gradually picking up.

"The changing relationship between supply and demand of China's manufacturing products, the stable business operations of the steel and coal industries, and the central government's call to cut excessive industrial capacity are all core factors pushing reform in these three industries," says Li Jin, a researcher at the Beijing-based China Enterprise Research Institute.

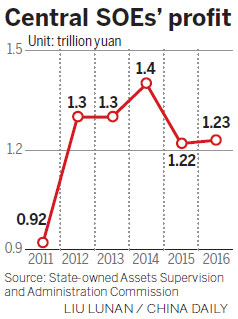

The SASAC has set a target to raise the profit growth rate gained by central SOEs to between 3 percent and 6 percent year-on-year in 2017.

The sales revenue of central SOEs reached 23.4 trillion yuan ($3.39 trillion) in 2016, up 2.6 percent year-on-year, while they gained 1.23 trillion yuan in profits, increasing 0.5 percent from the previous year, according to the National Business Daily.

China has, to date, cut the number of its central SOEs to 102. Local SOE watchdogs in 10 municipalities and provinces including Beijing, Chongqing and Guangdong, have already made plans to further recombine or cut the number of SOEs this year.

China has 150,000 SOEs at different levels, which manage more than 100 trillion yuan ($14.5 trillion; 13.6 trillion euros; 11.8 trillion) in assets and employ more than 30 million people.

zhongnan@chinadaily.com.cn

(China Daily Africa Weekly 01/20/2017 page28)

Today's Top News

- Expanding domestic demand a strategic move to sustain high-quality development

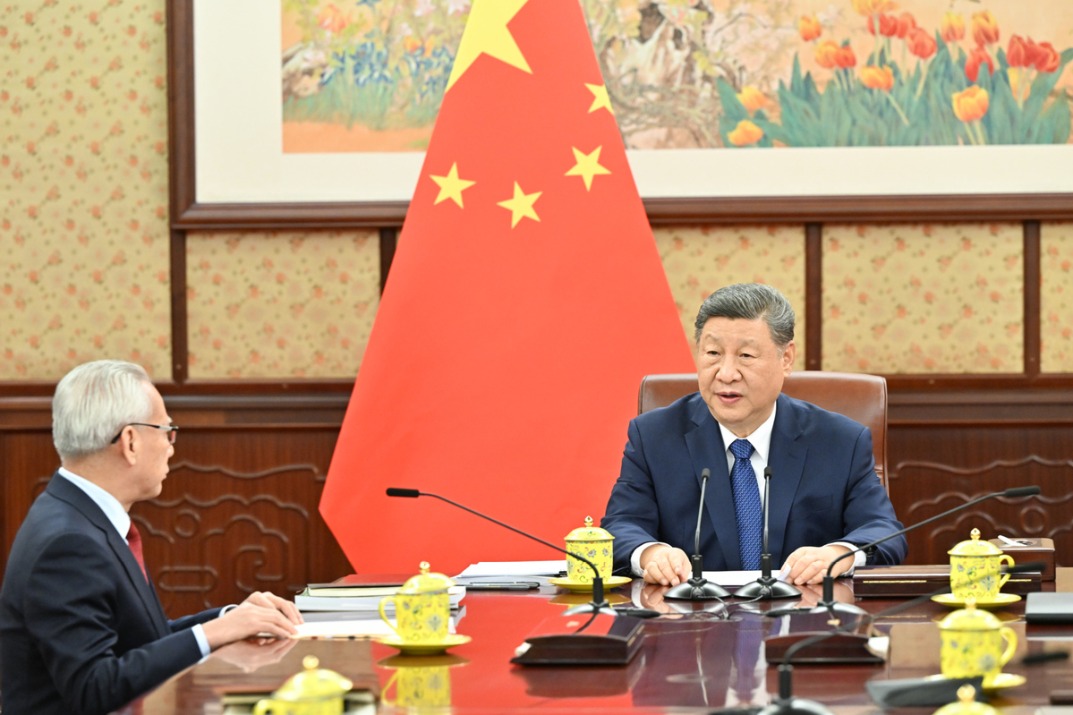

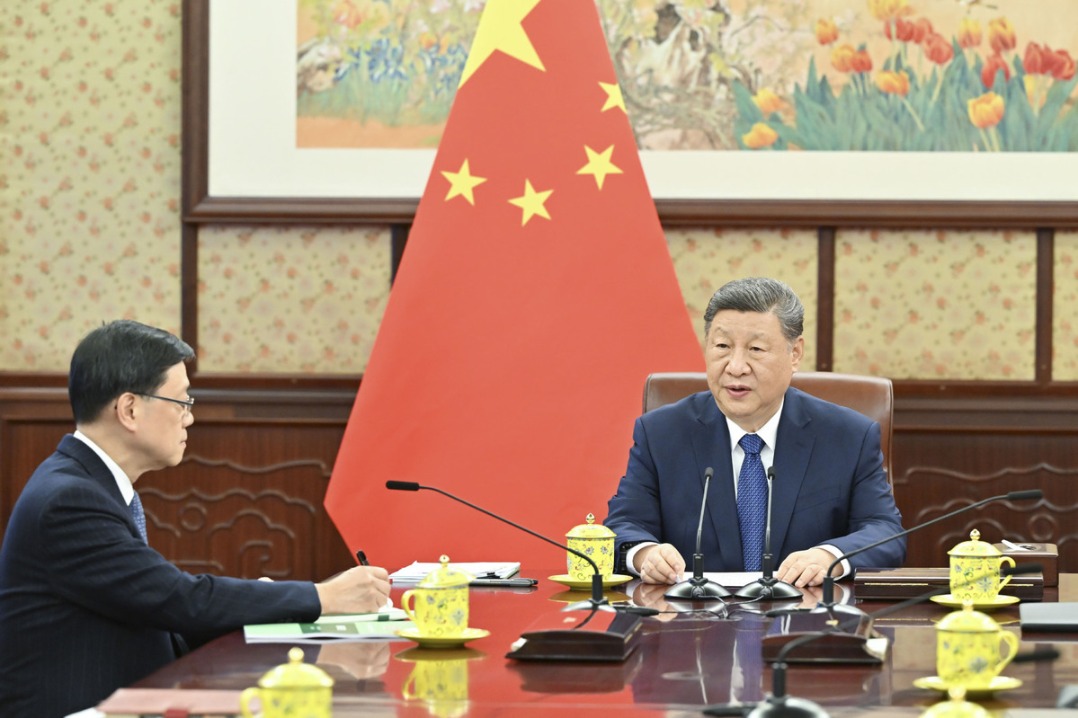

- Xi hears report from Macao SAR chief executive

- Xi hears report from HKSAR chief executive

- UN envoy calls on Japan to retract Taiwan comments

- Innovation to give edge in frontier sectors

- Sanctions on Japan's former senior official announced