Necessary changes

|

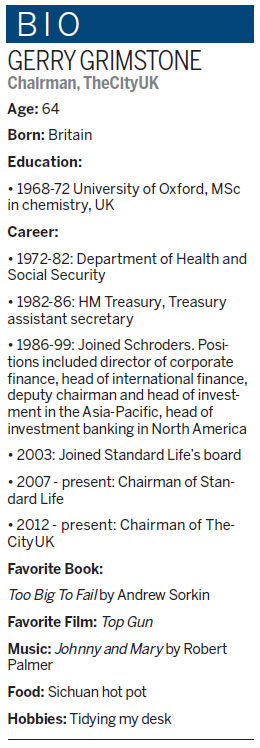

Gerry Grimstone, chairman of TheCityUK, has had a keen interest in China's economic reforms since 1992. Cecily Liu / China Daily |

Financial reforms will improve China's global connectivity, expert says

China's latest financial reforms are necessary as the country becomes increasingly engaged with the global economy and the pilot Shanghai Free Trade Zone is a good mechanism to effectively facilitate these reforms, says Gerry Grimstone.

The chairman of TheCityUK, a private association for financial and professional services, says reforms to be implemented in the Shanghai FTZ and subsequently across China will improve the country's global connectivity.

He says China's policy reforms in recent decades have "caused huge changes" for the country domestically, especially in the manufacturing sector, but as its economy becomes more important globally it will benefit from increasing its tertiary sectors and becoming a financial center.

"As China now becomes one of the world's greatest trading nations, it needs to spread competitiveness in other sectors, especially financial services, professional services and services in general. This is the next great leap forward for the Chinese economy," he says.

Grimstone, who is also chairman of the UK insurer Standard Life, has developed a keen interest in China's economic reforms since 1992 when he first visited China with other foreign experts to advise the Chinese government on reforming the state-owned enterprise sector.

More than two decades later, Grimstone is taking an active role in another Chinese reform, this time as chairman of the International Experts Consultation Group, which was established last year to help the United Kingdom advise the Chinese government on policy reforms for the Shanghai FTZ.

China launched the 29-square-kilometer Shanghai FTZ in September to help facilitate the country's economic and financial liberalization. Examples of reforms include liberalization of currency, interest rates and commodity trading.

The zone, which China plans to use as a spearhead for sweeping economic reforms over the next 10 years, will test new reforms and successful ones will be implemented across the country.

Central to the structure of the reforms is a "negative list" that shows sectors in which foreign investment is banned or restricted within the zone. There are no restrictions on anything not on the list.

Grimstone says the concept of having a negative list demonstrates a fundamental change in thinking by China's policymakers.

"The way my Chinese friends put it to me is that in China everything is forbidden unless it is allowed. And in the FTZ, everything is allowed unless it is forbidden. This is a deep philosophical change."

Grimstone says the change of mentality signifies a freeing up of the Chinese economy, allowing market forces to play a bigger role in driving economic growth. Liberalization of the economy will also significantly contribute to China's growing connectivity with global financial markets.

"I think financial services around the world are about interconnectivity. The reason why London has a larger international financial services industry is because London is an intermediary in the world," Grimstone says.

For example, London as a financial center has more French bankers than Paris and more German bankers than Frankfurt, because having a hub where banks, insurance companies and other financial institutions are close to each other makes business more efficient, he says.

For this reason, many financial transactions taking place in London do not relate to physical investment in the United Kingdom, but do create employment and economic growth for the country, Grimstone says. He believes the Chinese mainland has the potential to become a financial hub for Asia in a similar way.

Although financial centers like Hong Kong and Singapore are currently playing this role, the mainland has the potential to establish its rightful place in the Asian financial markets because it has the unique advantage of being a hub for trade, which is inseparable from financial services.

"Financial centers are interrelated to the economy. The Chinese mainland will achieve its position through the strength of its domestic economy," he says.

Grimstone expects that after successful financial reforms, the state will play a smaller role in the Chinese economy, and this will lead to a big shift in the regulatory environment, with both opportunities and risks.

"The issue is, what is to be the relationship between the state and the market, because the state needs to give up something, but will gain a more successful and prosperous economy," he says.

Effective privatization and market liberalization are achieved by strong state direction, as was the case with similar reforms in the 1980s in Britain under former prime minister Margaret Thatcher, Grimstone says.

He argues that Britain's experience of major privatization in the 1980s means it has many important lessons to share with China, and this recent history shows that China and Britain have a lot in common.

"It is very easy to forget that going back as recently as the 1980s Britain's telecommunications, travel, aviation, steel, ship building and other industries were controlled by the state. It is very easy to forget the scope of reform in the UK," he says.

But Grimstone remembers these reforms very well because he worked as a civil servant in Britain's Treasury back then and had firsthand experience working on reforms that still shape the British economy today.

"When I worked with Margaret Thatcher and (chancellor of the exchequer) Nigel Lawson, there was strong central direction. You have to involve the market in the reforms. You have to take risks and be bold in terms of what you're doing," he says.

Based on that experience, Grimstone says it is important for China's reforms to be "done step by step" and for those developing the reforms to consult with experts who are practitioners in the market and have skills and knowledge to help the state determine the right balance it needs to achieve with the market.

To help the Chinese government devise policies for the Shanghai FTZ, Grimstone's consultation group has already assembled about 50 international firms in various fields to share "what we learnt here and elsewhere in the world".

He says one example is the need for practical maritime insurance contracts. In London, two parties can easily use a simplified form of the standard contract after an agreement is reached, whereas in China insurance contracts need to go to the authorities to be approved.

"There is no need for that, because the contract form is approved by the government. As long as the industry is regulated, the government doesn't need to look at each individual step. It knows how each little thing runs by its supervision of the whole system."

It is this type of detail that would make China's financial markets effective and competitive, Grimstone says. He likens China's current financial market reform to an impressionist painting, whereas the end product should be a finely detailed Chinese ink painting.

"China has vision from the top, so we can begin to see the architecture. This is like an impressionist painting, as long as you look from a slight distance, you think the colors look beautiful. But for a Chinese painting, you can look very close and the details are very fine," he says.

Grimstone says he is confident about China's financial reforms because the Chinese government is good at long-term thinking, partly because the Chinese political system allows each leader to stay in office for 10 years.

"The Chinese have always been very good at planning. They are sometimes better at planning than we in the West, because they have so many levers of power that they can control. They can set a plan out and they can fulfill it."

cecily.liu@chinadaily.com.cn

(China Daily European Weekly 05/30/2014 page32)

Today's Top News

- Factory activity sees marginal improvement in November

- Venezuela slams US' 'colonial threat' on its airspace

- Xi: Strengthen cyberspace governance framework

- Takaichi must stop rubbing salt in wounds, retract Taiwan remarks

- Millions vie for civil service jobs

- Chinese landmark trade corridor handles over 5m TEUs