Precious options open up on new frontier

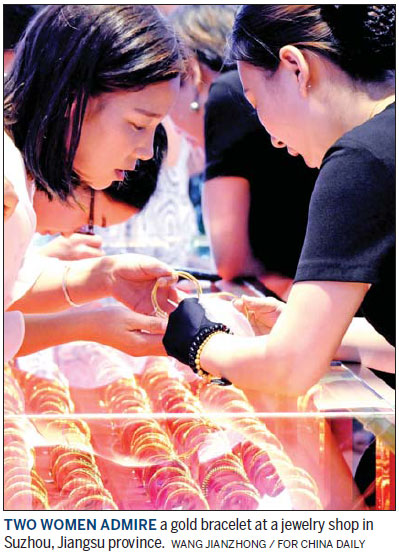

When Ma Aiju invested 100,000 yuan ($14,900; 13,300 euros; 11,400) in gold futures online late last month, her hands trembled as she tapped on the laptop keyboard to enter her details.

Until that point, gold bars and jewelry had been her preferred investment option. She'd invested larger sums in the past, too, but somehow futures was a new frontier, something scary.

"I don't see one bit of gold (in futures), and money flows in and out, and when you look at the price index surge and dive, your heart beats faster and you can't sleep," the 52-year-old from Shanghai says.

Investors like Ma are diversifying their portfolios. Gold is in, as yields appear relatively stable.

"If you subcategorize gold investments, you'll see physical gold, gold futures and gold exchange-traded funds. They all produce different results," Ma says.

According to analysts, investors today have more gold-related investment channels than ever.

Thomas Huang, deputy CEO of Harvest Wealth Management Co Ltd, says investors can choose from at least three ways: gold futures, stocks in gold-related companies such as miners and processors, and gold EFTs. This is on top of the option of buying physical gold.

While physical gold yields profits only when its price rises, the gold futures market enables investors book profits from shorting, which gives more flexibility.

In addition, fluctuations in the shares of gold miners and processors and jewelry retailers may be wider than that of physical gold because more factors are at play, like investor sentiment, government policy, company performance and speculation, Huang says.

Investors are slowly learning to appreciate the nuances underlying the pricing rationale behind various types of gold investments.

"For gold jewelry, the costs of material, processing, branding and marketing are considered. For gold bars and coins, you need to look at the cost of delivery and storage. As for ETFs and gold futures, prices can be more volatile, as more factors affect the market," says Wang Bowen, a Shanghai investor, who adds that he mainly invests in gold ETFs.

However, yields from these channels can vary, so investors need to be clear about their goals and risk tolerance.

"For example, margin trading in gold futures can be risky," says Wu Hao, a researcher for Guotai and Junan Securities Co Ltd. "If risk tolerance isn't high, then investors should put only a small amount of money into this category and more in ETFs and paper gold."

(China Daily Africa Weekly 09/16/2016 page28)

Today's Top News

- Expanding domestic demand a strategic move to sustain high-quality development

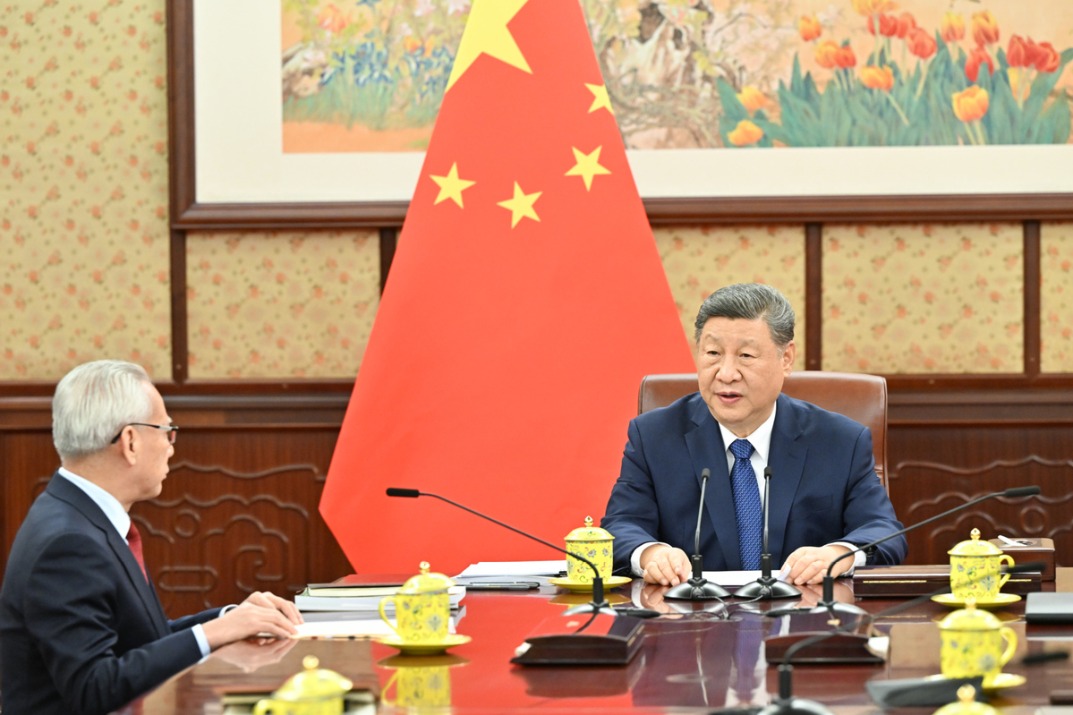

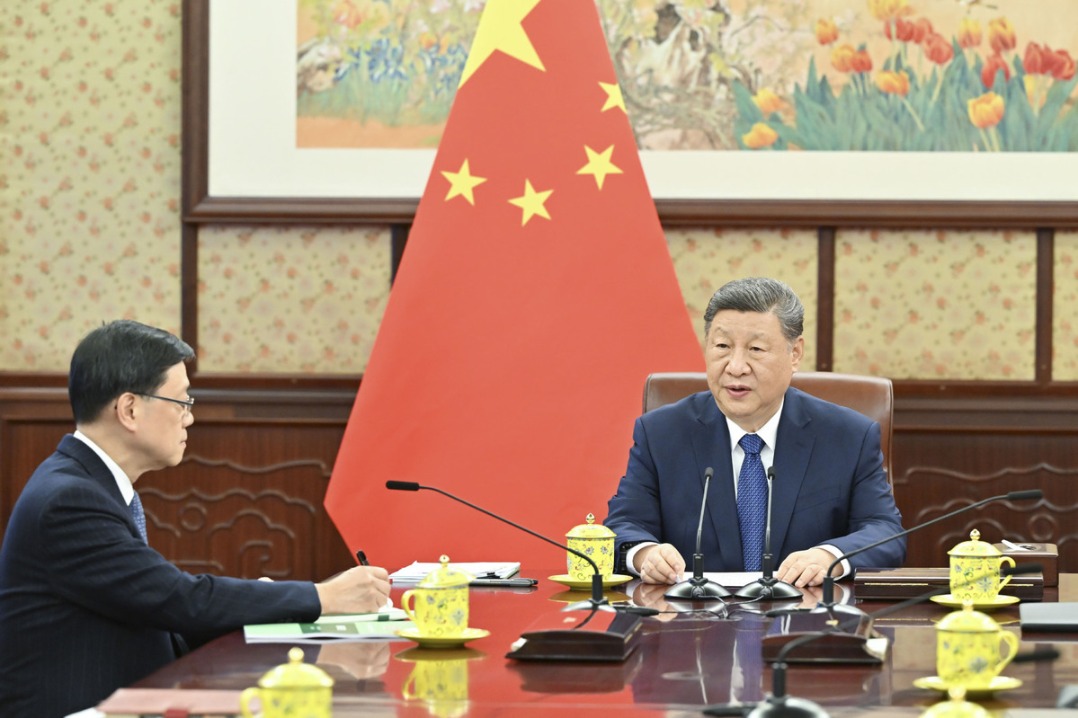

- Xi hears report from Macao SAR chief executive

- Xi hears report from HKSAR chief executive

- UN envoy calls on Japan to retract Taiwan comments

- Innovation to give edge in frontier sectors

- Sanctions on Japan's former senior official announced