IN BRIEF (Page 24)

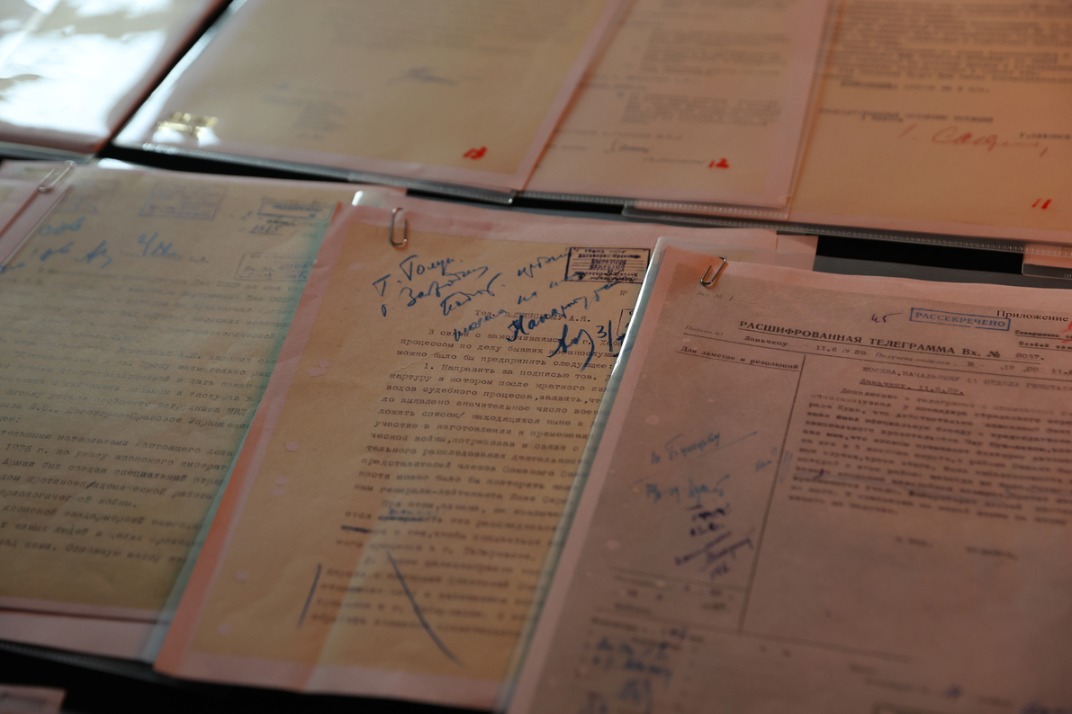

| A manufacturing robot is demonstrated at the World Intelligent Manufacturing Summit on Dec 6 in Nanjing, Jiangsu province. The three-day event attracted 285 exhibitors from home and abroad. Cui Xiao / For China Daily |

51 companies added to trading board

Some 51 small and medium-sized enterprises were added to China's New Third Board, increasing its number of listed companies to 9,786 as of Dec 2. Turnover on the board reached 4.65 billion yuan ($676 million; 628 million euros; 535 million), up 4.7 percent from a week ago. A total of 2,304 SMEs have been added to the board since the beginning of 2016, with combined market value of more than 3.74 trillion yuan. The New Third Board, or the National Equities Exchange and Quotation system, helps SMEs transfer shares and raise funds.

McDonald's to keep minority stake

US fast-food chain McDonald's Corp is looking to raise up to $2 billion (1.85 billion euros; 1.58 billion) from the sale of its Chinese mainland and Hong Kong restaurants after deciding to keep "a significant minority stake in the business", a person with direct knowledge of the plans said on Dec 6.

The company has picked a consortium led by private-equity firm Carlyle Group LP and Chinese conglomerate CITIC Group Corp to buy the restaurants. Its decision to retain the minority stake lowered the price tag for the business from the possible $3 billion expected previously, said the person, who declined to be identified because details of the deal are not public. McDonald's wants exposure to future growth in the world's second-largest economy, which is why it decided to maintain the stake, the source said.

Chinese company's US deal blocked

The Foreign Ministry expressed displeasure on Dec 5 after US President Barack Obama blocked a Chinese investment fund from acquiring the US business of German semiconductor equipment maker Aixtron on the pretext of national security. Foreign Ministry spokesman Lu Kang said the government had always supported Chinese firms investing overseas on the basis of market principles, international rules and respecting local laws. The Aixtron deal is purely a commercial matter, he said.

Goldman Sachs sees slower 2017 growth

Goldman Sachs expects China to register lower annual growth in 2017, as property and auto sales are likely to decelerate. The bank forecasts a slight slowing in China's GDP growth to 6.5 percent in 2017, from a forecast of 6.7 percent in 2016.

Although Goldman expects only a modest slowing in real estate investment in 2017, it sees both price and transaction growth slowing significantly, meaning a much lower contribution to China's GDP growth from the housing sector in 2017. In a report to clients, the bank noted auto sales growth may slow sharply to 3 percent in 2017, from an estimated 15 percent this year, as the government is likely to cut tax rebates for auto purchases in half.

Coal-bed methane production to rise

China expects to increase its proven coal-bed methane reserves by 420 billion cubic meters during the 2016-20 period, the National Energy Administration said. The country seeks to extract 24 billion cubic meters of the clean energy source, and have three industrial bases by 2020, according to a development plan released by the NEA. Coal-bed methane will likely account for 13 percent of the country's natural gas output by that time, according to the administration.

Before new tax, luxury car sales increase

Luxury car dealers in China made calls to their best prospects, urging them to buy to avoid paying extra taxes on their gilded rides. Some distributors sold as many cars on Dec 7 night as they normally deliver in three months, as buyers sought to beat the implementation of a 10 percent levy in the form of value-added tax on vehicles costing more than 1.3 million yuan, according to Wang Cun, a China Automobile Dealers Association official.

Australia, China agree to open aviation

Australia and China reached an agreement to open up the aviation markets of the two countries, Australian Minister for Infrastructure and Transport Darren Chester and Minister for Trade, Tourism and Investment Steven Ciobo said in a statement on Dec 4. The new arrangements will remove all capacity restrictions between Australia and China for airlines, allowing Australian tourism businesses to take advantage of the largest and fastest-growing consumer market in the world.

Coal-rich province exceeds target cuts

Shanxi province, which supplies about a quarter of China's coal, shut down or restructured 25 mines this year, cutting 23.25 million tons of coal production capacity and surpassing the target of closing or restructuring 21 coal mines and reducing 20 million tons of production this year. The target was set in August as part of a plan to cut overcapacity between 2016 and 2020, according to local land and resources authorities. At the end of October, Shanxi's coal enterprises had inventories of 30.84 million tons - 4.91 million tons lower than in September.

China Mobile forges link with Alibaba

China Mobile and Alibaba Group Holding inked a comprehensive strategic partnership on Dec 7, as the world's largest telecom carrier by subscribers and China's largest e-commerce firm joined hands to boost growth. Under the agreement, the two sides will work closely in basic telecommunication services, information infrastructure, marketing and emerging sectors, China Mobile said in a statement.

The move came shortly after Alibaba inked a similar deal with China Unicom, the country's second largest telecom carrier, last month. China Mobile is stepping up efforts to expand its presence in the internet industry. China Unicom also wants to arrest its continuing profit decline by partnering with internet giants.

BoC committed to Belt and Road Initiative

Bank of China is committed to the Belt and Road Initiative, Tian Guoli, the chairman, said at the bank's New Year's Reception 2017 in Beijing. The bank is looking forward to grasping the opportunities the initiative presents in various countries for entrepreneurs and financiers, Tian told nearly 300 representatives of foreign embassies, multinational companies and international financial institutions in China and top executives from domestic financial institutions closely affiliated with the initiative. Tian said the bank puts great emphasis on exchanging ideas with friends from all sectors of the community.

Alipay teams up with European banks

Alipay, the popular digital payment tool run by China's Ant Financial Services Group, announced a partnership with three European banks on Dec 6. The payment service, which has 450 million active users, inked deals with financial institutions BNP Paribas, Barclays, UniCredit and SIX Payment Services, a major payment service company, to allow more European merchants to accept Alipay as a payment tool in Europe. Ant Financial, which is the internet finance affiliate of Alibaba Group, has been gearing up for global expansion. Helping more Chinese outbound travelers use Alipay overseas is one of the major steps in that effort.

(China Daily Africa Weekly 12/09/2016 page24)

Today's Top News

- China remembers victims of Nanjing Massacre, 88 years on

- New plan will be a road map for a stronger future

- Taiwan's character of the year a vote against confrontation

- Strengthened resilience key for economy

- Video sheds new light on Japan's wartime atrocities

- Xi: World yearns for peace, trust more than ever