What's news

| An Apple Inc store in Xuchang, Henan province. At the end of the third quarter of last year, Apple held 18.1 percent of smartphone market share in China. Gen Guoqing / China Daily |

Apple may find its new core in China

Increasing demand in China for Apple Inc's latest flagship devices, the iPhone 6 and iPhone 6 Plus, has spurred consumers there to buy more of the devices than their American counterparts for the first time, data from Switzerland-based financial services company UBS AG showed.

"Recent data suggest that iPhone demand saw considerable growth in China, even finding that China could constitute as much as 35 percent of shipments in the quarter compared with 22 percent a year ago," Steven Milunovich, an analyst with UBS, wrote in a research note published on Wednesday.

The US share of iPhone sales is expected to dip from 29 percent a year ago to 24 percent in the first quarter of 2015, he wrote.

Ministry raises sales tax on gas, oil products

China is raising sales taxes on oil products from Jan 13, the Ministry of Finance said. Taxes on gasoline, petroleum naphtha, solvents and lubricants will be raised 0.12 yuan per liter to 1.52 yuan (roughly 25 cents) per liter, while taxes on diesel, jet fuel and fuel oil will be raised by 0.10 yuan per liter to 1.2 yuan per liter, the ministry said. The government said it is cutting gas prices by 0.13 yuan per liter and diesel prices by 0.20 yuan per liter, according to the National Development and Reform Commission.

Nation to speed up yuan convertibility

The nation will accelerate the yuan's convertibility for capital accounts while strengthening efforts to monitor cross-border capital flows and financial risks, the State Administration of Foreign Exchange said at the annual work conference in Beijing. SAFE's priorities in 2015 include further simplifying administrative procedures for foreign exchange management, speeding up the construction of an administration system for external debt and capital flow, and introducing management innovations.

Coal industry outlook remains poor

The China Coal Industry Association said more measures will be taken to control coal supplies and support prices this year, with the industry outlook likely to remain poor because of overcapacity and weak economic growth. It added that it remained pessimistic about demand this year, with the economy under pressure from weak export markets and falling real estate investment.

Jiangsu raises standards on economic zones

Jiangsu province has issued new regulations on the upgrading of its economic development zones. The provincial government said zones that fail to meet environmental standards and targets for land efficiency, for instance, will be given official warnings, followed by a deadline for rectification. If changes aren't made, penalties or forceful closures will be issued. The regulations said provincial development zones that grow rapidly or strongly will be upgraded to state-level development zones.

Alibaba, Incheon partner to build complex

Alibaba Group Holding Ltd is in talks with the South Korean city of Incheon for a 1 trillion won ($923 million) joint investment in a new business complex, Dong-A Ilbo Daily reported on Jan 12. The newspaper said the complex would include a major shopping mall, a hotel and a logistics center. Alibaba's payment subsidiary Alipay is in advanced talks to buy a $550 million stake in India's One97 Communications.

Medical insurance provision heads for review

Financial officials have finished a draft revision of the nation's Insurance Law, which is expected to be submitted to the State Council for review. The revision will allow insurance companies that can offer life insurance policies to also sell medical liability coverage. It will also raise the capital requirement for shareholders of insurance companies.

Insurance firms get OK to invest

The China Insurance Regulatory Commission has issued a regulation that will allow insurance companies to invest in domestic infrastructure projects through bond, equity or other securities investments in the secondary market. Direct investment in such projects is currently banned. Insurers are also barred from investing in projects prohibited by the government or those that have unclear ownership or legal risks.

Shandong to boost fishing industry output

Shandong province proposed on Jan 7 to develop "maritime granaries" in an aim to better integrate Shandong's fishing industry and raise the total output of seafood from 8.63 million metric tons in 2013 to 10 million by 2020. The proposal could produce an average of 100kg of fish per capita for the province and 40 percent of the high-quality animal protein for the provincial population.

Banks approved to offer online accounts

Banks will be permitted to offer online accounts in a bid to help them keep up with developing trends in Internet finance. The People's Bank of China is soliciting opinions on guidelines for the creation of yuan-denominated online bank accounts. It has instructed banks to use appropriate technology, such as facial recognition software, to achieve the same results as real name authentication. Banks are also required to provide an external assessment for authorities to verify that they actually can determine clients' identities using such technology.

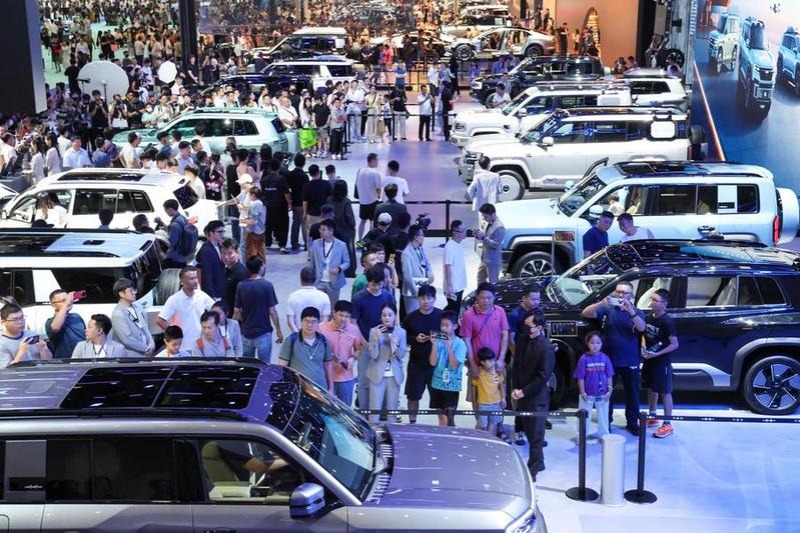

Plan permits car imports in Shanghai

The Ministry of Commerce approved a pilot plan allowing parallel imports of cars in the China (Shanghai) Pilot Free Trade Zone, which will give the vehicles full legal status and create lower prices for consumers. Automobile dealers with subsidiaries registered in the FTZ may participate in the pilot program, though they need to have a five-year business profile and profits within the past three years. They must also have made sales exceeding 400 million yuan ($64.3 million) in the most recent fiscal year.

Authorities ban private placements of SME bonds

Regulators have banned the private placement of small and medium-sized enterprises' bonds among individual investors. The move comes as the nation faces rising corporate default risks. The stock exchanges in Shanghai and Shenzhen, meanwhile, have prohibited funds raised through the sale of financial products to individuals from being invested in privately issued notes by SMEs. That condition applies to funds not directly managed by such investors, according to statements from the exchanges.

Bond futures will be based on long-term debt

The China Financial Futures Exchange has issued draft rules for 10-year government bond futures in another step toward interest rate liberalization. The futures will be based on long-term government bonds with durations of 6.5 to 10.25 years to maturity, the CFFEX said on Jan 7.

Bank of Shanghai chief front-runner to lead SAFE

Fan Yifei, the chairman of the Bank of Shanghai and vice-president of China Investment Corp, is the leading candidate to replace Yi Gang as head of the State Administration of Foreign Exchange, according to sources who asked not to be identified because the deliberations have not been made public. Fan would also replace Yi as deputy governor of the People's Bank of China, they said.

China Daily

(China Daily European Weekly 01/16/2015 page18)

Today's Top News

- Japan tempting fate if it interferes in the situation of Taiwan Strait

- Stable trade ties benefit China, US

- Experts advocate increasing scope of BRI to include soft power sectors

- New engine powers cargo drone expansion

- China to boost green industry cooperation

- Manufacturing PMI rises in November