Getting high on fine taste

The wine market in China has shrugged off a recent slump as individual consumers uncork local and imported varieties

When Rob Bevis launched his import and wholesale business, Roque Fine Wine, three years ago in China, he was told the country's wine market was nearing a tipping point.

The government's anti-corruption campaign, which promised long-term benefits for society, had an immediate adverse effect on wine consumption as it curbed officials' extravagant, taxpayer-funded banquets.

| In the past three years, China's wine market has steadily recovered to a path of healthy and sustainable growth. Provided to China Daily |

"At the time, my clients, such as restaurants, were primarily concerned about somehow maintaining the same level of profit margin," Bevis says. "Diners who used to spend 2,000 yuan ($305; 270 euros) on a bottle of wine were now spending only 600 yuan."

Sales of expensive imported wines, which were common at lavish banquets, fell in terms of volume and revenue. Traders lost a lot of corporate and government clients, and this pushed vintners to shift their focus to individual consumers.

But the going was not easy. For one, most individuals can afford only relatively inexpensive wines. For another, they were not very knowledgeable or informed about wine, so were easily confused by the many brands that entered the market.

Racketeers had a field day, with low-quality wines peddled at exorbitant prices. This created a strange situation, in which ignorant consumers would buy high-cost wines assuming they must be good varieties. Conversely, even if good-quality wines carried lower price tags, consumers would not buy them as they presumed they must be of poor quality, Bevis says.

But in the past three years, China's wine market has steadily recovered to a path of healthy and sustainable growth. Increasing numbers of consumers buy wine for their own consumption or to share with family and friends. Banquets are also no longer the only occasion to enjoy wine.

Moreover, consumers in China have broadened their knowledge and developed a taste for fine wines. They are willing to try more varieties sourced from different regions of the world.

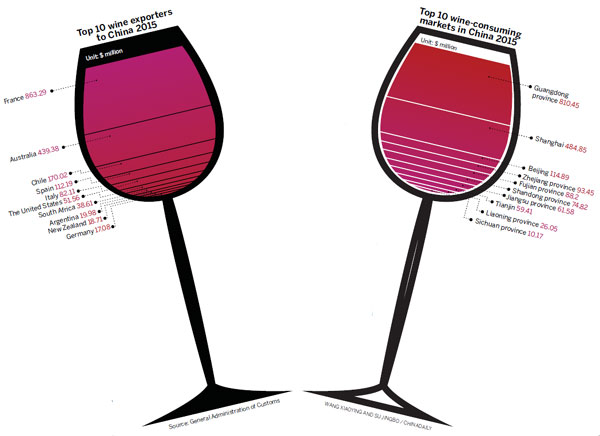

Evidence of this trend comes from wine consumption figures. Sales of imported bottled wines last year rebounded to a three-year high of 395 million liters, up 37 percent year-on-year. In terms of value, sales reached $1.87 billion, according to China's customs authority.

Leading the pack for foreign wines are French varieties, New World wines, like those from Chile and Argentina, are fast grabbing market share.

Market researchers say Chinese consumers are also buying more relatively expensive wines imported from New Zealand. Varieties such as sauvignon blanc from Marlborough are gaining in popularity, despite their average price being among the highest in imported wines, according to a research note by Rabobank, a Dutch company that provides food and agriculture financing and research services.

Wine trade experts say this trend is natural, as individual consumers prefer more diversified and differentiated products than corporate clients.

"In the past, a corporate client used to buy 100 crates of a wine label every month at the same price," recalls Zhang Meijun, a distributor of imported wine in the eastern city of Suzhou. "The wine would have the same taste, and people would still enjoy it over and over again. The occasion, too, would be the same usually: the business banquet. It was like making uniforms.

"Now, consumers' choices are more like custom-made garments. They differ from person to person. Drinkers choose their wine based on their own taste and the occasion. Some consumers even pair their wines with the films they watch or the music they listen to."

For their part, traders encourage buyers to try as many varieties as possible through a wide range of events and education programs via online and mobile channels.

Pudao Wines, a subsidiary of Australian retail giant Woolworths Liquor Group, has been establishing wine boutiques in China that provide fine wines to private clients and wine-related services.

ASC Fine Wine, one of the largest fine wine importers in China, has also devoted more resources to online retail channels. It has its own online platform and stores on e-commerce sites like Tmall. The company says it adjusts its prices and products to keep them in a range that is attractive to an increasing number of consumers.

Enoteca, a specialist wine shop based in Tokyo, often organizes wine tasting and other events at its China stores to share information about growing grapes, including details about the geographical features of the wine regions and the heritage of wineries.

China-made wines are also visible. Their price points and product portfolios are regularly adjusted to stay competitive in a market that is marked by a growing affinity for imported wines.

According to a research note by Winechina, a website focused on China's wine market, wines produced in the country account for 70 percent of the national market.

Some new Chinese labels, such as Grace Vineyard in the Ningxia Hui autonomous region, are gaining in popularity among wine consumers and are even being exported.

But it is the established wine brands like Chang Yu and Great Wall that still dominate the domestic market. They are performing better in lower-tier cities where the distribution system and consumer groups are less affected by imports than in first-tier cities and coastal cities, Winechina reports.

Zhou Hongjiang, general manger of Chang Yu, says China's wine market is not a zero-sum game between imported wines and local brands. As the market expands, all players that offer high-quality products can hope to attract more buyers.

Zhu Qi, 46, a wine collector in Shanghai, says the coming of age for China's wine market "is actually very good for wine consumers like me because tasting wines is like touring a place: it involves a lot of senses, memories and imagination".

He adds, "In the past, when wine varieties and sources were limited, I felt like a person who could not travel far. Now, with more choices, I feel like touring around the globe."

Consumers like Zhu expect a more transparent and consistent pricing system.

"One thing confuses me, and that is the price," he says. "In China, the same bottle of wine at various retailers may vary greatly, from 100 to 380 yuan. Perhaps, it's because retailers' capacity to manage costs varies. It's also likely that the market is still not mature enough and quite segmented."

wuyiyao@chinadaily.com.cn

(China Daily European Weekly 05/20/2016 page26)

Today's Top News

- Takaichi must stop rubbing salt in wounds, retract Taiwan remarks

- Millions vie for civil service jobs

- Chinese landmark trade corridor handles over 5m TEUs

- China holds first national civil service exam since raising eligibility age cap

- Xi's article on CPC self-reform to be published

- Xi stresses improving long-term mechanisms for cyberspace governance