Bullish feeling

Open doors

|

||||

"QFII has been stabilizing the market," Guo said. He said China wants large foreign institutions to put money into Chinese shares. "Because these investors are more professional, they will also invest and keep the money in China for a long period of time," he says.

Foreign money currently accounts for just 1.5 percent of the overall mainland equity market. A 10-fold increase to the QFII and the RQFII schemes would translate to about $400 billion in new funds flowing into the market, currently worth $38.5 billion, a very likely possibility, says Howhow Zhang, an analyst with the Shanghai-based boutique consultancy Z-Ben Advisors.

"If you look at other emerging markets such as India, Brazil and Russia, foreign participation is between 10 percent and 20 percent. In China, the current quota is tiny, so a 10-fold increase is not an exaggeration," he says.

The CSRC has in fact been pushing forward reforms in the stock market over the past years, including cutting trading taxes, urging companies to pay cash dividends, and improving the delisting system.

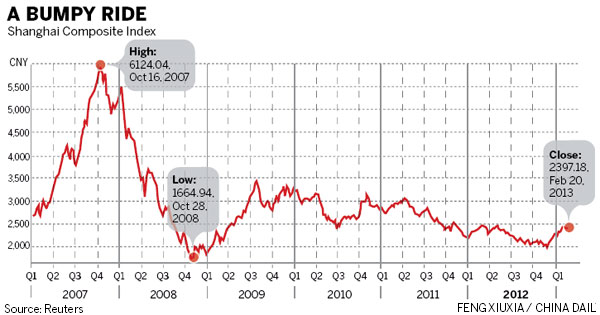

The whole market has become more and more stabilized in the past three years. There has been a significant improvement in the valuation system. Although stocks for big companies are still undervalued, things are changing for the better, Guo says.

Contact writers at xieyu@chinadaily.com.cn and gaochangxin@chinadaily.com.cn

(China Daily 02/22/2013 page1)

Today's Top News

- Xi stresses improving long-term mechanisms for cyberspace governance

- Experts share ideas on advancing human rights

- Japan PM's remarks on Taiwan send severely wrong signal

- Key steps to boost RMB's intl standing highlighted

- Sustained fight against corruption urged

- Xi calls for promotion of spirit of volunteerism