Fallen founder still pulls the strings

Huang Guangyu has increased his stake in GOME electrical appliance despite serving 14-year jail term

Disgraced business tycoon Huang Guangyu is in prison, but it has not stopped him from tightening his grip on China's leading electrical appliance chain.

The founder of Gome Electrical Appliances Holding Ltd has been behind bars since November 2008 after being handed a 14-year jail sentence in 2010 for bribery, illegal foreign exchange activities and insider trading.

| A Gome outlet in Yichang, Hubei province. Liu Junfeng / For China Daily |

Also known as Wong Kwongyu, his Cantonese name, the 46-year-old managed to increase his stake in the Hong Kong-listed Gome despite sitting in a Beijing prison cell.

Before his fall from grace, Huang used to stride the business world like a colossus and topped the Hurun Report rich list for three years with a personal fortune of $6.3 billion.

After being forced to resign as chairman in 2009, his reign at Gome looked to be over. But six years later, Huang still appears to be the power behind the throne after increasing his stake in the company from 32.43 percent to 55.34 percent.

In a complicated deal, Gome Electrical Appliances Holding Ltd in July bought 578 stores that were not included in the Hong Kong listing from another Huang company, Gome Management Ltd, for HK$11.3 billion ($1.46 billion; 1.3 billion euros). With an estimated 15 percent share in the home appliance market, Gome dominates the sector with about 1,700 stores in China.

"The move will further strengthen Gome's total retail value chain and fuel its expansion in second and third-tier markets, and e-commerce development in particular," says Wang Junzhou, chief executive officer of the group, in a prepared statement.

"Despite being convicted of insider trading, he will still be able to run the company when he is released," says Hong Daode, a professor with the China University of Political Science and Law.

Whatever happens, Huang will continue to be a driving force within the group. Born into a poor farming family in southern China's Guangdong province, he dropped out of school when he was 16 and started selling cheap electrical goods in Beijing with his brother Huang Junqin.

From there, he built a business empire. And even though he is now behind bars, Huang still controls the firm through his wife Du Juan, who holds senior positions within the parent company Gome Holdings Group, and his sister Huang Xiuhong, a director at Gome Electrical Appliances.

In August, Li Juntao was made head of the company's online operation in a move to fend off rival e-commerce competitors. He was brought into the group by Huang Guangyu and has held various senior roles.

"The appointment of Li, who has been with Huang (Guangyu) since joining Gome in 1988, is a sign that the integration of the company's online and offline business is moving into a high gear," according to All View Cloud, a Beijing-based consultancy specializing in the home appliance market in China.

When Huang was officially running Gome, online shopping companies, such as JD.com and Alibaba Group Holding Ltd's Tmall Marketplace, have sprouted up to challenge traditional chain stores.

Data from CCID Consulting Co Ltd, a large IT research service company, shows that overall online sales of home appliances, not including mobile phones, jumped by 56 percent to 61.1 billion yuan ($9.56 billion; 8.5 billion euros) in China during the first half of the year, compared with the same period in 2014.

At the same time, sales of refrigerators, air conditioners, washing machines and televisions in "bricks-and-mortar" stores dropped by 11 percent. The overall sector was worth 382 billion yuan in the first six months of 2015.

"E-commerce is seen as Gome's weakest link in development while Li is seen by Huang as a trusted lieutenant to help the company's online business thrive," says Zhang Yanbin, vice-president of AVC. "He has a deep understanding about Gome's retail business and supply chain operation."

Even though Huang spends most of his time in a small cell, he still has access to the group's documents and the minutes of board meetings. He also receives regular visits from family members and his team of lawyers.

This has helped him keep up-to-date with the inner workings of one of China's sprawling corporations. Still, Gome has lacked his hands-on approach to doing business, industry insiders point out.

"Huang is the heart and soul of the company and being in prison has affected its performance," says Wang, of Analysys International. "Mind you, the company was one of the first in China to test the waters in e-commerce back in 2002, although it didn't really engage in the sector seriously until 2011."

In a previous interview, Gome's new online head admitted that the group's e-commerce business had been slow to take off. "If we don't move fast, the gap between us and our competitors will just continue to grow," Li says.

His plan is simple. Li is looking to generate 60 billion yuan from the online operation by 2017. That target equals Gome's revenue last year and would mean a tenfold increase in the company's existing Internet business.

"This might be very difficult for the company to achieve," says Wang, of Analysys International, who has been following the e-commerce sector for years. "It will be hard to catch up in a market with so many dominant players."

A glance at the numbers underlines the challenge Huang and Gome face. Data from Analysys International showed that JD.com accounted for 60 percent of China's online home appliance market. Gome's share was just 3 percent.

Even their high street rivals are forging head. Suning Commerce Group Co Ltd, a major electrical appliance chain with 1,600 stores, teamed up with e-commerce giant Alibaba in a cross investment deal earlier this month. The partnership will help Suning strengthen its online sales.

"In terms of the home appliance market in China, about 85 percent of sales are still made in bricks-and-mortar stores," says Zhang, of AVC. "Offline stores have proved to be a valuable resource in the retail business, otherwise Alibaba would never have agreed to a deal with Suning."

If Gome is to catch up online, Huang will have to play a major role in reshaping policy, according to Zhang. His unique understanding of the group and his obsession with being No 1 will prove crucial in the battle ahead.

"I met Huang years ago, and he is bold and aggressive in business," Zhang says. "He is the kind of person that is always looking to be No 1 in the market. I think he will come up with something and play this game very differently."

mengjing@chinadaily.com.cn

(China Daily Africa Weekly 09/05/2015 page22)

Today's Top News

- China urges sincerity from US in trade talks

- Renowned global scholars discuss key role of China studies at Shanghai event

- Tim Cook: I love China's Labubu

- US cannot expect talks to be fruitful while introducing restrictive measures

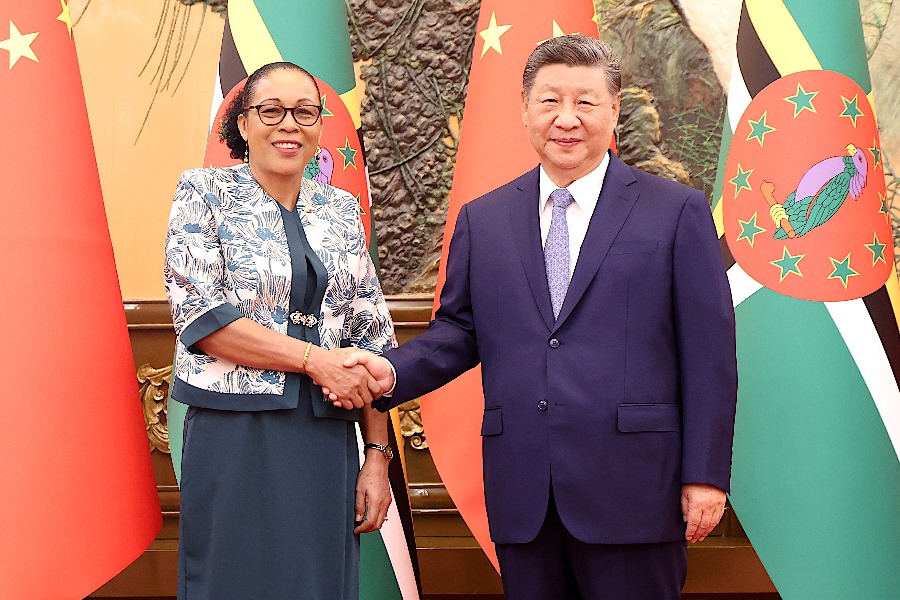

- Xi meets Sri Lankan PM

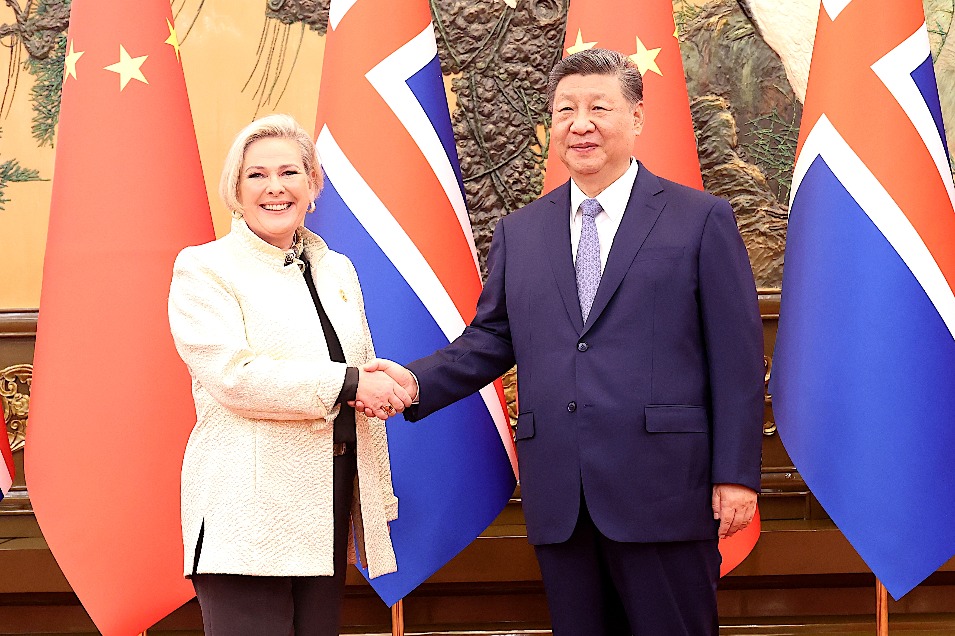

- Xi meets president of Iceland