Double effort needed to boost economy

Both government and private sector must help China overcome difficulties, especially requirements for successful reform

A friend of mine with a factory in Jiangsu province called me last month. In a sad voice, he told me his factory is closing and that he is now asking provincial and local administrations for a grace period to make arrangements for his workers and facilities.

The reason for the closure is simple: His products belong to the chemical refinery sector, in which it has become difficult to meet environmental standards. This section of the industry has been dropped from the recommended list of the local government. My friend told me his factory had developed well over the past 30 years thanks to government support. Today, he has lost that protective umbrella.

This shows how important the local government's role is in economic development: It can decide the destiny of an enterprise.

In contrast, the boss of another small factory in the same province says he is happy because his company has received many orders from customers, including the local authorities and construction companies. This happened after the company switched to making materials for infrastructure construction such as new railways and highways, after the boss received advice to do so from a "friend" in government.

This shows how a company with close links to a local government can succeed, while those without those links lose out. We know this is not normal, because business should be governed by the market, not dependent only on government relations. Unfortunately, this scenario still exists in some areas.

So it's not surprising that private investment within China in the first six months has fallen to a surprising degree.

But while China has faced many problems in the first half of the year, the country's economic performance has gained wide praise from the international community. China has adopted a series of proactive policies to stabilize and improve economic development conditions.

China's GDP growth in the first half was 6.7 percent, better than the 6.3 percent forecast by some experts.

That is why the recent so-called Six Plus One meeting in Beijing - a gathering of major international institutions such as the World Bank, plus China - praised China's economic contributions in recent months. The key message was that the fundamentals of the Chinese economy remain positive, meaning that it will achieve strong, sustainable and balanced growth and contribute to boosting global economic growth.

The main reason China achieved such good results in the first half is that policymakers played a significant role in the macro economy. They have lifted limitations on development, car sales and house purchases in some areas in the past three years. They have worked to provide more support for financing and banking for the real economy. The government obviously provided cushioning to save the housing and car industries, which has helped rescue China's economy from fears of a hard landing.

In China, the land belongs to local governments. All infrastructure projects must acquire land to build, so local governments are the only ones that benefit from land sales. In addition to its role as landlord, the government can own or have shares in infrastructure projects like subways, harbors, airports and high-speed railways. It's clear that in China, the government has special functions that provide advantages for overcoming difficulties that cannot be solved in Western nations.

During the recent meeting of the Communist Party of China's Political Bureau, the possibility of a financial bubble was mentioned in documents, showing that top leaders have noticed the risks in the recent reform process. Such a bubble could include excessive debts of local governments and overheated investment in real estate and the overseas acquisition of businesses. These are becoming crucial factors that could damage the stability and health of China's economy.

Although local government debt has reached 1 trillion yuan ($150 billion; 135 billion euros), the government has enough tools and measures to attenuate the pressure if present. Regulators have approved policies to handle debt through issuance of bonds and other financial instruments, and with these measures the local authorities and companies involved can easily ensure the continuity and consistent execution of all projects. Channeling debts in this way will help stimulate the economy.

We often say that we need to double our efforts to boost the economy. This should mean efforts from both government and the private sector. It's the only way to overcome the difficulties we face, especially the requirements of supply-side reform, which is a key to solving problems in the market.

Supply-side reform includes reforming the government's role in the market, improving policymaking, development planning and risk management, and providing better service to meet demand. Imbalance in either supply or demand, both market fundamentals, could jeopardize the economy, so we have to maintain parity on both sides.

On the supply side, while China's domestic private investment during the first half fell significantly, Chinese private investment in the United States amounted to tens of billions of dollars. This shows that policymakers must adopt new policies to make investment more attractive in the domestic market, not in the United States.

On the demand side, the purchasing managers index in July was 49.9 percent, the lowest figure in the past five months. This reflects the downward economic pressure that still poses a challenge to reform, and is sign we must pay more attention to economic problems from either side.

So in this sense I'm watchful of trends in China's economy, because there also are hidden risks. These include self-centered attitudes on the part of local governments and enterprises. When these two main market players become too ambitious in terms of making money or making themselves look good, they can develop a greedy spirit that turns them away from abiding by rules and laws. This distorts the discipline and the principle of the social morality and justice that are needed for the country to advance.

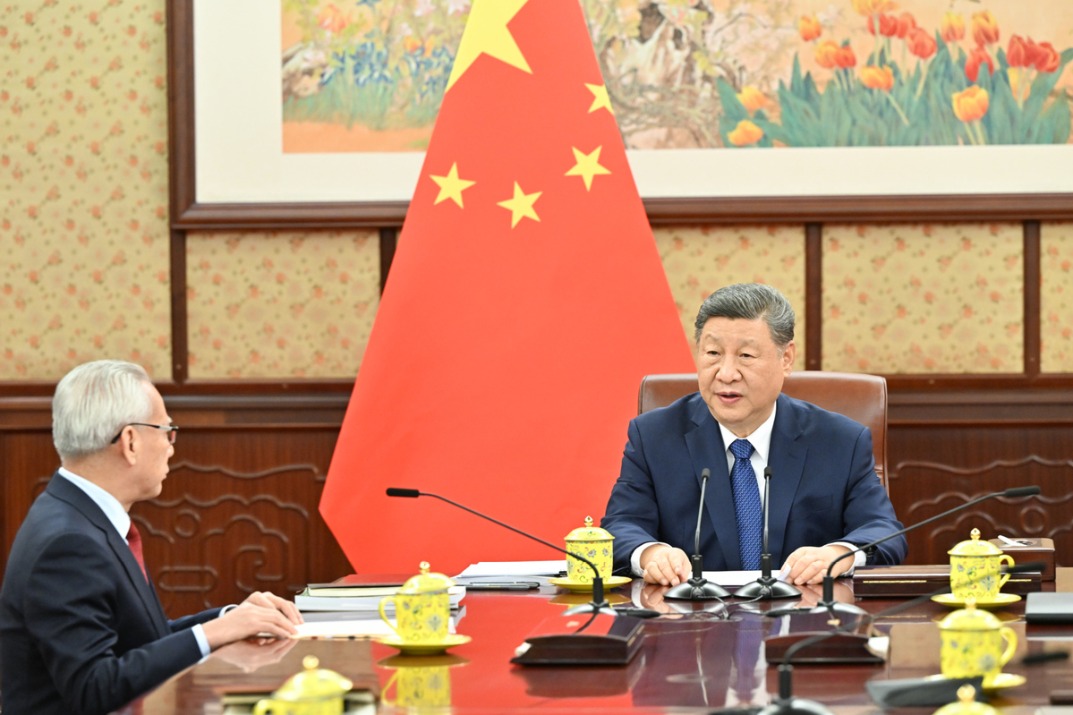

So the real risk for China's future is failure to constrain selfishness in policymaking and in operating businesses. We should not forget that President Xi Jinping called for better supervision of reform efforts, to ensure that reform does not deviate from the right direction.

Confidence and confusion will co-exist for a long period, but we should have enough patience to work toward improving market conditions for a better result in the second half of the year.

China still has a good chance to fulfill the targets it set for 2016. First, the National Development and Reform Commission announced that the country would cut interest rates and banks' reserve ratio requirements at an appropriate time to enhance the strength of the economy. More positive policies will be announced to encourage private investment and support future listing activities. And Chinese banks will provide easier and faster financing to support private entities.

We have no reason not to believe that China and other global leaders will work together at the upcoming G20 summit in Hangzhou to strive for stable, reliable development of the world economy.

The author is a senior fellow at Renmin University of China's Chongyang Institute for Financial Studies. The views do not necessarily reflect those of China Daily.

(China Daily Africa Weekly 08/05/2016 page9)

Today's Top News

- Crossing a milestone in the journey called Sinology

- China-Russia media forum held in Beijing

- Where mobility will drive China and the West

- HK community strongly supports Lai's conviction

- Japan paying high price for PM's rhetoric

- Japan's move to mislead public firmly opposed