Everyone's friend

Media may hype China's ties with Africa but there are other serious players in the game

As African leaders descend on Johannesburg for the Second Summit of the Forum on China-Africa Cooperation, the focus will again be on relations between the world's second-largest economy and the emerging continent.

Built on the foundations of a close political relationship from the 1950s, it has been one of the intriguing geopolitical relationships of the past decade or more.

| Chinese and local employees work at the Mombasa-Nairobi Standard Gauge Railway. Many parts of the continent have benefited from Chinese-built roads, airports, ports, hospitals and sports facilities. Photos by Nick J.P. Moore and Provided to China Daily |

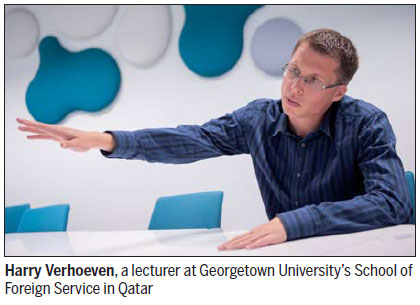

China's trade with Africa, which was only $10 billion in 2000, could hit $400 billion by 2020, according to official Chinese forecasts revealed at a forum in Beijing on Nov 9.

Many parts of the continent have benefited from Chinese-built roads, airports, ports, hospitals and various sports facilities as well as ministerial buildings.

Even the shiny new $200 million African Union building, which opened in Addis Ababa in 2012, was funded and built by the Chinese.

But China's slowing economy is putting a partial brake on its demand for Africa's resources and also investment on the continent.

Direct investment in Africa fell by 40 percent year-on-year in the first half of this year to $1.19 billion, although the aim to build up the stock of investment to $100 billion by 2020 was still on course, China's Ministry of Commerce said on Nov 17.

The summit at the Sandton Convention Centre, however, comes at a time when Africa has other suitors, too.

None more so than India, whose prime minister, Narendra Modi, clearly wanted to revitalize its relationship with at least 40 African leaders attending the third India-Africa forum summit in New Delhi in October. India's trade with Africa stood at $70 billion in 2013 and is rising.

The United States, India's second-largest trading partner at $90 billion annually, is also trying to put the fizz back into its relationship with Africa. US President Barack Obama hosted the first US-Africa Leaders Summit in Washington last year.

The European Union, which has five former major African colonial powers - the UK, France, Portugal, Belgium and Germany - held the EU-Africa Summit in Brussels last year in an attempt to revive its relationship.

Not being the only game in town, however, may suit China's foreign strategists.

It will enable Chinese President Xi Jinping, when he addresses the summit, to stress the importance of the FOCAC relationship while also setting the course of expectations on a more realistic bearing.

Harry Verhoeven, a lecturer at Georgetown University's School of Foreign Service in Qatar, believes it would be a great relief to Chinese policymakers if this message is put across.

"China has never wanted to rock the boat with its relationship with Africa. It is just not in its interest to do that. It is quite happy to be among a number of players on the continent," he says.

The Belgian academic, author also of Water, Civilization and Power in Sudan, believes many have misread the China-Africa relationship.

"If it were to have a dominant relationship with Africa, it would come with too many awkward responsibilities. China is actually busy doing other things. It has domestic concerns to deal with. It basically wants a pragmatic relationship with Africa and the West."

Shi Yinhong, professor of international relations and director of the Center on American Studies at Renmin University of China in Beijing and one of China's leading foreign policy experts, agrees the relationship has been too high profile at times and attracted criticism, particularly in the West.

"I think Africa has been an important part of China's foreign policy. China has had a lot of diplomatic influence there and there has also been quite significant economic expansion," he says.

"It has to be put into context, however. China's relations and economic ties with North America, Europe and Russia in technological and other areas have always been more important than with Africa. I think the president, however, will be right to emphasize the value of this relationship in Johannesburg."

The Johannesburg meeting is the sixth since FOCAC was inaugurated in 2000 but it is only the second to be categorized as a summit with heads of state participating.

It was the first summit in Beijing in November 2006 with its procession of people in African dress and 30-foot high posters of giraffes and elephants, that first drew the world's attention to the relationship.

David Shinn, adjunct professor of international affairs at George Washington University's Elliott School of International Affairs, says it all became over-hyped.

"All the media attention was on this new relationship. If you looked at the trade numbers, it is true that China overtook the US as Africa's largest trading partner in 2009 and now has almost triple the trade America does. But whose fault is that? Is it China's or is the US'? You could argue that the US is not trying hard enough."

The narrative at the time was that Africa was moving away from the so-called Washington Consensus, a series of measures imposed by the World Bank and the IMF to encourage the development of the private sector in African countries, to embrace China's state capitalism model.

Shinn, also a former US ambassador to Ethiopia and Burkina Faso and co-author with Joshua Eisenman of China and Africa: A century of Engagement, a detailed country-by-country analysis of the relationship, says none of this had much to do with what was important in Africa.

"They are the sort of arguments put forward by economists that don't bear out the reality on the ground. They are more symbolic.

"They are both essentially irrelevant (as models). China itself does not have any real problem with the private sector. Most Chinese companies in Africa today are private."

While China's trade with Africa was $220 billion last year, the country's trade with the European Union the same year was $501 billion and with the United States higher still at $590 billion.

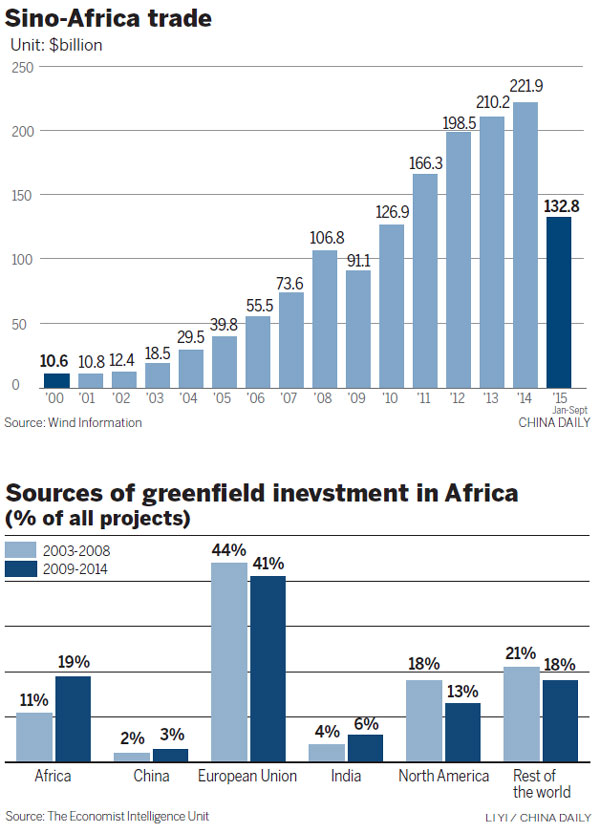

In terms of greenfield investment, China accounted for just 3 percent of Africa's total between 2009 and 2014, according to the Economist Intelligence Unit, compared to 41 percent from the European Union, 13 percent from North America and 6 percent from India. Nearly one-fifth of new greenfield investment (19 percent) came from within Africa itself.

Tim Steinecke, researcher of Asia-Africa relations at the University of St Andrews in Scotland, who wrote recently in The Diplomat about India's growing relationship with Africa, says Indian Prime Minister Modi is clearly upping the stakes.

Up to about 50 African heads of state and other high-level representatives attended the recent New Delhi summit, whereas at the two previous meetings, again in the Indian capital in 2008, and in Addis Ababa in 2011, only 15 attended.

Steinecke, who was speaking from Germany, says that until recently Chinese and Indian companies did not compete in Africa, but this is changing.

"They were addressing different aspects of the African economy. Indian commercial actors were mainly private companies with long standing roots on the continent, whereas the Chinese involvement was mainly state-owned enterprises," he says.

"Now, however, Indian energy companies are looking for alternative fuel supplies, other than from the Middle East, partly driven by cost, and Africa is a lot closer and cheaper to import from."

However, Alemayehu Geda, professor of economics at Addis Ababa University, is skeptical that India can really compete with China in Africa.

"You have only got to look at sheer scale of the credit that Africa gets from the China EximBank and the China Development Bank, its two policy banks. It is almost incomparable with what India can offer in terms of financing," he says.

"China's financing of major projects such as hydroelectricity power to highways and telecoms could run between $200 billion and $250 billion at any one time, whereas India's Exim Bank (Export-Import Bank of India) might just extend financing to a sugar factory for $1 billion."

Ross Anthony, interim director of the Centre for Chinese Studies at Stellenbosch University, believes having so many partners can only be good for Africa.

"The diversification of actors is most certainly a plus for African countries. Not only does it entail greater development and business opportunities, but also means that if one market is down, Africa has alternative partners which can help make up the shortfall," he says.

Some argue that Africa is now an end point of a new silk road for China, India and Southeast Asia (from where also there have been a number of high-profile African investments), as well as the US and Europe.

Peter Frankopan, author of The Silk Roads and director of the Oxford Centre for Byzantine Research at Oxford University, says in China's case it has been refashioning its historic links with the continent that started in the Ming Dynasty (1368-1644).

"China's interest in Africa goes back to the great expeditions of Admiral Zheng He when Chinese ships set across the oceans.

"I think Africa is now just one part of the picture when you look at China's silk roads. It is also developing maritime links in the Caribbean and South America and in Asia. There is a sense that we in the West can't compete on this scale. In fact, we feel snookered by it all," he says.

Kenya's coast is the one African point on China's new Maritime Silk Road linking from there to Europe, the Middle East and Asia as part of the government's Belt and Road Initiative.

China Communications Construction Company Group is currently building the first of three berths of the new Lamu port, which is part of the $24-billion Lamu Port Southern Sudan-Ethiopia Transport, or LAPSSET, corridor, which will link the region to the coast.

Michael Power, global investment strategist for Investec Asset Management, based in Cape Town, says the scale of the project confirms that Africa is very much part of China's Belt and Road Initiative.

"If you see a map of the world and see where China's maritime routes go, you can see that Kenya is the access point not only to east but also north east and central Africa. China will use Lamu as the main jumping off point to the rest of the continent."

Many have described the current competition between China and other powers as a new scramble for Africa.

But Alex Vines, head of the Africa program at Chatham House, Europe's largest foreign policy think tank based in London, says such an assessment tends to suggest African governments have no choice in this at all.

"Africa is in a much stronger position to determine what it wants. Part of this will be re-engaging with other players and not just with China according to changing economic circumstances," he says.

"They should be determining their own destiny. It is African leaders and the choice they make that will really drive growth."

Zhong Nan contributed to the story.

andrewmoody@chinadaily.com.cn

(China Daily European Weekly 11/27/2015 page4)

Today's Top News

- Japan tempting fate if it interferes in the situation of Taiwan Strait

- Stable trade ties benefit China, US

- Experts advocate increasing scope of BRI to include soft power sectors

- New engine powers cargo drone expansion

- China to boost green industry cooperation

- Manufacturing PMI rises in November