Missing the tree for the leaves

Views on Chinese economy tend to bifurcate into extreme binary views but the reality is a complicated mixture, says author

Arthur R. Kroeber believes the debate about the China economy is almost always too polarized.

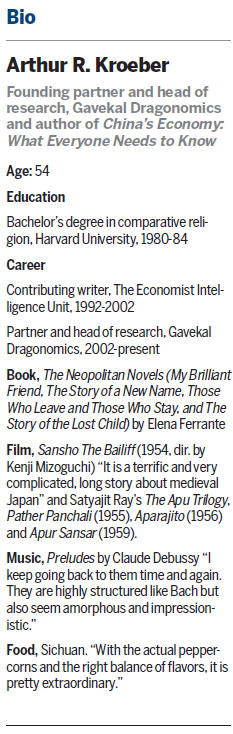

The founding partner and head of research of Gavekal Dragonomics, a Beijing research firm, and author of a new book, China's Economy: What Everyone Needs to Know, says as a result it is difficult to get the true picture.

| Arthur R. Kroeber says people often try to simplify China into one narrow story line. Feng Yongbin / China Daily |

"I think the biggest mistake, in general, is that people always think you can reduce China to one thing. It's good, it's bad; it is going to take over the world or it is going to collapse tomorrow," he says.

"These views tend to bifurcate into extreme binary views. The reality obviously is some complicated mixture."

Kroeber, 54, was speaking in the meeting room at the offices of his company, which he helped found in 2002, at the Soho Nexus Center.

His book is timely with huge international interest in the Chinese economy, which intensified at the start of the year with a renewed bout of stock market volatility, which has recently abated.

"That is kind of good luck, I have to say. This project actually originated a couple of years ago. I was often asked by clients whether there was one book they could read to give them the basic facts about the Chinese economy. I never could come up with one.

"There are obviously some dense academic tomes, which are quite good, but not very accessible to an ordinary reader and particularly not to the kind of business reader who wants a quick scan. So there was kind of gap in the market."

The resultant 319 pages, although an interesting read, are in no way just a beginner's guide but a genuine examination of the issues facing the Chinese economy from reform and opening-up in the late 1970s to today's many policy dilemmas.

"The problem is that people try to simplify China into one narrow story line, which they would never think of doing, for example, with the United States, or any other large, complex economy," he says.

One of the major issues with the Chinese economy is slowing growth. The government has set itself the target of doubling 2010 per capita income by 2020 in the current five-year plan (2016-20), which would result in China being defined as a high-income country. To do this, it has to achieve 6.5 percent GDP growth in each of the next five years.

Some think the government should move away from growth targets.

"They've had growth targets since the early 1980s and it has been a deliberate part of the development strategy. It was a way to motivate local officials and officials all the way up the line. It is similar to what Japan and South Korea did.

"I think now, however, everyone knows that growth is slowing to some new level but no-one can quite agree on what that new level is, or should be."

China contributed a quarter of global growth in the years after the financial crisis and now with its growth slowing, the rest of the world - particularly commodity producers such as in Africa - can no longer rely on this scale of support.

"China had a huge impact on commodity prices and this was particularly important for emerging markets for a long time. This huge fall in prices has been terrible for a big segment of these markets."

Kroeber, who grew up in an academic family in New York and is the grandson of Alfred L Kroeber, a highly influential early anthropologist, did not want to become an academic himself.

After studying comparative religion at Harvard University, he became a freelance journalist, first on local US newspapers and then for publications such as the Economist Intelligence Unit, which eventually took him to Beijing.

"I swore when I left college I would never go to graduate school and although I kept that promise I've wound up relocating many aspects of academic life in my professional career."

He admits also to not being a formally trained economist and that he had to pick up the subject.

"I wound up in India doing freelance reporting and I quickly came to realize you couldn't understand politics or the social environment unless you had an understanding of what the economic motivations of people were."

Kroeber predicts that China's economy might overtake the US in size by 2028, although just a couple of years ago it seemed as though this might have been by 2018. But since then the US economy has picked up pace while China's has slowed.

"I think in an economic sense what is most significant is not the size of the Chinese economy but the scale of its trade and investment links with other countries. I think the most interesting statistic is that China is now the biggest trading partner of more countries in the world than any other country."

By overtaking the US, it would just be reverting to the position it held for many centuries before 1800.

Kroeber, however, does not think there is anything so remarkable about the position that China once held, given the size of its population.

"All economies were largely agrarian then and all agrarian economies then had more or less the same per capita income. So China, with the biggest population had the biggest economy, although it had a pretty sophisticated pre-industrial manufacturing economy for textiles and porcelain."

The author says what would be really significant is that if China became the world's richest economy but he is dismissive of those who suggest this might happen by the 2070s or 2080s.

"I would put money on it never happening because no other developing country has been able to exceed the US in per capita trends. Japan is the most notable example because it did look like it would in the late 1980s but it hit a wall. Most countries have flattened out at between 60 and 80 percent of the US level."

Despite the yuan now being included in the Special Drawing Rights basket of currencies, Kroeber does not believe that the yuan will replace the dollar as a global reserve currency any time soon.

"Let's dispense with this idea that the renminbi is anywhere close to replacing the dollar as a major reserve currency. The qualifications for being a major reserve currency, let alone the central reserve currency, are that you have an extremely deep and open and transparent capital market that anyone can invest in, and China doesn't have this."

He thinks there has been a certain amount of paranoia in the US about China wanting to set up an alternative Bretton Woods system with the launch of the Asian Infrastructure Investment Bank last year.

"The problem for the US administration was there was no way the US could ever join because the US Congress, in its current configuration, would never approve the money for it. They made a choice instead which, in my view, was in error, to try and make an issue out of it."

Kroeber says that although China might have the capital, it does not have the ability to create an alternative financial order.

"It just does not have the intellectual resources right now that the World Bank and the IMF have built up over decades."

He does believe the Chinese system has many strengths, not least its deeply ingrained bureaucracy, which he says would be difficult for any other country to replicate.

"The Chinese have had a long history of having a systematic bureaucracy. If you don't have those 15 centuries of heritage, it is difficult to conjure up the quality of those institutions out of the air. This is one of the obstacles for the replication of the China model in, for example, Africa."

andrewmoody@chinadaily.com.cn

(China Daily European Weekly 04/15/2016 page32)

Today's Top News

- Takaichi must stop rubbing salt in wounds, retract Taiwan remarks

- Millions vie for civil service jobs

- Chinese landmark trade corridor handles over 5m TEUs

- China holds first national civil service exam since raising eligibility age cap

- Xi's article on CPC self-reform to be published

- Xi stresses improving long-term mechanisms for cyberspace governance