Forum founder confident about yuan

SDR inclusion would give China greater incentive to speed up capital account reforms, Marsh says

China's financial market reform is on track to push the renminbi toward reserve currency status with the International Monetary Fund, but more work is needed to open up China's debt market for foreign bond issuers, says David Marsh, managing director and co-founder of the Official Monetary and Financial Institutions Forum.

Although the renminbi is increasingly being used overseas by companies that issue offshore bonds, the difficulties foreign issuers of bonds face in tapping into China's domestic debt market will limit the currency's broader international use, he says.

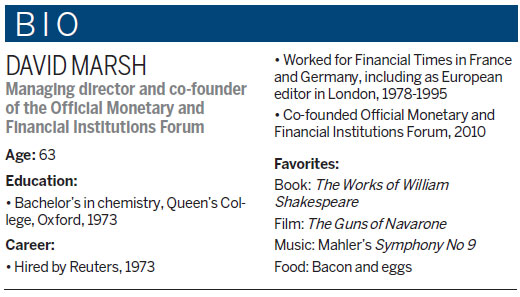

| David Marsh says China's financial market reform is on track to push the renminbi toward reserve currency status with the International Monetary Fund. Cecily Liu / China Daily |

"Conditions (for a reserve currency) are that you need to open up capital markets and allow foreign investors, particularly central banks, to issue renminbi-denominated bonds because they are reputable borrowers."

The increasing issuance of renminbi debt overseas will help the currency to build offshore liquidity, and the renminbi's accountability in overseas capital market will also grow. "So I foresee this process to take place over the next 20 years, to make the renminbi more liquid and predictable," Marsh says.

The renminbi has stepped into the international financial market spotlight because the IMF is due to make a judgment on whether to include it in its basket of special drawing rights by the end of November, meaning governments that hold SDR currencies in their national reserves would need to increase their allocation of renminbi.

The SDR basket of reserve currencies is held by many IMF member countries' central banks. Currently, those currencies are the dollar, the euro, the sterling and the yen.

If successful, the SDR push would be a big step for the renminbi toward reserve status. "I think there will be a decision to say yes in principle," Marsh says. "China's exchange rate will become more free than at the moment, although the authority will maintain a steady hand on its financial system, so there will be an element of control."

He says potential SDR inclusion would give China a greater incentive to speed up its capital account reforms and exchange rate liberalization, but he believes China is justified in opening up its markets gradually, "like a sluice gate".

"China could keep a relatively controlled system, meaning as much control as necessary and as much liberalization as possible. The Chinese government will remain in control, and they have the right to re-impose control (if the market responds unexpectedly to fast-paced opening-up)," Marsh says.

What must be remembered is that the opening-up of China's exchange rate is already very fast paced, and just as Britain had exchange rate controls until 1979 and many European countries did so until the 1990s, so China should take its time to liberalize, he says.

Traditionally, the renminbi was pegged to the dollar in order for China's domestic and export market to maintain stability, and restrictions on both the inflow and outflow of renminbi were a part of this exchange rate control strategy.

This all changed after the 2008 financial crisis, when the Chinese government realized the danger of the world relying too heavily on the dollar as a dominant reserve currency. In response, the government started the renminbi's internationalization process and liberalized its capital account controls to allow the renminbi's exchange to be set in a more free-market way.

Consequently, use of the renminbi overseas grew, and one key phenomenon was the growth of renminbi-denominated bonds being issued in overseas financial markets.

According to estimates by Ben Yuen Cheuk Bun, managing director and head of fixed income at Bank of China Hong Kong Asset Management, total offshore renminbi bond issuance this year is likely to be around 300 billion yuan ($47 billion).

In comparison, according to one estimate by the World Bank's International Finance Corp, foreign companies' issuance of China's onshore renminbi bonds, known as panda bonds, could exceed $50 billion in the next five years.

But Marsh says this debt market has great potential to grow if bond issuers are allowed access to China's onshore debt market, which is far larger and more liquid.

For this to happen, China needs to introduce rules to allow foreign issuers access to its panda bond market. This market is expected to help bonds obtain more senior status and also bring down the costs of borrowing, so it would make sense for companies to issue bonds on a large scale, he says.

"We need more routine issuance of renminbi bonds. If China is a large foreign creditor, it would like to hold claims denominated in its own currency," says Marsh, explaining that denominating the debt in renminbi would allow Chinese creditors to eliminate exchange risks and costs.

He says some people mistakenly believe that a country with a current account surplus would never have a reserve currency, which comes with a current account deficit, but this is not true because a current account surplus country like China can have a reserve currency as long as it maintains an open capital market to international investors.

China over the years has built up a large current account surplus, meaning it exports more products to trade partners than it imports from them, and consequently accumulates more foreign capital in its reserves than it sends out in renminbi to other countries.

Marsh says that over the long term, Chinese investors will be able to lend more through renminbi-denominated bonds by demonstrating to the market that the appetite for renminbi-denominated bonds is larger than bonds denominated in other currencies.

"It is a process of market supply and demand. The borrowers could say that their appetite is not so big for dollar or euro- denominated bonds, but would rather prefer renminbi bonds."

The other change that needs to happen in China is a shift of mentality by Chinese pension funds and social security funds, to invest the large volume of funds they hold in these renminbi-denominated bonds, as opposed to keeping it in cash, which they are currently accustomed to doing, he says.

The SDR inclusion likely would have large symbolic significance, and in concrete terms, all IMF countries would allocate a portion of their currency reserves to the renminbi, he says. It is only the beginning of a journey because building up liquidity for the corporate use of renminbi is crucial for its reserve status.

As of September, the equivalent of about $280 billion in special drawing rights are allocated to IMF members, compared with about $11.3 trillion in global reserve assets. According to an estimate by Standard Chartered Plc and AXA Investment Managers, at least $1 trillion of global reserves would migrate to Chinese assets if the yuan joins the IMF's reserve basket.

But this is very small compared with the daily exchange turnover of trillions of foreign exchanges, says Marsh. "So the institutional shift by other investors is more important."

cecily.liu@mail.chinadaily.com.cn

(China Daily European Weekly 11/27/2015 page21)

Today's Top News

- Japan tempting fate if it interferes in the situation of Taiwan Strait

- Stable trade ties benefit China, US

- Experts advocate increasing scope of BRI to include soft power sectors

- New engine powers cargo drone expansion

- China to boost green industry cooperation

- Manufacturing PMI rises in November