Hands-on approach helps after the buyout

Chinese companies are becoming more adept at effectively managing the enterprises they have acquired in other countries

Chinese companies, often rich in capital but with limited experience in managing cross-border investment, have been putting more effort into sharpening their post-merger integration skills as the latest wave of foreign mergers and acquisitions presents a number of major challenges.

Anbang Insurance Group Co, the Beijing-based insurer that gained prominence for its high-profile global acquisitions, is among the Chinese companies that have started reaping rewards from their overseas acquisitions thanks to effective post-merger strategies.

South Korean firm Tongyang Life Insurance Co, which Anbang acquired for $1 billion last September, saw its net profit hit a record high of 155.5 billion won ($136 million; 122.8 million euros; 108.5 million) in the first half of this year, up by 18.2 percent from a year earlier. Sales revenue also soared by 76.6 percent to reach 4.09 trillion won.

Senior executives at Anbang and Tongyang Life attributed the improvement in business to the adoption of Anbang's business strategies and management concepts.

While maintaining the stability of Tongyang's South Korean management team, Anbang introduced some bold reforms, including a flattened corporate structure with greater emphasis on capability, rather than age and seniority.

Such arrangements have improved the firm's operational efficiency and service quality, which in turn helped reduce client complaints, according to Zhang Ke, vice-president and chief financial officer of Tongyang.

Anbang also established a special committee for budget control to ensure that costs are tightly monitored while maintaining the quality of its services and products.

"We make our goals clear - controlling costs while enhancing productivity and competitiveness," said Han S. Koo, president and chief executive of Tongyang Life Insurance.

Anbang's emphasis on mobile technology and the internet has boosted Tongyang's premium income, and the ratio of sales through smartphones has been lifted from just 10 percent in 2013 to 50 percent today.

By absorbing Anbang's management ideas, Tongyang has become a leading insurer in South Korea and gained the opportunity to become an international player thanks to the broader investment access provided by the Chinese parent company.

Anbang also improved the pay structure at Tongyang, encouraging local employees and motivating them to contribute ideas which are proving beneficial for the company.

The case of Anbang and its South Korean subsidiary could show that Chinese companies, instead of just pouring capital overseas, are beginning to export and practice their management skills in cross-border post-merger integration.

Industry experts say that the change in the way Chinese firms work with their investments and their willingness to motivate local management will help drive stronger business performance in the future.

"We've seen changes in the way Chinese firms work with their investments on the ground. Chinese firms are now more willing to allow local management a greater stake in the operation, therefore incentivizing management to work with the new owners," says Annabella Fu van Bijnen, a partner at law firm Linklaters.

"This allows local management to continue working within the business, but also empowers them to make good decisions and drive stronger performance," she says.

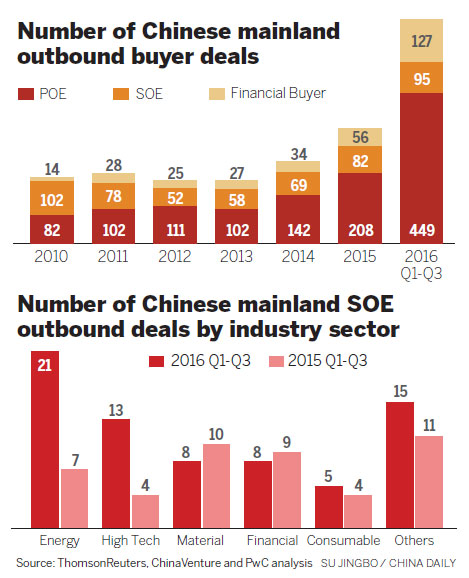

China's outbound foreign direct investment reached $99 billion in the first half of this year, more than 50 percent up from the same period last year, according to a report by accounting firm Ernst & Young LLP.

Grace Tso, M&A Partner at law firm Baker & McKenzie in Hong Kong, says that there are similarities in M&A deals that end up in a successful integration.

"Of all elements, the most crucial ones will be planning and communication: Organized, detailed planning and clear, frequent and consistent communication, both between function teams and employees internally and to the market externally," she says.

Despite the surge in the volume and value of outbound M&A deals carried out by Chinese firms, bridging the cultural divide and tackling complex cross-border issues involving financing, contracting and the environment remain daunting challenges, industry experts say.

"The desire for expansion poses a critical challenge to the overseas investment and operating abilities of Chinese enterprises. 'Going out' is not the ultimate goal. Rather, the key is how far you can go and how successful you become," says Albert Ng, China managing partner at Ernst & Young LLP.

China's outbound FDI could reach a record high in 2016, exceeding $170 billion, according to Ernst & Young.

"The challenges for Chinese enterprises are to improve their strategic decision-making and operating capabilities, seize the opportunities and generate new drivers for growth in order to survive - and thrive - in international markets," Ng says.

Tracy Wut, M&A Partner at Baker & McKenzie in Hong Kong, says that there is no "one size fits all" integration process but some key elements, including identifying the group's strategic objectives set by senior management, will help make a successful integration.

"Key management personnel should continue to be involved in both comprehensive information gathering phase and in strategic and tactical decision-making during the ensuing analysis phase," Wut says.

Successful cases such as South Korea's Tongyang Life Insurance may help to defuse suspicions regarding massive overseas buyouts by Chinese firms that have recently encountered growing obstacles in some Western countries, such as the German authorities' withdrawal of the approval of a Chinese company's takeover of German chip equipment maker Aixtron SE.

Chinese industry experts say that the move will hamper the 670 million-euro ($742 million; 597 million) deal by Fujian Grand Chip Investment Fund LP and has negatively impacted on the credibility of the German government.

Jing Shuiyu and Zhou Wa contributed to this story.

Contact the writers through lixiang@chinadaily.com.cn

(China Daily Africa Weekly 11/11/2016 page27)

Today's Top News

- Evidence mounts of Japan's wartime atrocities

- Gunmen kill 11, wound many on Sydney beach

- Study finds Earth's deep water reservoirs

- China remembers victims of Nanjing Massacre 88 years on

- Philippines' provocations will avail it nothing: China Daily editorial

- China steps up financial support to spur consumption