Art world gets a dose of reality

Supply-side reform and austerity drive have put paid to irrational prices, promising market recast for future growth

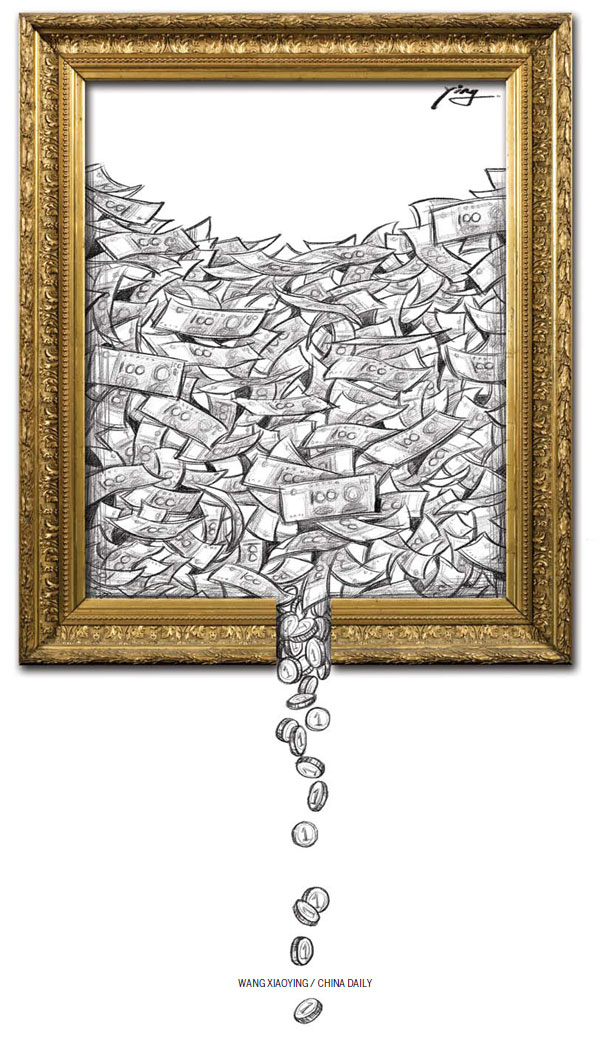

China's ongoing supply-side reform has injected a much-needed dose of reality into China's hyped-up art market, experts say.

Not just paintings, drawings and antiques, but even ornate furniture, old fine teas, precious commodities and rare crafts are part of China's artworks.

"The supply-side structural reform provides opportunities for the art market in China, and it leads overly high-priced products to return to rational prices," says Ren Helei, a researcher at the Center for Soft Power Studies at Peking University. "This should be the growth trend of the market."

In November, the government proposed to launch supply-side reform, which aims to raise the quality of products, better allocate resources and stabilize economic growth. Little did people realize then that the initiative will have a bearing on China's art market, which has been steadily shrinking in recent years.

Some precious goods that had irrationally high prices due to market frenzy are now witnessing major price drops as a result of dampened demand and fewer investments.

The turnover in the Chinese art auction market last year was 50.6 billion yuan ($7.6 billion; 6.8 billion euros), a 20 percent drop on the previous year.

The volume of transactions in auctioned goods also saw a retreat, according to a report by Art Market Monitor, a Beijing affiliate of printing company Artron in Shenzhen.

China's artworks have experienced a distinct decline, as investors, now low on confidence, grow cautious.

"The business model that relied on high growth in traditional resources and significant appreciation of art assets in a short time has ended," Ren says. "The art market should seek some emerging business opportunities. It should meet the demand for contemporary aesthetics."

Experts say in the long term, art consumption is likely to support the transformation and structural adjustment of China's art market, which is largely focused on collecting and investing.

The market is also expected to develop a mass dimension. Deals at art galleries, exhibitions and other primary markets will likely become major growth engines.

"The growth potential in art consumption has been directly reflected by the turnover at the Shanghai Art Fair last year," says Wu Fang, art director at Huafu Art Space in Shanghai.

"The turnover at the fair reached 141 million yuan, with the income mainly coming from transactions for low-cost consumer art, most priced at several thousand yuan to 30,000 yuan.

"Art consumption is expected to draw more attention, and the content and style of artworks are likely to become more modern. The methods of creating art and the structure of the market should also be transformed to adapt to a brand-new era."

Art auctioneers and art collection agencies say there has been an obvious decline in auctions of traditional goods. At the same time, they have seen an increase in online art consumption, with buyers being increasingly younger.

As a result of continuous expansion of the auction industry in recent years, a lot of artworks have been auctioned repeatedly. There is also a serious demand-supply imbalance in auctioned goods. Consequently, it is now difficult to find top-level artworks.

Among art and other precious products, those that suffered the most were neither affordable or cheap consumer arts nor rare high-end fine arts, but mid-range artworks that have limited investment value.

Even among high-end collections, some segments like green tea and rosewood furniture suffered. For example, not long ago, some art collections and fine goods commanded extremely high prices, but they came under pressure when the government's austerity drive dampened demand.

Many premium tea brands have seen a slide in prices. One type of the finest Pu'er by Chinese tea brand Dayi, a top-class green tea, saw its price drop from 24,000 yuan per kilogram to just 10,000 yuan per kg.

In the past decade, demand for rosewood furniture has soared in China. The market was worth more than 100 billion yuan in 2012, according to Greenpeace, the global environmental protection organization.

Yet the furniture sector has also seen demand slow in the past couple of years. Prices of rosewood furniture have plunged 30 percent, according to the China Rosewood Association.

Similarly, prices of objects made of coconut husk, once considered highly precious, have plummeted. A bracelet with a cluster of 108 coconut husks used to sell for more than 5,000 yuan. Now, it is hard to even find coconut husks for sale in the market, as demand has been tepid.

Liu Shuangzhou, a law professor at the Central University of Finance and Economics, says: "Consumers should consider their income levels and decide how much they should spend on artworks. Art consumption should be transformed from an elite consumption to a mass business.

"Investors should assess the risks of investing in art and fine goods, rather than assess only value. Buyers must also appraise art themselves. All this is consistent with the concept of supply-side reform, which emphasizes that goods should be priced cost-effectively and in line with their actual value."

zhuwenqian@chinadaily.com.cn

(China Daily European Weekly 08/19/2016 page27)

Today's Top News

- Xi stresses improving long-term mechanisms for cyberspace governance

- Experts share ideas on advancing human rights

- Japan PM's remarks on Taiwan send severely wrong signal

- Key steps to boost RMB's intl standing highlighted

- Sustained fight against corruption urged

- Xi calls for promotion of spirit of volunteerism