Rural riches

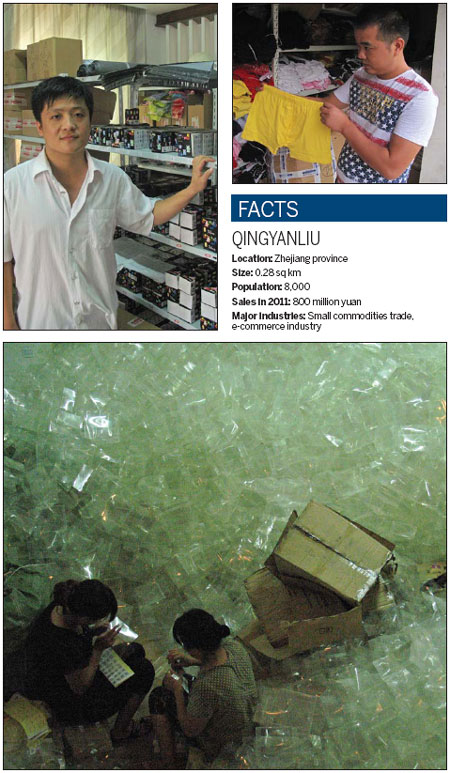

| Far top: Big boxes ready to be delivered. Top left: Wang Hao in his stock room. Top right: Xie Zuoshou, the owner of an online underwear store. Above: Workers inflate plastic cushioning bags for the express delivery business. Photos by Lin Jing / China Daily |

A symbiotic relationship between a well-known city and a nearby village has fostered nearly 2,000 e-commerce businesses in just a few years

The story of Qingyanliu is not your simple rags-to-riches tale of how a Chinese village sped down the fast lane to economic success. It is a multifaceted story about collaboration and vision, of hard work and patience. More specifically, it is about how a neighboring city of booming trade markets helped a village smaller than one-third square kilometer to become one of the hottest incubators of e-commerce in Zhejiang province.

Qingyanliu is a village about 3 kilometers southeast of Yiwu, a city known for its thriving small commodities markets and as the banner for China's market economy. There is a saying that in the city "you can find all the commodities you want, as long as you can imagine it."

That proximity of city and village is not just simply a convenience for business owners looking for cheap rent in Qingyanliu or for products from Yiwu to funnel into the village. It has also greatly helped the village grow into what many Chinese media are now calling the "Taobao Village".

Taobao is China's most popular online marketplace.

In 2005, with manufacturing and an industry chain skyrocketing in Yiwu, the village committee decided to develop Qingyanliu, which had only 1,500 farmers a year earlier, as an area to establish the fertile industry of e-commerce.

"What we provide in Qingyanliu is a benign environment for e-commerce startups," says Liu Wengao, vice-chairman of Yiwu Jiangdong Electronics Commerce Association, who has been in charge of developing e-commerce in the village since 2005.

Almost immediately, the village was bursting at the seams, with near constant construction of new homes and office space for business owners. In that year alone, the village added about 200,000 square meters of housing for rent.

YJECA provided some capital and know-how for new businesspeople to set up shop. It also provided training sessions for newbie online store operators and invited established shop owners on Taobao to talk about their experiences. Weekly meetings were held every Saturday afternoon, mainly to discuss sales techniques and let everyone know what was happening in the growing industry.

Wang Hao chose Qingyanliu as the site for his e-commerce shop only last year, but he understands why it grew so rapidly. A former restaurant owner in Liaoning province in northeastern China, he learned about the village on the Internet and came for a look in April last year.

Two months later, he rented two 100-sq-m rooms.

"It was good for us to start our business here because it is convenient for deliveries (from Yiwu) and we can buy goods cheaply," says Wang, owner of Xinhao Accessories, one of thousands of shops on Taobao. "You can find whatever you want to sell in Yiwu at the lowest price in China. It's convenient and reduces costs. Newcomers cannot get a good price from factories directly because they lack credibility in the market. And the delivery fees are quite high."

Liu of YJECA also organized a few distributors to form an online supermarket that provided pictures of products. New businesspeople in the village then choose pictures from the supermarket and upload them to their Taobao shops. Every day, these new shops can receive goods from distributors based on sales needs.

Today, about 2,000 companies in Qingyanliu tout 1.7 million products. The value of sales was about 800 million yuan ($126 million; 100 million euros) last year. Market floor space covers 4.7 million square meters

Every day, about 30 express delivery companies send about 10,000 parcels to cities across the country. Another advantage of setting up shop in the village is that YJECA negotiates with express delivery companies on behalf of e-commerce shops for special rates.

But one major drawback to the boom is the soaring rent. The annual rent for an 80-sq-m apartment jumped from 7,000 yuan to almost 15,000 yuan from 2005 to 2012. Total income from rent in the village is now about 30 million yuan a year.

Wang, for instance, has seen his business prosper. His initial investment of 160,000 yuan, with 33,000 yuan in annual rent, turned into sales of over 800,000 yuan last year. This year, he says, he reached that sales figure in July.

Yiwu has clearly benefited from this symbiosis. By June, 11,000 business-to-business sellers populated Yiwu, a 20-percent increase from the same period last year. About 350,000 parcels were delivered every day, up 70 percent.

Last year, total sales in e-commerce reached 50 billion yuan in Yiwu, and the number of online stores grew from hundreds four years ago to more than 60,000. Among them, 1,100 stores have monthly sales of over 100,000 yuan.

Many domestic companies in the region that were originally physical establishments are jumping on the e-commerce bandwagon.

Shunyida General Merchandise Firm, for example, once only had a brick-and-mortar store in the village but now also has two online stores selling ceramic pots and tools used in brewing tea. In the past month, the company has sent out about 100 parcels a day.

The store manager, Zhang Kun, says online stores are more complicated than physical ones.

"For online stores, we have to face individual consumers, while in the physical store, we only have to deal with distributors, who better understand our products and are not so picky," says Zhang, who adds that the company still sees e-commerce as the best way of helping the business to grow brand over the long run.

In April last year, the company set up Mateng E-commerce Co to market two online brands called Bolvya and Taobaowang in its stores.

Zhang says they will try different promotional strategies. In September they listed one ceramic pot on Juhuasuan, a group-buying site under the umbrella of the e-commerce giant Alibaba Group Holding Ltd. The price was 97 yuan, compared with the original 233 yuan.

"With this promotion, we plan to draw more traffic to our online store and increase the exposure of our own products," Zhang says.

However with all this growth one problem is an emerging shortage of talent, something of a hot-button issue in the industrial regions of China.

Chen Shousong with the local consultancy Analysys International says the rapid development of e-commerce has not only jumpstarted regional growth, but also redefined the business model for traditional offline companies. This, in turn, has raised higher requirements for workers in various fields, including customer service and website design.

"The total shortage of talents in the city is about 400,000 to 500,000," Liu says. "Though the local school here, Yiwu Industrial & Commercial College, has talented students, they still need to gain experience and learn new skills. Now the association is cooperating with other schools to train e-commerce talent."

Meanwhile, many companies have outgrown the cozy village because their annual sales have on average exceeded 20 million yuan.

Liu says the current structure in Qingyanliu is not suitable for large e-commerce companies. He says that after two years it's natural for many companies move out of the village.

"As business keeps growing, some companies will need a warehouse that is 2,000 sq m or more for inventory, while rooms in Qingyanliu are limited to 100 sq m. So after a year or two, they will move out of the village to industrial parks nearby," he says.

Xie Zuoshou, the owner of BJ Mall, an online underwear store, is one such company. "Qingyanliu is only an incubation center. But companies with a bigger plan have to move out," he says.

The company made about 17 million yuan of online sales last year, and Xie expects 30 million yuan within two years. He plans to move the company to a 2,000-sq-m warehouse in Beiyuan Industrial Park Zone in Yiwu.

He says that small companies may feel the online supermarket is fine, but for bigger companies, the supply chain is of great importance.

"If e-commerce companies want to survive, they have to either cooperate with factories or invest in production. With my own factory, I can better control the supply chain and product quality."

Yang Xiao, another analyst with Analysys, says that for companies starting online, e-commerce is only a means, not an end.

"In the long run, they still need to pay attention to the basic elements of business, such as services, company operation and supply chains," Yang says.

The Qingyanliu phenomenon has been seen in many towns and villages across China over the past three years.

The number of e-commerce companies registered in villages and towns rose from 306,000 in 2009 to 590,000 last year, while the number of employees in e-commerce companies in these villages grew from 450,000 in 2009 to 970,000 in 2011, according to a recent report by the Chinese Academy of Social Sciences.

Though many other areas are trying to catch up, such as Shaji town in Jiangsu province, which focuses on the production and sales of furniture, Liu is confident Qingyanliu will maintain its place as the best place for startups.

"The other areas cannot compete with Qingyanliu. They lack a complete industry chain, from printing and advertising to packaging and logistics."

Liu says that the association is investing at least 30 million yuan to build a warehouse that will open by the end of the year, providing additional packing and delivery services.

"In the future, if people want to start e-commerce companies in the village, they will only have to keep an eye on their business sitting in front of the computer and leave all other jobs including packaging, graphic design and logistics to us."

Contact the writers at linjingcd@chinadaily.com.cn and suzhou@chinadaily.com.cn

(China Daily 12/14/2012 page16)

Today's Top News

- Xi stresses improving long-term mechanisms for cyberspace governance

- Experts share ideas on advancing human rights

- Japan PM's remarks on Taiwan send severely wrong signal

- Key steps to boost RMB's intl standing highlighted

- Sustained fight against corruption urged

- Xi calls for promotion of spirit of volunteerism