Newcomer and old hand can work together to build up regions

European development bank chief says opportunities for joint projects with AIIB abound

The European Bank for Reconstruction and Development is eyeing opportunities to work closely with the Asian Infrastructure Investment Bank, both in offering advice as it grows and jointly funding infrastructure projects.

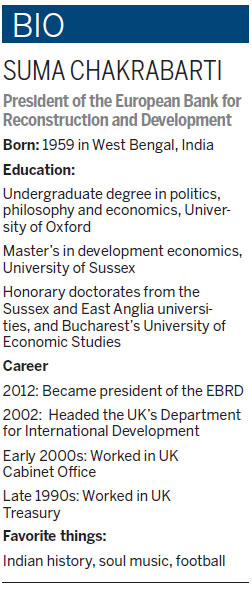

Suma Chakrabarti, president of the EBRD, says the creation of the AIIB has significant implications for an older development-oriented bank such as the EBRD, as the combined strength of both can allow them to take on much larger projects.

| Suma Chakrabarti, president of the European Bank for Reconstruction and Development, says he will also hold talks with his counterparts in China to examine how the EBRD could work with the Asian Infrastructure Investment Bank. Cecily Liu / China Daily |

In addition, the efficient and innovative funding methods that the AIIB may demonstrate can also inspire and set benchmarks that affect how the EBRD examines and funds projects, he says.

Chakrabarti was due to visit China on June 26 and 27, including giving a speech on the AIIB about the establishment of a reasonable business model, governance and standards.

He will also hold talks with his counterparts in China to examine how the EBRD can potentially cooperate with the AIIB, particularly in the geographical regions where the two banks have overlapping responsibilities.

"What I'd really like to achieve by next year, when the AIIB is running, is to have at least two or three co-finance projects. That's going to be our main push," Chakrabarti says. "Of course, we can do other things together, but projects will be a good way to start."

Founded in 1991, the EBRD is a multilateral developmental investment bank that initially focused on countries in the former Eastern Bloc. Over time, it has expanded to support development in 30 countries, from Central Europe to Central Asia.

The potential partnership between the EBRD and the AIIB has attracted attention from industry experts, although at this stage they can only speculate on the possible results.

Hou Zhenbo, a researcher with the Overseas Development Institute, a think tank based in London, says the overlap between the two banks, given what is known so far, will probably be infrastructure projects in Central Asia and former Soviet states, although it is difficult to guess how large the investments might be.

Christopher Bovis, a professor of business law at the University of Hull Business School, says the EBRD's investment partnership with the AIIB could help to develop and continuously expand a pipeline of public-private partnership projects on the basis of a clearly defined eligibility framework.

The EBRD would subsequently carry out the due diligence and financial appraisal in the structuring phase, price the guarantee or loan, and monitor the project thereafter, he says, adding that the EBRD may also be prepared to act as a controlling creditor according to principles to be established in agreement with market participants.

"The AIIB and the EBRD would share the risk of the losses of the project portfolio. The EBRD risk would be ring-fenced (financially seperate) and its participation therefore capped at an agreed annual budgetary amount," Bovis says. "The EBRD would be covering the residual risk up to its maximum exposure on any individual transaction. The risks taken by the AIIB, on the other hand, would be compensated via a risk premium charged up-front to the project entity at the time of agreement."

He says this premium would be priced to reflect the subordinated status of the credit line and the associated risks for the EBRD, as well as covering expected management and other costs.

Because both the EBRD and the AIIB have similar financing structures and goals, Chakrabarti says they can jointly invest in projects and share revenues. In addition to debt financing, he says the two banks can also work together on equity financing, where investors would have greater participation in a project's decision-making process.

In particular, opportunities would exist in municipal infrastructure investment, such as in sanitation, water management, public transport and street lighting, he says.

"Equity investment, in our view, will allow us to use our expertise to help a company become more comfortable and effective on the ground," he explains. "As an equity investor, we would typically have a position on the board of a company, and we can then cooperate with the company to make it better."

Chakrabarti says one example of equity investment by the EBRD is in Turkey, where for five or six years its cooperation was solely in debt financing. Now it has developed into a relationship in which more equity investment is done. This transition is important, he says, because by helping Turkish firms to become more effective in management and operations, the EBRD is assisting the country's growth.

This model of cooperation can be an option in joint funding projects with the AIIB, he says.

For Chakrabarti, the EBRD's local knowledge and expertise is crucial. The bank has offices in most of the markets it helps fund, which assists in building good relationships with local politicians.

His advice to the AIIB is not to start with a framework that is too rigid, as this would mean the bank would have little room to adjust when market conditions change. Instead, he says, it would be better to have constitutions and systems that ensure flexibility, and then gradually make new rules after the bank finds a strategy that works.

He also says the significance of the AIIB for Asian markets cannot be underestimated, politically or economically.

"The creation of the AIIB shows that the huge infrastructure needs of Asia have not yet been met, and that Asia is clearly rising, growing politically and economically as a regional bloc that needs more focus," he says.

In addition, he says, establishing the AIIB with a global membership has a great impact, especially in areas concerning international development such as achieving sustainable development goals and combating climate change.

In this sense, the creation of the AIIB may lead to more effective solutions for important global issues that require a great level of cooperation by governments internationally.

Apart from his speech on the AIIB, Chakrabarti says he also hopes to talk with Chinese infrastructure companies during his visit about funneling investment into regions where the EBRD provides funding.

Although the EBRD has not yet funded infrastructure projects by Chinese firms, he says this is an important task on his agenda, particularly in recognition of the growth of China's economy and outbound infrastructure investment.

A crucial benefit of cooperating with Chinese firms on infrastructure projects would be to give them knowledge of international markets where EBRD teams already understand the political and economic environment. In countries that do not have a completely solid and rigid political and regulatory environment, the EBRD's relationships can play a crucial role in reducing the risks for Chinese investors.

Chakrabarti says the key reason for collaboration is to help channel Chinese investment into regions that need it for growth, and to help Chinese firms find worthy opportunities from a financial perspective.

Stephen Skulley, head of Lloyds Bank Commercial Banking Asia, echoes this view and says European banks can play a complementary role in facilitating Chinese infrastructure investment in Europe.

Last year, Lloyds Banking Group signed a memorandum of understanding with China Development Bank Corp that had a particular focus on infrastructure and energy projects in Britain. The agreement also will enable the companies to support each other's clients with banking services, he adds.

Han Fang contributed to this story.

cecily.liu@chinadaily.com.cn

(China Daily European Weekly 06/26/2015 page32)

Today's Top News

- Japan tempting fate if it interferes in the situation of Taiwan Strait

- Stable trade ties benefit China, US

- Experts advocate increasing scope of BRI to include soft power sectors

- New engine powers cargo drone expansion

- China to boost green industry cooperation

- Manufacturing PMI rises in November