Industrial profits dive in December

Overcapacity, deflation hit factories; fortunes of State enterprises, private sector diverge

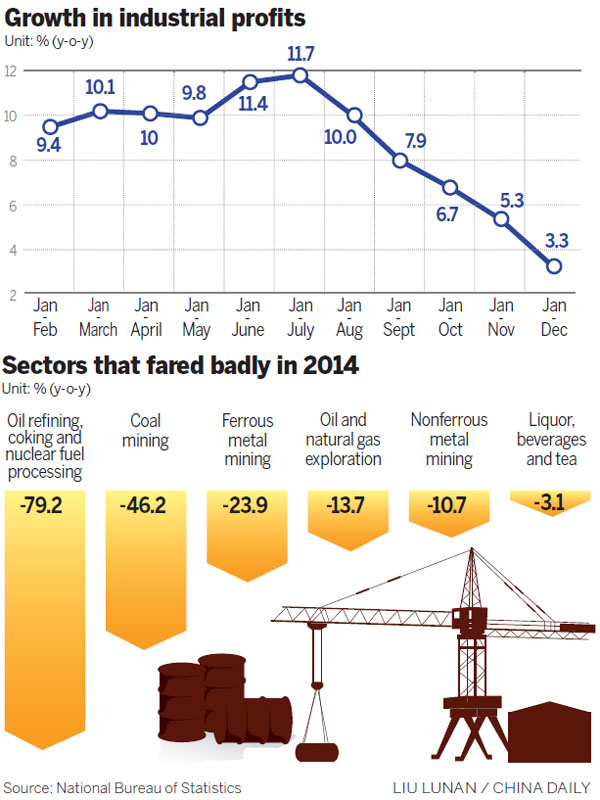

Excess capacity and the deflationary forces associated with plunging crude oil prices devastated manufacturers' profits last month, with a year-on-year plunge of 8 percent, the National Bureau of Statistics said on Jan 27.

The decline was the largest since at least October 2011, when the current data series began.

The pace of contraction accelerated throughout the fourth quarter, with falls of 2.1 percent in October and 4.2 percent in November.

Full-year profits edged up 3.3 percent to 6.47 trillion yuan ($1.04 trillion; 0.92 trillion euros), the NBS reported.

Profits of state-owned enterprises fell 5.7 percent last year, while those of private companies rose 4.9 percent.

All companies in the NBS survey have annual revenues exceeding 20 million yuan.

Out of 41 industries, 11 recorded lower profits. The declines were especially steep in the energy sector: oil refining and nuclear fuel processing enterprises' profits fell 79.2 percent, while profits in the coal mining and washing industry declined 46.2 percent.

Sharp drops in factory-gate prices and raw materials costs drove profits down, said He Ping, an economist at the NBS. The oil and coal industries accounted for about 80 percent of the entire industrial sector's profit decline, said He.

"But profits of consumer goods manufacturers increased 5 percent, indicating that the impetus for growth is shifting to consumption and away from the traditional investment," he added.

Fast-rising production costs also crimped profits, experts say.

The Producer Price Index has been falling for nearly three years, and the decline deepened to 3.3 percent in December, intensified by sharp recent falls in world commodity prices.

Separately, the Small and Medium-sized Enterprises Confidence Index, calculated by Standard Chartered Bank, fell in December after a mild improvement in November. The sub-index for three-month business expectations fell sharply, and fixed-asset investment and employment readings also weakened.

The findings suggest that the SME sector is likely to stay weak in the first quarter of this year, the bank said.

"Disinflationary pressure continues to build, threatening the economy," says Li Wei, a researcher at Standard Chartered. "Slowing inflation could undermine corporate profit margins and income growth. Building disinflationary pressure clearly justifies further monetary easing."

Li says that further deceleration in GDP growth is likely in the first quarter of this year, which may continue to dent investment and consumer confidence, aggravate weakness in the housing sector and worsen the employment outlook.

"We therefore think that policymakers are ready to take additional measures to stabilize the economy in 2015. We expect the People's Bank of China to cut benchmark interest rates in the first three months, as policymakers have acknowledged high financing costs in the real economy."

chenjia@chinadaily.com.cn

(China Daily European Weekly 01/30/2015 page23)

Today's Top News

- Japan tempting fate if it interferes in the situation of Taiwan Strait

- Stable trade ties benefit China, US

- Experts advocate increasing scope of BRI to include soft power sectors

- New engine powers cargo drone expansion

- China to boost green industry cooperation

- Manufacturing PMI rises in November