Metals group looks to bright future

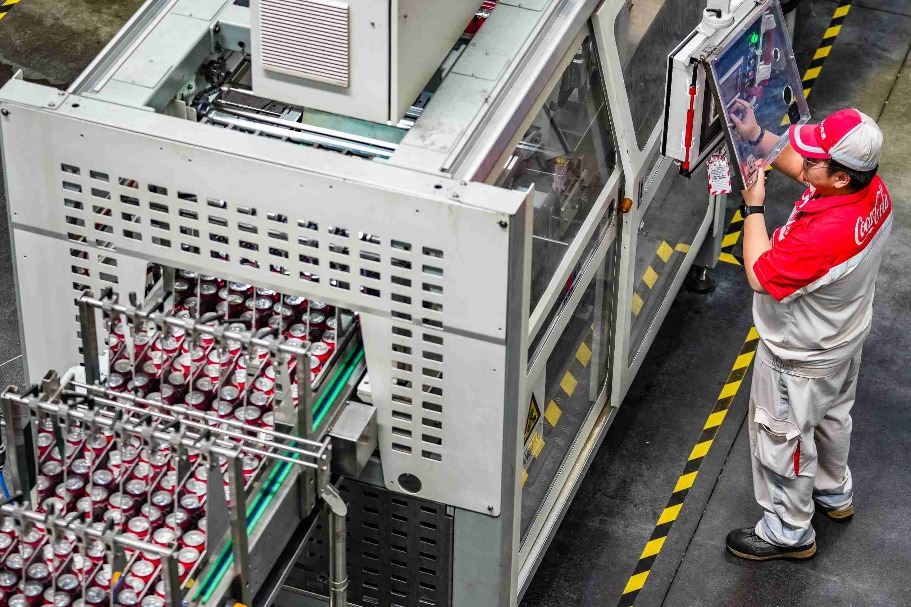

| Miners of Wesizwe Platinum Ltd, the South Africa operation of Jinchuan Group, at a construction site in Johannesburg. Photos provided to China Daily |

Company follows path of acquisitions and integration to secure resources

Boosted by expanding demand at home, a leading metal mining and production company from China has been looking to Africa to secure supplies through acquisitions as well as integration with local partners.

"Our parent company's output of metals such as copper and cobalt grew very fast in recent years. Our own resources are far below what is needed for the smelting. And thus a stable and sustainable supply of such resources is a very urgent need," says Gao Jianke, chief executive officer of Wesizwe Platinum Ltd, speaking in his office in Devcon Park in Johannesburg.

Wesizwe Platinum was a mining company listed in South Africa's Johannesburg Stock Exchange before Jinchuan Group Co Ltd and the China-Africa Development Fund, or CAD Fund, jointly acquired a 51 percent stake in May 2011 with a capital injection of $227 million, Gao says.

While progress at times has been challenging, the rewards for the company and local residents have been great.

Jinchuan Group, located in Northwest China's Gansu province, is China's largest producer of platinum, nickel and cobalt, and also is China's third-largest copper producer. But more than 50 percent of the group's nickel ore is supplied from overseas and the group's own copper ore accounts for less than one fifth of the demand, Gao says.

"The supply shortage is also true for other miners and producers that experienced fast development in recent years. For Chinese resources companies, 'going out' was inevitable, even though our overseas footprint was small before 2008," Gao says.

Some 60 or 70 percent of the Jinchuan Group's overseas assets are in Africa, which has rich reserves of copper and cobalt ores and platinum-containing soil. The group has delineated four regions for resource supplies: the Europe and Africa region headquartered in Johannesburg; the Americas region based in Canada; the Oceania region covering Australia and Southeast Asia and the region of Central Asia and China.

Other metal producers from China have also extended their reach into Africa with Sinosteel Corporation engaged in chrome ore mining in South Africa and Baiyin Nonferrous Metals Group Co Ltd involved in gold mining in the same country.

In the 1990s, Jinchuan Group started to look abroad to acquire resources, mainly through trade. In 2004, a subsidiary, South Africa Jinchuan Resources (Pty) Ltd, was made responsible for the international trading of nickel, copper, cobalt and chrome ores.

"Starting in 2008, we seriously began to develop overseas mining projects. The volume of resources that we acquired through trade was too small, in sharp contrast with what we really could control having an overseas mine project," Gao says.

China has been Africa's largest trade partner for five consecutive years and a major source of new investment. Meanwhile, Africa has been an important import market for China, as well as its second-largest market for overseas contract projects and the fourth-largest destination of overseas investment. China's direct investment in Africa reached $25 billion by the end of 2013. There are more than 2,500 Chinese companies with investments in Africa, according to the Ministry of Commerce.

In May, Chinese Premier Li Keqiang made an eight-day trip to Africa and visited Ethiopia, Nigeria, Angola and Kenya, aiming to expand economic ties with the continent.

Wei Jianguo, vice-chairman of the China Center for International Economic Exchanges, noted that "now is the best time for Chinese enterprises to go to Africa for investment".

In July 2009, Jinchuan Group acquired a majority stake in Zambia's Munali nickel mine, the first such overseas operation for the group.

In January 2012, the group acquired Metorex Ltd, the group's trading partner of cobalt ores, and restructured the board while retaining the management staff. Metorex, now a wholly owned subsidiary of Jinchuan Group, is headquartered in Johannesburg and owns mines in Zambia and the Democratic Republic of the Congo. The subsidiary's resources include 4.74 million tons of copper and 330,000 tons of cobalt.

In the case of South Africa's Wesizwe Platinum, the 2008 global financial crisis created a capital shortage for the company, which was listed in Johannesburg in 2005. In May 2011, Jinchuan Group and CAD Fund took a majority stake in Wesizwe and reorganized the board. Construction on a mine project that broke ground in July 2011 is expected to finish by 2017 with a total investment of 10.2 billion rand ($955 million). Once established, the production of the mine is forecast to reach 2.76 million tons a year.

"The model of our overseas operations is either a majority stake or a wholly owned subsidiary, which is in line with our strategy of securing resources supplies," Gao says.

Wesizwe now has 58 employees, with three from China, and has created about 1,000 jobs for locals, mainly miners, through a contractor. Employment is expected to surge to 3,500 once production starts.

"Though the transaction was concluded three years ago, our operation is still confronted with challenges. The due diligence investigation could not cover all the potential problems," Gao says. "What was promised may not come true, which will significantly affect the progress of project construction, just like the delay in local power supplies increased our cost in the project construction."

He adds that the key move for the operation of the restructured company is to become familiar with the basics, especially the laws and regulations.

"Cultural integration and communications, if not smooth, will also bring about difficulties. Each year we arrange for two senior executives of the platinum mine to visit the parent company for management training, and we send experts from the parent company to the South African projects," Gao says.

"The significance of Chinese enterprises' acquisition of local companies lies in technology integration as well as the advancement of our management priorities to enhance efficiency and generate bigger value," he adds.

The biggest challenge for the current operation comes from labor issues, given that strikes are "now much broader and more severe than years ago and directly affect our project's progress through hitting different industries", Gao says.

"Once the mine's construction is finished, our employment will dramatically increase. We have to devote more to employment management, which is a big challenge," Gao says.

Meanwhile, rising costs also present a concern for the platinum mine.

"On the whole, the cost of platinum mining in South Africa has kept rising in recent years, about 10 or 12 percent annually for the mining industry, higher than the average of general industries of about 7 or 8 percent. Cost increases mainly come from inflation, production costs and human resources costs. As the mine goes deeper, the costs keep increasing. Labor costs even outrun production costs here, unlike at home," Gao says.

Power costs have increased for three straight years, 25 percent annually, and "it's hard to predict whether the rise will stop", he adds.

The Chinese investor is also devoted to corporate social responsibilities.

"Since we received a mining permit in 2008, we drafted a CSR plan each year to get the approval from the Department of Mineral Resources. CSR spending accounts to about 1 percent of the annual investment and covers community schools, hospitals and facility supplies. A failure in CSR performance will dent the approval of the mining permit," Gao says.

He adds that the company also provides community training in work skills, and 30 percent of Wesizwe's total of 58 workers come from local communities.

Contact the writers through lijiabao@chinadaily.com.cn

(China Daily Africa Weekly 06/20/2014 page22)

Today's Top News

- China to hold economic and trade talks with US in Malaysia

- Taiwan compatriots invited for anniversary

- Financial sector mobilizes to support high-quality growth

- Airbus opens new jet assembly line in China

- Country provides platform for AI development

- Resilience, security, inclusivity priorities for plan