M&A decline in Europe not a worry

Some might be concerned over a drop in Chinese overseas investments in the EU, but here's why there is no cause for alarm

Chinese overseas direct investment in almost every region of the world showed healthy increases in the first five months of the year.

However, a drop of 14.7 percent in ODI in Europe is worth noting. What's behind this? Is it a new trend or just a temporary phenomenon?

From January to May, Chinese investors made direct investments overseas in 4,136 enterprises in 151 countries and regions. ODI amounted to $73.2 billion, up 61.9 percent year on year. But the distribution does not appear balanced: In North America, Australia, Asia and Latin America it increased 208 percent, 72.4 percent, 62.8 percent and 50.5 percent respectively; in Africa it increased 5 percent; but in Europe, we had that 14.7 percent drop.

In fact, the decrease can be regarded as a temporary phenomenon. The main reason is that the ODI fluctuates a lot. Mergers and acquisitions contribute the main part of ODI. But the value of different deals can differ greatly.

In 2015, for example, total M&A transactions amounted to $40.1 billion and the average amount per deal was around $200 million. Among them, however, China Chemical Rubber Company's acquisition of 60 percent of the stock of Italy's Pirelli - with a value of 4.6 billion euros ($5.1 billion), accounted for about 12.7 percent of the year's total amount. One more or one less such acquisition can greatly impact the quarterly change rate of ODI investment in the European Union.

The truth is that China's investment in the EU is especially volatile. If we compare the standard deviation of the rate of annual increase from 2007 to 2014, we see it is 269 percent for the European Union, 66 percent for the United States and 68 percent for the Association of Southeast Asian Nations.

In 2007, the rate of increase for the EU was 711 percent, but for 2008 the rate became a negative 55 percent. In the most recent five years, three showed an increase and two a decrease.

One more sign the decrease is temporary is that China's ODI in the EU dropped 43.4 percent year-on-year for the first four months of 2016, but fell to 14.7 percent for the first five months. That means only one month, May, made a big difference.

While it fluctuates in some areas, the trend for China's ODI is always upward. In 2015, China's nonfinancial ODI hit $118.2 billion, an increase of 14.7 percent year-on-year, which is the 13th straight year of growth. By the end of last year, China's ODI for the first time exceeded $1 trillion.

Chinese foreign exchange reserves were $3.21 trillion in June this year, up slightly from $3.19 trillion in May. That means that the $118.2 billion ODI figure for 2015 is a relatively small number and China's ODI still has a lot of growth potential. Given that the EU is the largest destination for Chinese ODI apart from the investment transit region of Hong Kong, we can reasonably expect that ODI to the EU will continue to maintain an upward trend.

China's ODI to the EU is dominated by state-owned companies' large-scale acquisitions, which is the main source of fluctuation. But one new factor may reduce the fluctuations: Chinese private enterprise is becoming a more important factor in M&As.

China's state-owned enterprises played the main role in overseas M&As during the US subprime mortgage crisis and the European debt crisis, when many countries cut their ODI to the EU while China increased its EU investments. But in 2015, Chinese private enterprise accounted for 69 percent of the total investment.

While acquisitions by state-owned companies are sensitive in market-driven Europe, private enterprises can gain greater acceptance. Private sector investments are expected to increase.

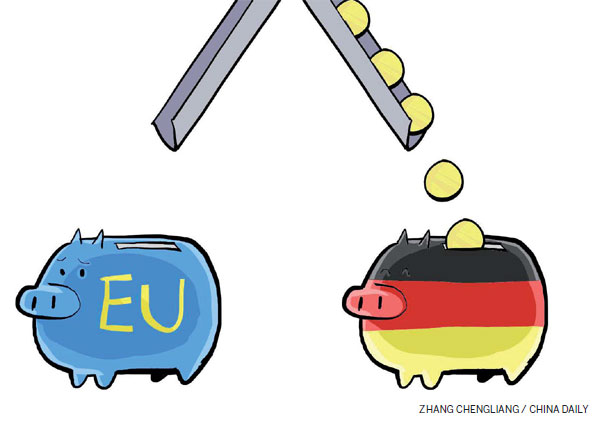

Another change is that Germany is becoming more important for China's ODI.

In the EU, the fluctuations in China's ODI occur mostly in France and Britain, while ODI in Germany has exhibited more stable growth. In 2015, there were 1,912 foreign projects in Germany, an increase of nearly 60 percent. Foreign investment in Germany amounted to 6.2 billion euros. It is notable that, for the second time, China ranked first for ODI in Germany.

The German equipment manufacturing industry, one of the world's most innovative, has become a popular choice for Chinese investment. In 31 categories of machinery manufacturing, Germany is in the top three in 27 categories. Leading technology, excellent quality, strict management and strong R&D and innovation capability have made for unique advantages and strong brands.

After the financial crisis, growth ground to a half for the equipment manufacturing industry as a whole in Europe. The German equipment industry also was affected to varying degrees, and some companies were forced to seek a merger or acquisition.

In the machine tool industry, for example, German companies' average number of employees is less than 130 people and most are family businesses. They have a limited ability to withstand an economic crisis, but their high levels of technology and international brands are exactly in line with Chinese capital's overseas M&A strategies.

Chinese enterprises pursuing M&As in Germany can benefit from target companies' international brands, international sales networks, marketing experience and management experience. After the completion of an acquisition, they can be used as training centers to improve China's technical and management skills.

One concern is that Brexit may introduce more uncertainty to European investment. Brexit will affect some projects, but it will open other opportunities, too. Brexit may reduce the attractiveness of the UK as a base for the European market, but it also may provide the UK with more motivation to strengthen its economic and trade ties with China to offset the negative effects of the European retreat. Another effect may be to cause some enterprises to invest more in France and Germany.

China's ODI has been increasing by 30 percent year-on-year in recent years, and the trend is expected to continue. China's ODI has increased very quickly since the US subprime crisis started in 2007. Since 2009, the EU has become the most attractive investment destination for China. The trend is just starting and is not expected to change anytime soon.

Brexit may cause structural change but will not derail the trend. China's ODI will grow in the future and play an important role in enhancing European economic stability and China-EU economic cooperation.

The author is a lecturer at the Management School of Shanghai University and a research fellow at the China Europe International Business School Lujiazui International Finance Research Center.

(China Daily European Weekly 07/29/2016 page12)

Today's Top News

- Chinese landmark trade corridor handles over 5m TEUs

- China holds first national civil service exam since raising eligibility age cap

- Xi's article on CPC self-reform to be published

- Xi stresses improving long-term mechanisms for cyberspace governance

- Experts share ideas on advancing human rights

- Japan PM's remarks on Taiwan send severely wrong signal