Premier: Tax reform to boost vitality

Pilot program to be expanded to property, construction, finance and consumer services

Premier Li Keqiang's message to China's tax and financial authorities is crystal clear: The ongoing landmark tax reform must reduce burdens on all industries.

Ahead of the deadline for a sweeping reform that seeks to replace China's decadeslong business tax with a value-added tax, Li visited the State Administration of Taxation and the Ministry of Finance on April 1, making sure tax-reduction measures are in place to benefit enterprises.

Starting May 1, a business tax to VAT pilot program, which began four years ago, will expand to the remaining four sectors - property, construction, finance and consumer services, which involve at least 10 million companies. Together they contribute 80 percent of China's total business tax revenue.

An 11 percent VAT will be levied on construction and real estate companies, while a 6 percent rate will be imposed on finance and consumer service sectors. In addition, VAT deductions will cover all enterprises' new property, the authorities said in March.

"The business tax to VAT reform is key to ensuring the effectiveness of the proactive fiscal policy and to pressing ahead with the structural, especially supply-side, reform for this year," Li says. "If this is well done, the real economy will be more vital."

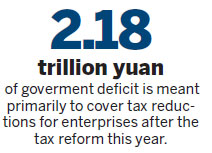

The premier says China has augmented the government deficit this year, and the increase - 560 billion yuan ($86.4 billion; 75.9 billion euros) up on 2014 to 2.18 trillion yuan - is meant primarily to cover tax reductions for enterprises after the tax reform.

The reform measures will alleviate the tax burden on enterprises by more than 500 billion yuan and will bolster the development of the service sector, which contributed more than half of China's GDP last year, Li says.

The country has imposed a value-added tax on tangible goods, with services being subjected to a business tax imposed on a company's sales, including costs, thus resulting in double taxation.

Unlike a business tax, VAT avoids double taxation by taxing only the difference between a commodity's price before taxes and its cost of production.

By eliminating repeated taxation, the reform will unify China's taxation system and help create a fair market environment, Li says.

zhaohuanxin@chinadaily.com.cn

| Passers-by at the gate of The Ministry of Finance headquarters in Beijing. Provided to China Daily |

(China Daily European Weekly 04/08/2016 page25)

Today's Top News

- Takaichi must stop rubbing salt in wounds, retract Taiwan remarks

- Millions vie for civil service jobs

- Chinese landmark trade corridor handles over 5m TEUs

- China holds first national civil service exam since raising eligibility age cap

- Xi's article on CPC self-reform to be published

- Xi stresses improving long-term mechanisms for cyberspace governance