Credit agency boss gives a low rating

Methods used are too US-centric and contributed to world financial crisis of 2008, he says

Restructuring the international rating system is the only way to promote the recovery of the world economy, and China can play a leadership role, says Guan Jianzhong, chairman of Dagong Global Credit Rating Group.

The new rating system must be able to determine the debtors' ability to repay loans in the future based on the way they pay loans today, as opposed to simply observing that they have made the loan repayment, he says.

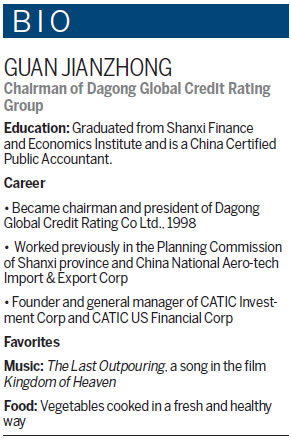

| Guan Jianzhong, chairman of Dagong Global Credit Rating Group, says the international rating system should be restructured. Cecily Liu / China Daily |

Guan, who developed the first Chinese credit rating methodology and established the first credit rating Postdoctoral Research Station in China, is a keen thinker with a particular focus on financial markets. He is also well known in China for having published several influential books on the global financial system and the thinking behind ratings.

He is pushing for a new world order for credit rating, convinced that the current US-centric systems are flawed and must be changed fundamentally to bring the world out of its economic malaise.

"The world credit rating system is dominated by US-headquartered rating agencies, and their ideology is very US-centric. I think their rating strategy made a big contribution to the 2008 financial crisis, which essentially was caused by debtors unable to pay back the excessive amounts they borrowed," Guan says in an interview in London where he spoke at the Boao Forum for Asia Financial Cooperation.

"I think it is wrong for the world's debtors to guide our thinking on how rating should be done. Instead, creditors should have more say in the rating system as it ultimately serves their interest a lot more."

Dagong, founded in Beijing in 1994, has a different method of analyzing credit. Fundamental to this is the examination of the way debtors repay their loans, which contrasts with many Western rating agencies' method of just analyzing whether a loan is being repaid, Guan says.

For example, a company that repays a loan by revenue collected in the day-to-day running of the business is rated highly, compared with one that pays loans by selling illiquid assets or borrows from other sources, which are rated less favorably because these sources of funding are classified as unsustainable.

"To correctly rate risks is very important because rating determines resource allocation," Guan says. "If the most reliable and productive debtors receive access to funding they will make a big contribution to economic growth, and to get this right is the driver for world economic recovery."

The three major US credit rating agencies - Standard & Poor's, Moody's and Fitch - have set up their credit rating service networks worldwide and controlthe credit ratings markets.

After analyzing these credit rating agencies' ideology, Guan discovered that they all use a country's political and economic system and financing capacity to determine the sovereign credit rating, a method he disagrees with.

More specifically, these agencies have five key criteria to determine sovereign ratings: political reliability, economic strengths, economic outlook as measured by the openness of its economy and financial markets, the independence of the central bank to issue currency, and the government's financing capacity.

"This ideology is fundamentally flawed. It explains why a country like the US is able to claim that it will never fail to repay debts no matter how indebted it becomes, because the answer is that its government is able to print money to repay debts," Guan says.

"The result of assigning sovereign credit rating using these criteria is that the world's largest debtor is assigned the highest credit rating, while the largest creditor's credit rating is far lower than that of the debtor.

"Against the general rule of a creditor-debtor relationship, this rating provides the world with distorted credit information, helps the debtor unreasonably gain the bulk of the world's credit resources, and is the source of the world's unbalanced economic development."

To put the issue in perspective, in 2007 the world's top 15 net debtors all had high ratings, of which six were AAA ratings. Their high credit ratings helped them to hold more than 58.6 percent of the world's credit resources, and many of them fell deeply into debt by 2008.

In 2009, the total of global foreign debt grew to $62.6 trillion, and the top 10 countries with the largest foreign debt are all developed countries. Their combined foreign debt was $46.73 trillion, accounting for 74.6 percent of global foreign debt, of which 26 percent belonged to debt of the central government.

Of all this debt income, 63.2 percent is spent on national social welfare and only 8.4 percent is used to develop the economy.

"The most developed countries account for the majority of the world credit resources, relying on their high credit ratings, but their contribution to the world economic growth is small," Guan says. "This is in direct relation to their irrational use of credit resources."

Such a situation demonstrates the mistake of Western rating strategy, he says, and Dagong has made it a mission to change this thinking. One opportunity Guan is watching closely is China's Belt and Road Initiative.

Proposed by Chinese President Xi Jinping, the Belt and Road Initiative strategy is a plan to strengthen trade and investment relationships between Asia and Europe by developing infrastructure along a land-based route and a sea-based route joining the two continents.

As this big infrastructure investment requires funding, rating becomes a necessary tool to attract capital, so Dagong is now gearing up to become a leading rating provider on projects along the Belt and Road Initiative routes. Guan says his team has developed a method of credit rating specifically for infrastructure projects, and will make the details public soon.

"Having a common and trusted credit rating method along the Belt and Road Initiative is important because the strategy essentially facilitates cross-border capital flow along these countries, and a unified standard allows investors to judge their risks and returns more reliably."

Guan graduated from Shanxi Finance and Economics Institute and is a China Certified Public Accountant. He specializes in the analysis of capital markets and credit systems, both domestic and international.

Before joining Dagong, he was involved in developing the Asian Bond Market Initiative, set up by the Association of Southeast Asian Nations and China, Japan and South Korea with a mission to promote market integration and development following the devastating Asian financial crisis in the late 1990s, thus helping prevent future crises.

As an adjunct to his efforts, Guan established institutional collaboration with Japanese and South Korean domestic credit ratings agencies, including China-Japan-Korea credit rating forums held in Beijing and Tokyo.

All this has shaped many of Guan's views on the way financial markets work, and helped him to develop the Dagong Credit Rating Methodology, said to be the first rating methodology focused on intellectual property rights incorporating international standards and adapting the methodology to conditions in China, as well as proposing a plan for the Chinese credit system and a manual for establishing Chinese credit system.

He says the new method of rating infrastructure investment focuses especially on infrastructure projects before or during construction, which is technically very challenging as most of the world's existing credit rating methods can only model risks based on infrastructure already in use.

"To have ratings for these infrastructure deals is very important because the amount of capital to be provided by public funding, through institutions like the Asian Infrastructure Investment Bank, is very limited, and a reliable credit rating will help attract private sector financing."

Guan says Dagong's emergence onto the global credit rating scene is inseparable from China becoming a crucial driver of global economic recovery.

"China needs a stable international political environment for its rise. Credit relations serve as the economic foundation for modern society, and international credit relations will function as a main incentive for international political and economic reforms.

"A fair, objective and reasonable international credit rating facility can issue an early warning against financial risks and prevent the outbreak of an international financial crisis, which is beneficial to China's stable development."

As Chinese capital is invested abroad, reliable information on credit risks is a precondition for efficient flow of China's capital to the rest of the world. Helping to build a new international credit rating system is consistent with China's peaceful development goals, he says.

In addition, China's status as the world's largest creditor nation has laid a strong foundation for the rebuilding of a new international credit rating system, because it is the creditor rather than the debtor who should make a judgment of credit risks, Guan says.

cecily.liu@mail.chinadailyuk.com

(China Daily European Weekly 11/20/2015 page32)

Today's Top News

- Japan tempting fate if it interferes in the situation of Taiwan Strait

- Stable trade ties benefit China, US

- Experts advocate increasing scope of BRI to include soft power sectors

- New engine powers cargo drone expansion

- China to boost green industry cooperation

- Manufacturing PMI rises in November