New bosses, new challenges

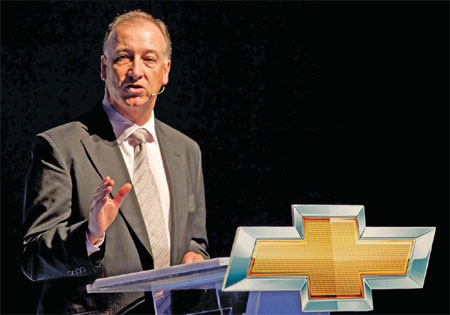

| Kevin Wale, 57, retired as president of General Motors China in October. Many Western auto brands in China have seen changes at the top. Xu Haifeng / for China Daily |

Hard drive ahead in China for those taking over at the wheel of car makers

Western auto brands in China have seen several changes in top management toward the end of this year, but while most departing bosses are being hailed for their achievements, their successors are coming under pressure to reap similar rewards in a much tougher market environment.

In June, Karl-Thomas Neumann, president of Volkswagen Group China, was transferred from his position and soon left China, following speculation that his headquarters in Germany was not happy about how scandal involving gearboxes had been handled.

Other bosses, however, have since been given a glorious send-off, leaving at their peak. Mercedes-Benz and BMW say goodbye this month to their top men in China, who have both supervised operations over a lengthy tenure.

Klaus Maier, president and CEO of Mercedes-Benz China, will finish at the end of the year and hand over to Nicholas Speeks, the current president of Mercedes-Benz Japan. During Maier's term, Mercedes' sales volume increased from 20,000 units in 2006 to 200,000 units in 2011.

BMW China's former president and CEO Christoph Stark also retired this month, having seen sales increase from 20,000 units in 2004 to 300,000 units this year.

Analysts say it is a good time for these top leaders to retire. In the past two years, the Chinese car market has cooled after growing at rates as high as 30 percent, and is unlikely to return to such heights.

Zhang Xin, an auto analyst from Guotai Junan Securities, says the growth rate will probably remain at about 5 percent.

"If the headquarters of Western brands accept this situation, the pressure on these new bosses is small," he says. "Otherwise, there will be huge pressure on them to match up to their predecessors."

Xu Changming, director of the State Information Center's information resource unit, says these brands have to lower their expectations for the Chinese market.

"The high growth era has passed," he says. "They have to respect this fact and make strategies and plans accordingly."

Less than two months ago, Kevin Wale, 57, retired as president of General Motors China.

In GM China's history, Wale's achievements are extraordinary. During the seven years he was in charge, GM dealerships have almost tripled to 2,900, and sales increased from 665,400 units to 2.55 million units in 2011, making GM the biggest seller in China.

Wale's high point was in 2009, when GM was facing bankruptcy in the United States. That year, the company delivered 1.83 million cars in China, up by 67 percent year-on-year. In a sense, the Chinese market was GM's silver lining to its cloud of despair.

Analysts say Wale hit good times in China, when the car market enjoyed 10 golden years, but admit nonetheless that he did a good job in localization.

Since 2005, when he was appointed president of GM China, Wale has introduced many new brands and models to China, including Chevrolet, which sold 80,000 units in its first year.

Also, GM's market share climbed to a record 15 percent in September, a level which will be a challenge for Wale's successor Bob Socia to maintain, far less top.

But Socia says he will expand the business in China by bringing in the Cadillac brand, putting more effort into the SUV segment and tapping the overseas market.

Although the growth rate has slowed down, he says the Chinese market is the fastest growing globally and still has great potential. At a news conference, he said he anticipated the Chinese auto industry would grow 7 percent.

Thomas McGuckin, partner of PwC Asia Pacific's automotive segment, says competition in the market is intensifying along with the cost pressures.

"Manufacturers need to hit the mark or risk seeing sales lag," he says. "They need to ensure they differentiate their products from others in segment class, as well as to improve the overall buying experience."

During the past few years, BMW has concentrated more on catering for Chinese buyers. In 2006 the company decided to extend the length of the locally produced BMW 5-series by 14 centimeters. The move was controversial at the time but proved a market success after four years when sales volume exceeded 90,000 units.

Now the company is purchasing more parts from local suppliers. Six years ago, BMW had 60 local suppliers; today it has more than 200, with purchase value tripling to 6 billion yuan ($960 million; 730 million euros).

"Premium brands have long benefited from strong margins, but pricing pressures continue," McGuckin says. "Localization and operation efficiency efforts will need to be accelerated to offset pricing challenges. Exceptional service and loyalty programs play a part of the buying experience."

Xu, from the State Information Center, says European premium brands have to realize that their target customers have changed fundamentally. While 10 years ago BMW and Mercedes-Benz were exclusive to the super-affluent, now more middle-class consumers have joined the market.

"So these brands have to adjust their sales policies and make plans for different niche markets," he says. "Besides, there is a strong revitalization of Chinese culture and new foreign managers need to keep their values in line with the Chinese values to be accepted."

McGuckin agrees. "Buyers are demanding more and more value at each price point and scrutinizing the total cost of ownership," he says. "New models will offer a lot of choice for buyers to find the vehicle that best suits their driving needs. Quality, safety, cabin technology and fuel efficiency are a bigger part of purchase consideration."

Another important factor is the relationship with the Chinese government and Chinese partners, Zhang says.

"For instance, the hybrid models made by the joint ventures are highly controversial and whether the government will approve them is not settled yet," he says.

Xu notes that foreign partners previously had a bigger say in a joint venture as Chinese partners were relatively weak in capital and technology, but now that competition in the market is fiercer, they have to get along better with each other and avoid disputes.

wangchao@chinadaily.com.cn

(China Daily 12/14/2012 page21)

Today's Top News

- Xi stresses improving long-term mechanisms for cyberspace governance

- Experts share ideas on advancing human rights

- Japan PM's remarks on Taiwan send severely wrong signal

- Key steps to boost RMB's intl standing highlighted

- Sustained fight against corruption urged

- Xi calls for promotion of spirit of volunteerism