Govt urged to give private firms space to innovate

As Chinese private enterprises have a strong ability to innovate, they should be given more room and incentives to develop, according to the head of the EU Chamber of Commerce in China.

The business organization released its annual Position Paper on Sept 1, in which it makes several suggestions on the 13th Five-Year Plan, China's blueprint for development between 2016 and 2020.

The plan has structured goals according to five key themes: Sharing, opening-up, green economy, balanced economy and innovation.

Joerg Wuttke, the president of the European Union chamber, says he believes China's private enterprises are mostly innovative, but those that have become global champions and are setting the pace, such as Alipay, are not mentioned in the development plan.

"China has underestimated the ability of private enterprises to innovate and to strive," he says. "In Germany, we're still in the 19th century and pay cash, sometimes cards, and here everybody basically goes to the shops, shows their mobile phone and pays online."

While governments undoubtedly have an important role to play in supporting basic research and establishing a mature regulatory framework, he says it's private businesses and investors that should be developing new technologies, as they have the clearest understanding of their industries and can make decisions in response to market forces.

Open markets and more private investment, which bring efficiency and increased capacity for innovation, are essential if China is to avoid getting stuck in the co-called middle-income trap, he adds.

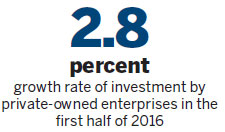

With China's economy in transition, growth rates of investment by privately owned enterprises fell from 10.1 percent last year to 2.8 percent in the first half of 2016.

Wuttke says he thinks the government still plays too large a role in the economy; for example, the Made in China 2025 strategy to upgrade the nations manufacturing sector, which he feels is too much top-down.

A strong role for the government in developing industries by directing capital into sectors that central planners have established as priorities will not allow China to realize its full economic potential, he warns.

"I think that the big money and big reorganization of industry is actually stifling Chinese innovation," he says, adding that reforms that aim to make Chinese SOEs more nimble and competitive are not quite there yet.

Xu Hongcai, an economist at the China Center for International Economic Exchanges, disagrees. He says encouraging private investment has become important work for officials.

The central government has held many meetings to discuss the issue, while local authorities have issued documents to attract private capital, he says.

Not long ago, the State Council also asked ministries to send teams to Beijing and the provinces of Liaoning, Anhui, Shandong, Henan, Hubei and Qinghai to supervise local efforts to encourage private investment. They were to gain an overall view in these places, point out problems and put forward suggested improvements.

Wu Jiangang, a research fellow at the China Europe International Business School, says private companies and SOEs have complementarities in China's economy. The growth in private enterprises is a slow process that needs time, while a rapid SOE reform would risk economic development and social stability.

So while China's economy slows down, the development of both private and state-owned enterprises will be important, he adds.

Contact the writers through chenyingqun@chinadaily.com.cn

(China Daily European Weekly 09/02/2016 page29)

Today's Top News

- Xi stresses improving long-term mechanisms for cyberspace governance

- Experts share ideas on advancing human rights

- Japan PM's remarks on Taiwan send severely wrong signal

- Key steps to boost RMB's intl standing highlighted

- Sustained fight against corruption urged

- Xi calls for promotion of spirit of volunteerism