4G comes of age with 400m users

Voice and messages make way for data as carriers search for the next big telecom idea

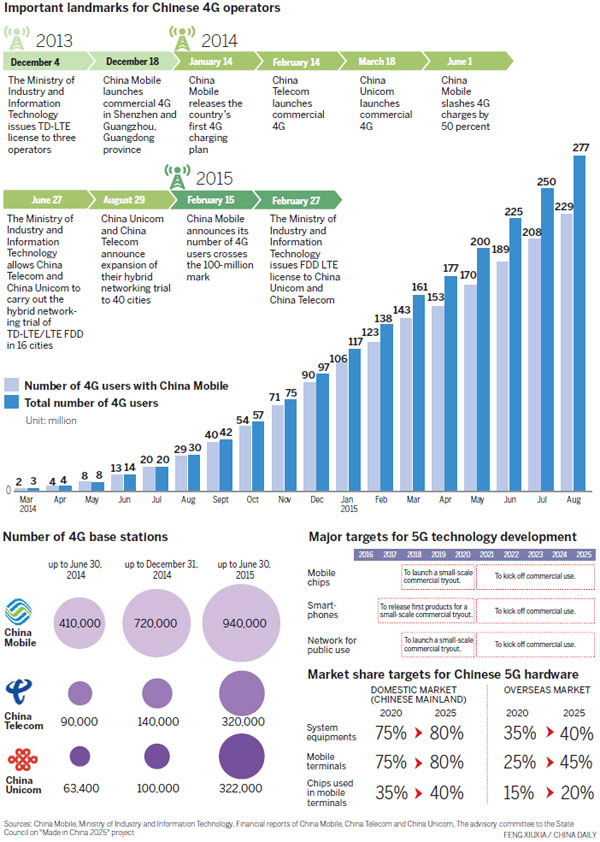

Less than two years after China first started getting used to fourth-generation telecom technology, the country has become the world's largest 4G market, with the biggest user population and most sophisticated networks.

Identified arguably as the brightest achievement in the national information technology sector over the past five years, the country has the goal of connecting 400 million people to 4G networks by the end of the year.

| The country has the goal of connecting 400 million people to 4G networks by the end of the year. Huang Jiexian / For China Daily |

| The area of Internet of Vehicles at Information and Communication Technology Show of China 2015. Provided to China Daily |

Chen Shanzhi, vice-president of Chinese telecom equipment maker Datang Group, is in no doubt about the importance of this next generation technology in telecom.

"The rapid expansion in 4G was one of the greatest successes of the 12th Five-Year Plan (2011-15)," he says.

China's ambitious 4G plan started a decade ago, when the central government was drawing its five-year national development strategy for the telecommunications sector.

Initial trials of the Time Division-Long Term Evolution technology - or TD-LTE, a 4G standard mainly developed by local telecom companies - were kicked off at the beginning of the 12th Five-Year Plan.

China pushed TD-LTE standard ahead of other widely accepted standards, hoping the self-developed technology would become a driving force for the sector.

China Mobile Ltd, the country's biggest telecom carrier by subscribers, started offering the commercial use of the TD-LTE in early 2013.

The smaller carriers, all state-owned, had to wait until the last days of that year to receive licenses to fully commercialize their 4G networks, using the European-originated LTE FDD, or Division Duplex standard.

China Mobile has dominated the domestic 4G market since then, with more than 200 million subscribers by August, according to its latest statistics.

There were more than 277 million 4G users nationwide, a 65 percent surge compared to the year before, according to statistics from the Ministry of Industry and Information Technology.

The number of 3G users, currently the largest telecom customer group, meanwhile, steadily declined as many upgraded to 4G, according to the ministry. The number of 3G users dropped more than 7.8 million in August, the steepest fall in three months.

Cao Shumin, president of the government think tank, the China Academy of Information and Communications Technology, says sales of 4G smartphones have risen at the same pace - at around 40 million a month - as has the level of mobile data traffic.

"The building of advanced telecom infrastructures in recent years has spurred an array of related sectors, and fits into the national strategy of letting the development of IT lift domestic consumption," Cao says.

Chinese customers have a growing choice of phones available, too, from the 6,000 yuan ($944) iPhone 6S to relatively inexpensive devices priced below 800 yuan.

The State Council first said in 2013 it would encourage the consumption of information via smartphones, to help expand the slowing domestic economy.

Its target was to raise public-sector and household spending on information consumption by at least 20 percent annually, through to 2015.

Gao Sumei, executive secretary of the China Information Technology Industry Federation, estimates the country's total spending on information consumption will exceed 3.2 trillion yuan this year, well above that 20 percent target growth.

Premier Li Keqiang's hard-hitting comments on the country's Internet services in April - that they were too slow, and cost too much - however, gave the pace of 4G development a significant shot in the arm.

The MIIT quickly announced plans to cut average annual mobile data charges by a third before 2016. The state-owned "Big Three" carriers also hustled to announce detailed price-cutting schemes.

After many customers complained the most-favorable price plans were only available after midnight when most of users were not using their phones, carriers announced daytime price reduction schemes too.

One particular offer also allowed customers to carry over unused data allowances into the following month - a notable break with previous policies, which did not allow monthly data-budget rollover.

Xiang Ligang, an independent telecom analyst and founder of the industry website cctime.com, says carriers were reluctant to lower their prices on data, because it had become their major source of income in the 4G era.

"As 4G technology became more popular, larger numbers of smartphone owners were no longer sending short messages or making phone calls.

"Instead, they are relying on mobile applications to take up higher levels of Internet traffic," Xiang says.

Voice call durations shrank 2.6 percent in the first eight months of 2015, while the number of short messages being sent also declined steadily, amid the widespread use of instant messaging apps such as Tencent Holdings Ltd's WeChat.

Carriers are busy looking for new revenue boosters, including renting 4G networks to privately owned secondary carriers.

But the emerging business model is yet to make significant enough profits to cover losses on voice and messaging services.

"The surging 4G development is changing the game," says Miao Wei, the minister of the MIIT.

"Carriers need new ideas to grow their operations," he says, adding that private capital is likely to play a bigger role in the previously State-controlled industry.

"Introducing private capital will give yet another boost - especially meaningful when a slowing economy is looking for a new growth engine," Miao says.

Less developed rural areas, meanwhile, are expected to take center stage in 4G development during the industry's next five years.

Carriers and local equipment makers are also developing updated versions of 4G technology, to increase connection quality and speed, in preparation for 5G networks to be put into commercial use around 2020.

gaoyuan@chinadaily.com.cn

(China Daily European Weekly 10/30/2015 page14)

Today's Top News

- Japan tempting fate if it interferes in the situation of Taiwan Strait

- Stable trade ties benefit China, US

- Experts advocate increasing scope of BRI to include soft power sectors

- New engine powers cargo drone expansion

- China to boost green industry cooperation

- Manufacturing PMI rises in November