Dilemma over decision to branch out

Young, progressive Chinese bank sets up in London but looks to continent

Shanghai Pudong Development Bank has opened an office in London, its first overseas, in a move to better understand Europe's financial environment and find a good location to establish a European subsidiary or branch.

"In finding a suitable location, we consider many factors, including legal environment, market barriers to entry, return on investment, room for future growth, and proximity to global financial centers," says Gao Xia, chief representative of SPD Bank in London.

Gao says the 20-year-old bank chose London for its representative office because the city's financial industry is the most international and it boasts mature legal systems and sophisticated banking systems. Also, Sino-UK economic ties and cross-board investment activities are robust, and the UK economy was among the first of the major economies to show signs of recovery.

"With London striving to build itself into an offshore RMB center and Shanghai embarking on the construction of its pilot free trade zone, we expect the two financial centers will have stronger and closer collaboration and make mutual progress," she says.

SPD Bank was incorporated in January 1993, and was listed on the Shanghai Stock Exchange in 1999. According to the 1,000 World Banks listing published by the British Banker magazine in July, SPD Bank was the 53rd largest in the world in terms of Tier 1 capital.

SPD Bank now has 38 branches and about 900 banking offices throughout the Chinese mainland and a branch in Hong Kong.

It is also the first Chinese bank to develop a focus on technological innovation, last year joining Silicon Valley Bank of the US to open the SPD Silicon Valley Bank.

Gao says her team wants to bring the same innovation ethos to London, and believes this will become the advantage of SPD Bank in Europe. Her team hopes to take innovative products to Europe, but at the same time use the base in London to learn innovative methods and take these lessons back to China.

|

|

A product the bank is promoting in China is mobile banking, which allows customers to pay for small purchases by connecting their mobile phones with payment terminals. The customer's bankcard is integrated with the phone's SIM card.

Gao says after setting up either a subsidiary or a branch in Europe, SPD Bank will initially focus on serving its existing customers in China who have expanded overseas. The European office will become an extension of SPD Bank's network in China.

"After setting up a branch in Hong Kong in 2011, we realized the speed of Chinese companies expanding their operations overseas. We want to follow our customers," Gao says.

SPD Bank is the latest Chinese bank to establish a presence in London, following Bank of China, China Construction Bank, Bank of Communications, Agricultural Bank of China, the Industrial and Commercial Bank of China and the China Merchants Bank.

However, despite the advantages, these banks have encountered challenges in recent years in London.

A year ago, the Financial Times reported that Chinese banks were moving big chunks of their European business to Luxembourg because they could only obtain permission to set up subsidiaries in London, not branches.

Branches are offshore arms of foreign banks that the local authority has little control over. Subsidiaries, in contrast, are subject to the strict capital requirements that apply to Britain's banks.

Since the financial crisis in 2008, the Financial Services Authority, Britain's financial services regulator, has made it difficult for foreign banks to set up branches in the country.

Bank of China, the first Chinese bank to expand into the UK, is the only one to have a branch there, which it opened in 1946.

Gao says the difficulty of establishing branches will be a factor to consider in SPD Bank's European expansion process, because subsidiaries inevitably incur many more restriction on capital requirement, limiting the bank's profit levels.

"For such a young bank as SPD Bank, we do not have a large capital overall," she says. "And because operating as subsidiaries requires a larger amount of capital investment in the UK, it would affect our profitability."

It is costly to establish a subsidiary in the first place, Gao says, and because SPD Bank may not have much room for expansion soon, investing in a subsidiary is hard to justify to shareholders.

Another important advantage of establishing a branch, she says, is that it can directly use the credit rating of the parent company, whereas it is hard for a subsidiary to get a good credit rating.

"Some big companies require their banks to have a certain credit rating, so by not having a rating we are automatically losing many potential clients," she says.

Another topic attracting much attention in London is the city's efforts to become an offshore center for the yuan, where the Chinese currency can be used with less regulatory restrictions.

In September 2011, then Chinese vice-premier Wang Qishan welcomed private-sector initiatives for the development of an offshore yuan market in London during his meetings with George Osborne, the British chancellor of the exchequer.

Since then, London's banks have been busy creating yuan-denominated products to attract investment, and educating their clients about the advantage of invoicing in the yuan.

HSBC and China Construction Bank, for example, started issuing yuan-denominated "dim sum" bonds in London last year.

However, Gao believes London still faces challenges in becoming an offshore center because the availability of yuan-denominated products is limited.

Currently, China's quota for qualified foreign institutional investors is $150 billion (108 billion euros). QFII, an allowance for foreign investors to buy Chinese mainland stocks, bonds and money market instruments, was launched in 2002, when it was only $30 billion.

As China's financial environment becomes increasingly open to foreign investment, it will require China's domestic banks to become more competitive and international in their practices, and SPD Bank's London expansion is a demonstration of this, Gao says.

Gao's words are echoed by Roger Gifford, lord mayor of the City of London, home to many of the world's leading financial services firms. Expansion of Chinese banks in London can greatly help China's banking industry to catch up with international standards and processes, he says.

"These banks learn a lot about international banking standards, which they can then bring back to China. This may relate to lending, credit cards, bond markets, foreign exchange, or whatever. So this process is one of harmonizing standards."

At the same time, he says, Chinese banks contribute a lot to London, through employment and tax, as well as helping to facilitate trade and investment between China and the UK.

Contact the writers through cecily.liu@chinadaily.com.cn

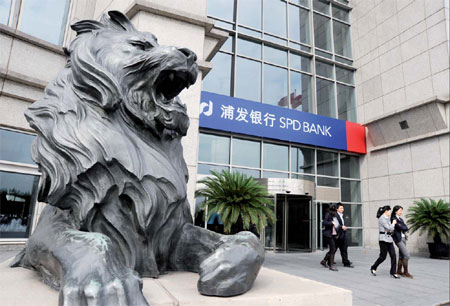

| Shanghai Pudong Development Bank says it wants to bring innovative products to Europe. File Photo |

(China Daily European Weekly 11/01/2013 page19)

Today's Top News

- Xi stresses improving long-term mechanisms for cyberspace governance

- Experts share ideas on advancing human rights

- Japan PM's remarks on Taiwan send severely wrong signal

- Key steps to boost RMB's intl standing highlighted

- Sustained fight against corruption urged

- Xi calls for promotion of spirit of volunteerism