Outbound M&As surge in volume and value

The volume and value of outbound mergers and acquisitions by Chinese mainland companies hit a record high in the first three quarters of 2016, a report by PricewaterhouseCoopers shows.

Deal volume, the report says, reached a record of 671, nearly double that for the whole of 2015, while deal values totaled $164.3 billion, increasing 198.2 percent year-on-year.

ChemChina's acquisition of Swiss seed and chemical group Syngenta for $43 billion was the largest one.

Carol Wu, PwC China's transaction services partner, said that given the existing global economic scenario and domestic competitive landscape, Chinese companies are increasingly opting for overseas M&As for both diversification and technology upgrading.

"Smooth financing channels in capital markets and fast-growing financial investors are the main reasons for the significant increase in the first three quarters," Wu says.

Listed companies accounted for more than 56 percent of the outbound M&A transactions, by deal amount, in the first three quarters of 2016.

By transaction volume, privately owned enterprises were still the most active players, clinching 449 M&A deals in the first three quarters. The figure was nearly five times higher than the number for state-owned enterprises.

For the first time, privately owned enterprises surpassed state-owned enterprises in transaction value, accounting for half of the total over the first three quarters of 2016.

"Some privately-owned enterprises have completed several deals, and in the process accumulated worthwhile experience that will be of long-term benefit to them," Wu says.

Financial investors became more active with 127 M&A deals made in the first three quarters, doubling the number made in all of 2015.

Mature markets such as Europe and North America continued to be the main destinations for Chinese buyers of sophisticated technology, advanced management experience and well-known brands. Asia was also popular among investors because of the Belt and Road Initiative.

PwC forecast that Chinese mainland outbound M&A will keep growing based on the 2016 results benefiting from encouraging policies and the renminbi's internationalization.

The changing international tax environment will raise new challenges for risk control and compliance procedures, the report said.

caixiao@chinadaily.com.cn

(China Daily Africa Weekly 11/11/2016 page30)

Today's Top News

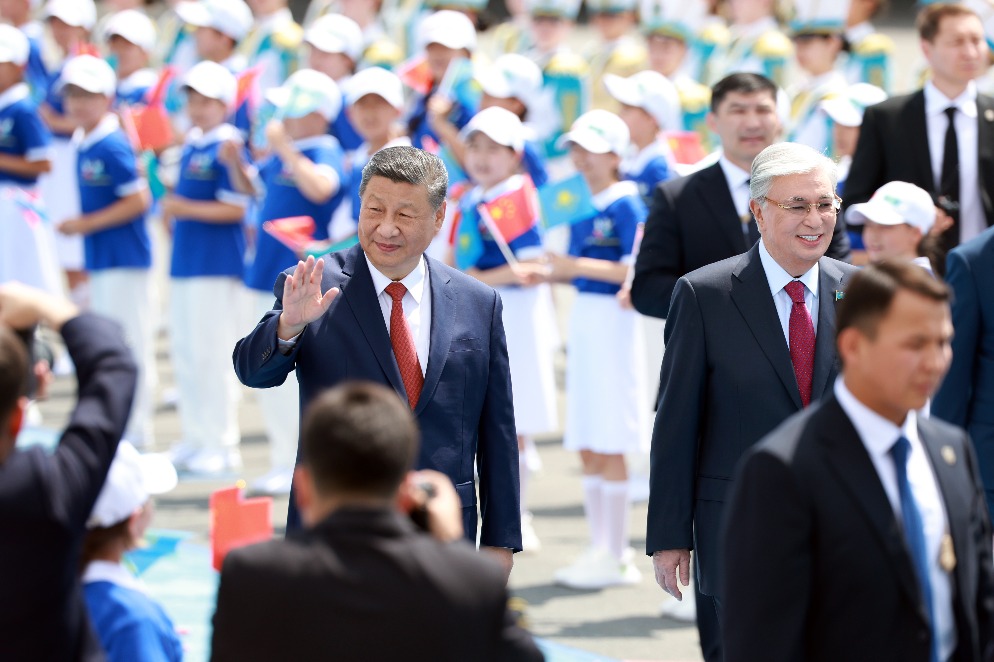

- Xi meets Kazakh President Kassym-Jomart Tokayev

- Xi arrives in Astana for China-Central Asia Summit

- Xi leaves for 2nd China-Central Asia Summit

- China's retail sales grow 6.4% in May

- Separatist acts can't stop civil exchanges

- Sino-Uzbek all-round cultural partnership bridging civilizations