Wealthy Chinese to invest $463b overseas

High net worth people are forecast to raise their overseas assets from 16 percent to 30 percent of their total in the next 10 years

In the next 10 years, wealthy Chinese are expected to invest around 30 percent of their assets overseas, amounting to at least 3 trillion yuan ($463 billion; 409 billion euros), according to a report released on March 28 tracking investments by the group.

"It is a sound proportion to use 30 percent of the total assets as overseas investments to reduce asset risks," says the Global Realty Investment White Paper by Global House Buyer, a Beijing-based services provider to Chinese overseas investors.

| Chinese homebuyers at a real estate exhibition for overseas projects. Australia, the United States, the United Kingdom and Canada are the top four countries most Chinese investors are interested in, a report said. Provided to China Daily |

"Since China is still at infant status for individual overseas investment, the investment is anticipated to grow at a compound growth rate of 20.6 percent in the next 10 years."

The report tracks rich Chinese with personal wealth of at least 10 million yuan. At the end of 2013, that group amounted to 1.09 million people, according to the 2014 Hurun Wealth Report.

The overseas assets of the Chinese investors accounted for 16 percent of total assets on average, according to a 2015 report by Hurun Institute and Visas Consulting Group.

Over half of wealthy Chinese invested less than 5 percent of their total assets overseas, while only 8 percent invested more than 50 percent of their total assets overseas, according to the report.

Wealthy Chinese are shifting their focus to sustainable, safe returns for the long term, according to the white paper, which analyzes the realty markets in Australia, the United States, the United Kingdom and Canada, the top four countries most Chinese investors are interested in.

With the depreciation of the nation's currency, the renminbi, and the slowing of China's economy fueling fears of investment risks, Chinese investors tend to diversity their assets and increase the interest in overseas investments, it says.

The diversification of asset allocation has been extended from the domestic stock and real estate markets to overseas stocks, bonds, real estate and other forms of investment.

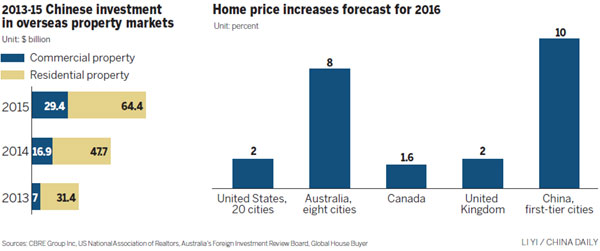

In the past two years, the overseas investments of wealthy Chinese in real estate increased dramatically, the white paper says.

Investments amounted to $64.6 billion in 2014, up 68 percent from 2013, with $16.9 billion in commercial and $47.7 billion in residential real estate. The volume is expected to reach $98 billion, up 52 percent, in 2015.

The number of Chinese people investing in overseas residential property in 2014 increased by more than 46 percent over 2013, with the United States alone amounting to $28.6 billion, a record high, accounting for 60 percent, followed by Canada at 20 percent, and Australia at 12 percent.

A survey highlighting the preferred emigration and overseas investment destinations of high net worth Chinese found that Los Angeles was the most popular location with 17.4 percent of the vote. San Francisco was next with 16 percent, and New York third with 13.5 percent.

The Immigration and the Chinese HNWI 2015 report and survey by Hurun Institute and Visas Consulting Group was based on responses from 284 Chinese with an average wealth of 30 million yuan who have either emigrated or are considering emigrating.

The average price of homes purchased in the US by wealthy Chinese buyers was $831,800, considerably higher than the US average of $256,000, according to the National Association of Realtors' 2015 Profile of Home Buying Activity of International Clients.

"This is in part due to the strong capital strength of Chinese buyers and also in part for the insufficient buying channels and real estate information," the Global Realty Investment White Paper says.

While the total dollar amount of international sales in 2015 in the US increased by 13 percent over the previous year, the total number of sales dropped by 10 percent - from 235,600 to 209,000 sales for the year ending in March 2015, the white paper says.

"The drop in number of sales reflects both the stabilization and rising prices of the US real estate market, as well as the strengthening of the US dollar abroad," it adds.

London is the top European city sought after by Chinese homebuyers, the white paper says. Part of the city's appeal for global elites is that London's house prices and monthly rents increased by 11.2 percent and 8 percent respectively in 2015, while the average growth rate of UK house prices was 5.6 percent and average rents grew by 4.9 percent.

However, the white paper includes a note of caution about realty investment returns in London in 2016, saying that Nomura, a financial services group and global investment bank, noted expectations for a UK interest rate hike in May, and highlighted the economic and political uncertainty surrounding Britain's status in the European Union.

The white paper sees the United States as the best destination for realty investments in 2016, considering the appreciation of the dollar, the recovery of the US economy and continuous trend of increasing house prices and stable rental demand.

Ma Guangyuan, a Beijing-based independent economist, says the US Federal Reserve's decision to raise interest rates in December - the first rate hike in almost a decade, ends the era of free-flowing and cheap money. Dollar-denominated assets as a result witnessed a rise in return rates, leading to the relative weakening of other currencies.

He says the return rates of realty investments in China will shrink and the sharp increase in housing prices in China's first-tier cities will abate.

The next three years will see the global diversification of asset allocation in search of a safe harbor for wealth. "To guarantee the assets is more important than to increase the assets in the next 10 years," he adds.

Ma also says Chinese investors should be cautious when investing overseas. The success of domestic realty investments will not ensure the same success overseas, and investors need to make sure they do their homework before committing their money.

lijing2009@chinadaily.com.cn

(China Daily European Weekly 04/01/2016 page27)

Today's Top News

- Takaichi must stop rubbing salt in wounds, retract Taiwan remarks

- Millions vie for civil service jobs

- Chinese landmark trade corridor handles over 5m TEUs

- China holds first national civil service exam since raising eligibility age cap

- Xi's article on CPC self-reform to be published

- Xi stresses improving long-term mechanisms for cyberspace governance