Feeling at home with their studies

Chinese are snapping up properties overseas near good schools for their children to reduce commutes and risks

When Olivia Zhang takes off from Shanghai for Vancouver this summer for full-time postgraduate studies, the 26-year-old sales manager with a commodity trading company, will be taking a considerable bankroll with her. Unlike other students who look to rent a dormitory bed or a hostel room, Zhang is seeking to buy a flat.

"I had applied for student dormitory rooms, but their availability is limited. Will I get one? Fat chance! So, I thought, why not just buy an apartment if I could afford one? I'll then own it, and I can earn returns on my investment later," Zhang says.

The funds will be from the sale of her apartment in Shanghai. Her family members are permanent residents in Canada, so a visa and property deal should not be a problem.

There are many Chinese homebuyers like Zhang in Canada and other countries these days. These wealthy people call their overseas properties xuequfang, or properties within a stone's throw from a good school, college or university.

Once they or their children finish their education, they rent out or resell their xuequfang, or live there permanently if they are able to.

According to Juwai, a website that provides information on overseas properties, cities with famous educational institutions are seeing a steady rise in realty prices, thanks to such nonspeculative buyers, who now account for more than half of the Chinese snapping up overseas properties.

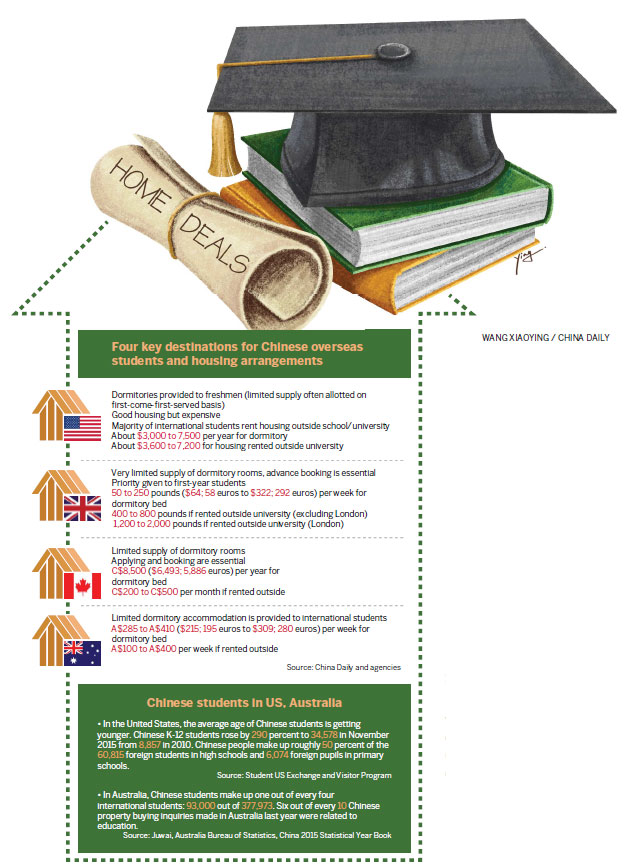

For instance, in the United Kingdom, 54 percent of Chinese property queries are for xuequfang; in Australia, it is more than 60 percent; and in the United States, more than 72 percent.

An influx of overseas students has a positive impact on local economies, including real estate, says Charles Pittar, CEO of Juwai. For instance, Chinese students spend more than $18 billion a year in Australia.

"When Australia wins a foreign student, it gains tens of thousands of dollars in education fees, and at least as much in retail and services spending, plus potentially much more in real estate investment," Pittar says.

Last year alone, Juwai funneled Chinese inquiries for Australian properties worth A$1.6 billion ($1.2 billion; 1.1 billion euros). Queries worth a potential $1 billion came for xuequfang.

The scene is not vastly different in the US, says property agent Peter Ng in Los Angeles. States such as New York, Massachusetts and Pennsylvania produce healthy demand given their famed educational institutions.

He says: "Chinese families who buy homes for children focus a lot on the safety of the neighborhood. This is so because the average age of Chinese students pursuing education in the US is now significantly lower than before.

"Some are middle school students and some are even primary school students. So, they really want their homes to be as close to school as possible, to reduce commuting time and risks.

"Also, some students are buying homes for themselves. They look forward to buying property as early as possible. If they are able to continue their stay after their education and work there, they can stay in the same place without the trouble of relocating, or they can resell at a profit and reinvest in larger houses."

Ng says properties with more than three bedrooms are popular among Chinese buyers. One room is often reserved for visiting family members or friends, is sublet to other students to lower the cost, or is transformed into a study.

Daniel Tang, a San Diego-based home sales consultant with CBRE real estate, says: "Chinese students are now aware of many institutions, not just the Ivy League colleges. They are looking at smaller but good colleges outside the top 10, particularly those with strong competence in disciplines like design, art, communications and engineering. So, demand for housing is rising in California, Texas and Illinois."

Similarly, in the UK, Chinese are looking to buy homes as they need to invest fewer yuan now, given the erosion of the pound's value of late. They are not unduly concerned about the potential impact of Brexit on the local property market as they believe such effects are likely to be short term in nature.

Brian Zhou, 49, a resident of Shanghai, agrees. He has just bought a two-bedroom apartment in the South Bank area of London for his 22-year-old daughter. "People like me are not speculative buyers. So, quality and the neighborhood are important," he says.

wuyiyao@chinadaily.com.cn

| A property trade center in Queensland, Australia. Wu Yiyao / China Daily |

(China Daily European Weekly 07/15/2016 page26)

Today's Top News

- Chinese landmark trade corridor handles over 5m TEUs

- China holds first national civil service exam since raising eligibility age cap

- Xi's article on CPC self-reform to be published

- Xi stresses improving long-term mechanisms for cyberspace governance

- Experts share ideas on advancing human rights

- Japan PM's remarks on Taiwan send severely wrong signal