New tax may be costly for polluters

Measure could cull outdated factory capacity, force companies to improve technologies

A draft of China's first environmental protection tax law, submitted to the top legislative body for initial discussion, aims to impose the heaviest-ever penalties on polluters.

The Standing Committee of the National People's Congress read the draft during its bimonthly meeting.

| A fermentation workshop of a biofactory in Shijiazhuang, Hebei province. The factory used to be a cement factory and was a heavy polluter before 2014. Wang Xiao / Xinhua |

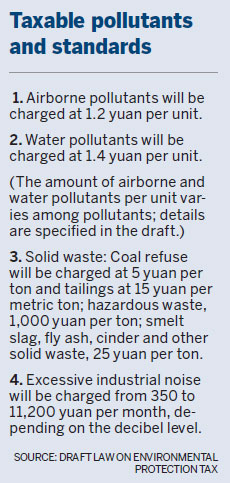

The draft designates four taxable types of pollution - airborne and water pollutants, solid waste and noise. Companies and individuals who directly discharge these would be subject to the tax, Finance Minister Lou Jiwei told legislators on Aug 29.

The draft adopts the current standards for pollutant discharge fees as the lower range, and provincial governments would have the authority to raise tax fees based on the local environmental situation, Lou said.

It also stipulates incentives to reduce emissions, saying taxpayers could receive a 50 percent reduction if they lower airborne and water pollutant emissions by half of the national or provincial standards.

Municipal sewage and household waste treatment plants would be exempt from the tax, as would mobile pollution sources like vehicles, vessels and airplanes. Agricultural pollutants would also be excluded, though large-scale breeding farms would be taxed.

The proposal would yield an estimated 22.8 billion yuan to 45.7 billion yuan ($3.4 billion to $6.8 billion; 3 billion to 6.1 billion euros) in annual tax revenue, according to research by the State Administration of Taxation.

Shi Zhengwen, a professor of fiscal and tax law at China University of Political Science and Law, says the proposed tax comes at a good time, considering the severe pollution in recent years and the ongoing economic reform.

"It's not an extra burden for companies, but a more standardized tax with stronger force, and easier for taxpayers to follow," he says, adding that it would not greatly expand the existing fees.

But small companies that generate huge emissions would face greater financial pressure. Because of this, the tax would help cull outdated capacity and force companies to improve facilities and technologies, advancing the nation's transition toward green economic growth, he adds.

The draft is seen as a major step in taxation and environmental protection, says Chang Jiwen, an expert in environmental policies at the State Council Development Research Center.

China began levying pollutant discharge fees in 2003 and by 2015 had collected more than 211.6 billion yuan.

Lou says the fees have been effective "in preventing and controlling environmental pollution", but he adds that local governments sometimes interfered or neglected to collect them, making it necessary to establish a law.

"It will be good to strengthen forces against polluting emissions from the root and avoid governments' administrative interference," according to statement from the NPC's Financial and Economic Affairs Committee.

Contact the writers at zhengjinran@chinadaily.com.cn

(China Daily Africa Weekly 09/02/2016 page14)

Today's Top News

- Foreign ministers of China, Egypt call for Gaza progress

- Shield machine achieves Yangtze tunnel milestone

- Expanding domestic demand a strategic move to sustain high-quality development

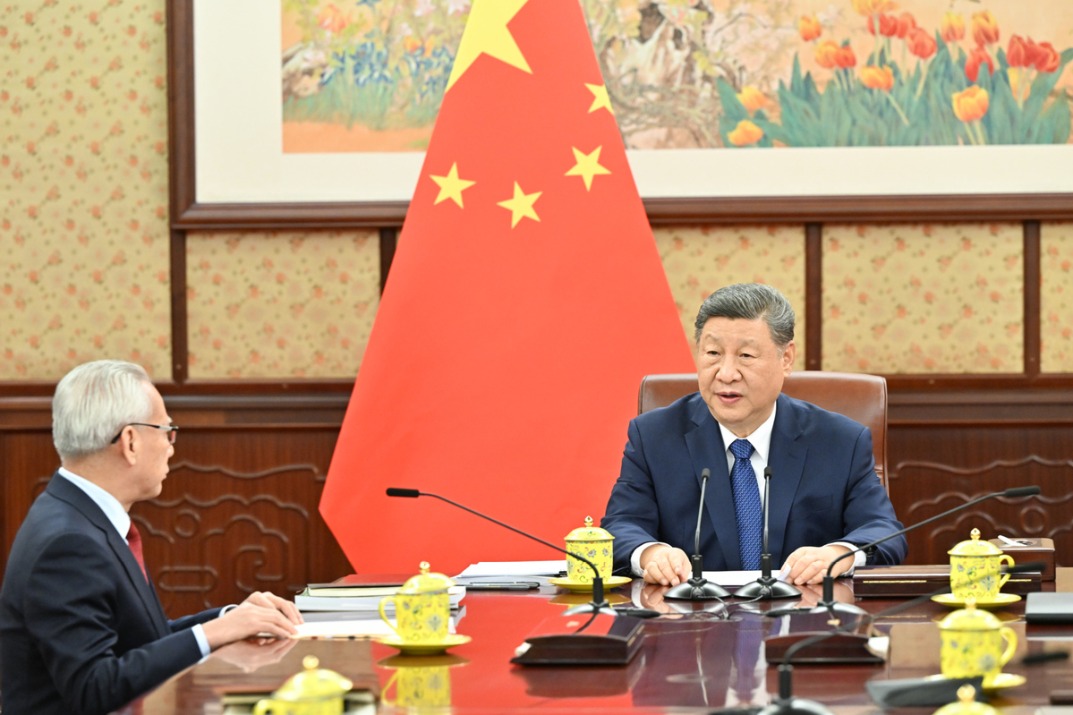

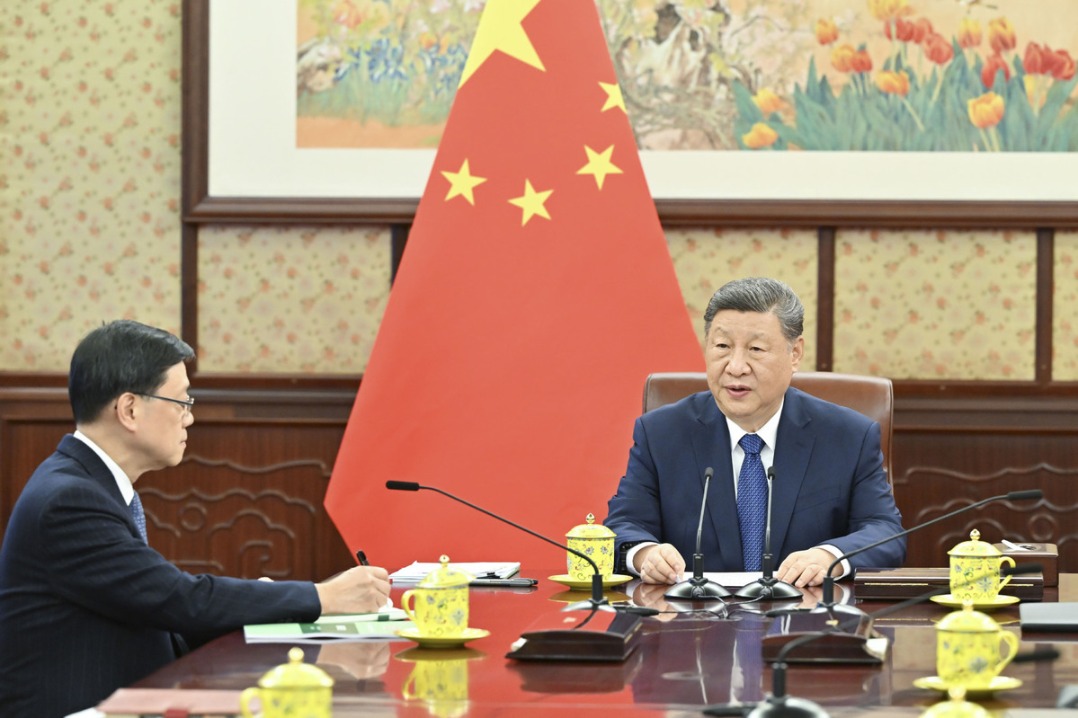

- Xi hears report from Macao SAR chief executive

- Xi hears report from HKSAR chief executive

- UN envoy calls on Japan to retract Taiwan comments