UK remains attractive despite Brexit

The United Kingdom will remain an attractive destination for Chinese investors after Brexit, and investing in the healthcare sector offers potential, according to Matt Siddle, a portfolio manager at global asset management company Fidelity International.

"The UK economy will continue to be sound after Brexit, and the pool of skilled and flexible workers is large in the UK. So there are many reasons for the UK to be a popular destination for Chinese investors," he says.

Siddle adds that investing in healthcare companies in the UK offers good opportunities.

"Healthcare is a long-term structural growth story with increasing demand from an aging population, and the outlook for pharmaceutical companies is improving as their new drug pipelines are healthy, the cost of research and development has declined substantially, and the first cycle review approvals of new drugs has increased.

"With attractive valuations, the healthcare sector is definitely one of the most attractive areas with growth opportunities."

Siddle also says the UK stock market has not been affected much by the decision to leave the European Union because most of the earnings of the companies listed on the bourse are generated from outside the country. Less than 30 percent of the revenue of firms listed on the FTSE 100 index comes from the UK.

"The vote to leave the EU had a negative impact on investor sentiment on UK equities, but it also creates opportunities for investors to buy good-quality companies with cash-generative businesses at a discounted price," Siddle says.

In the last 18 months, European markets have been supported by macro factors such as falling oil prices and euro depreciation, as well as ample liquidity injected through the European Central Bank's expanded quantitative easing program, according to Fidelity.

"In light of the referendum result, central bank policy is likely to remain supportive and European equity market valuations will benefit from Chinese stimulus measures, and mergers and acquisitions," Siddle adds.

Wu Weijun, chief partner of PricewaterhouseCoopers in Beijing, says the June 23 referendum result was a disappointment because economic interconnectivity is the future and Brexit is a step backward.

"But I don't think China-UK relations will be affected much by Brexit," Wu says.

According to Wu, multinational companies should continue to have strategic cooperation with the UK.

Bilateral trade between China and the EU was $564.85 billion last year, while trade between China and the UK reached $78.54 billion, according to the General Administration of Customs.

caixiao@chinadaily.com.cn

(China Daily Africa Weekly 08/05/2016 page24)

Today's Top News

- Foreign ministers of China, Egypt call for Gaza progress

- Shield machine achieves Yangtze tunnel milestone

- Expanding domestic demand a strategic move to sustain high-quality development

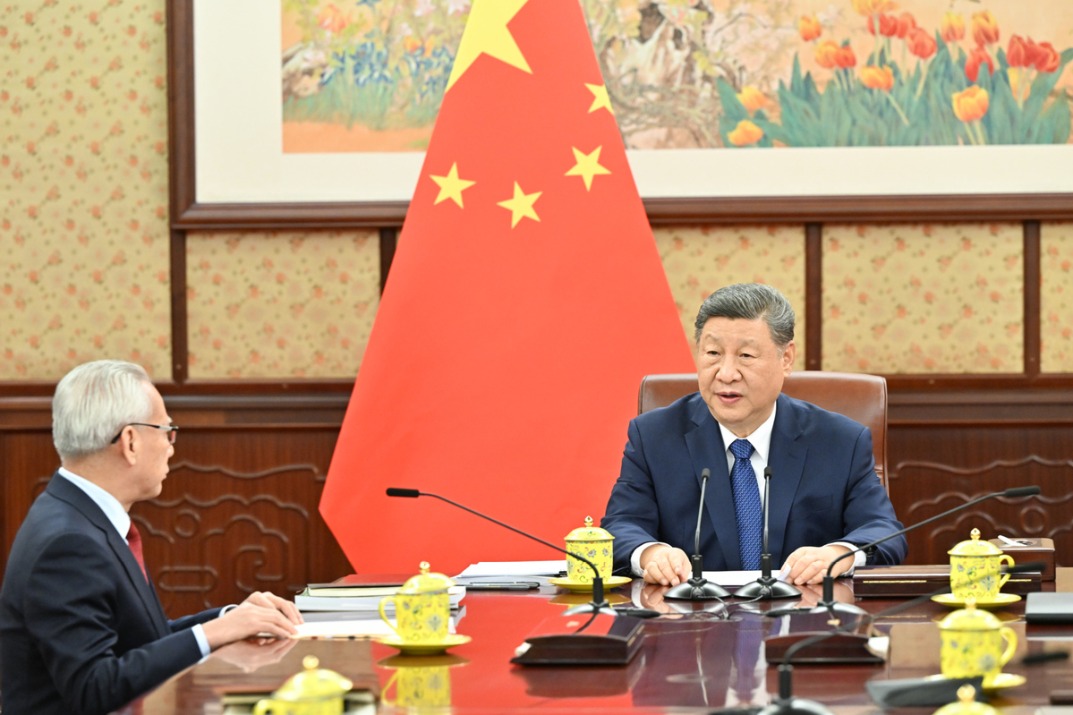

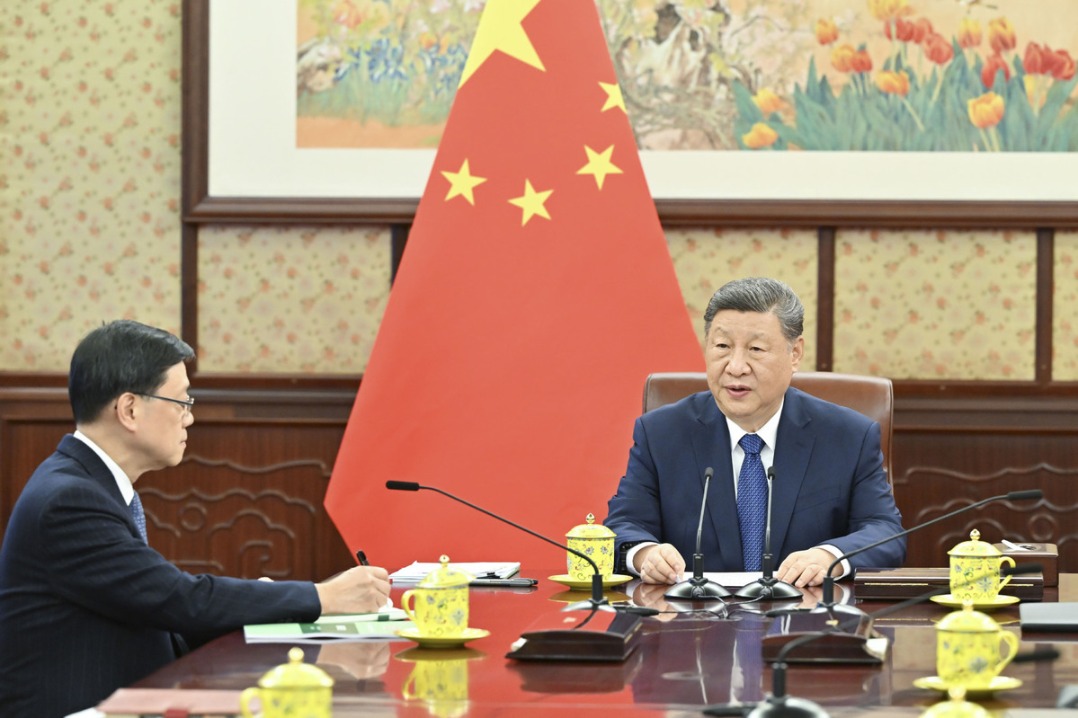

- Xi hears report from Macao SAR chief executive

- Xi hears report from HKSAR chief executive

- UN envoy calls on Japan to retract Taiwan comments