Clouds of doubt darken trade outlook

| An employee in the workshop of a textile company in Shaoxing, Zhejiang province. Some textile companies in Shaoxing are retreating from European markets. Provided to China Daily |

Chinese companies eye new markets to stay Buoyant as european economies contract

As the European Union has lowered expectations for its economy, China's trade relationship with its largest trading partner looks gloomy for the rest of this year, and all of next, analysts say.

Although China's overall export performance in October turned out to be better than expected, the figures related to the EU were disappointing.

China's total exports last month were $175.57 billion (138 billion euros), 11.6 percent higher year-on-year compared with September's 9.9 percent year-on-year growth.

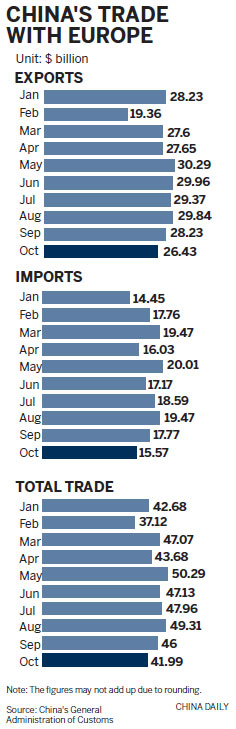

However, bilateral trade between China and the EU continued to drop by 5.5 percent from a year earlier to $41.99 billion in October. The decrease was 3 percent year-on-year for bilateral trade in the first 10 months of this year.

In October, exports to the EU fell 8 percent year-on-year to $26.43 billion, while imports fell 0.8 percent to $15.57 billion.

The European Commission issued its autumn economic outlook on Nov 7, describing the region's economy as "sailing through rough waters". The report forecasts that the EU will have an annual GDP growth of 0.5 percent in 2013. In the May report, it had predicted growth of 1.3 percent next year.

Worse, the German economy, which was relatively robust during the EU debt crisis, is expected to have slowed further in the second half of 2012.

The European Commission report estimates that Germany will have annual GDP growth of 0.8 percent in 2012 and 2013. It had previously predicted 1 percent for this year and 1.4 percent for 2013.

In the first 10 months of this year, China's exports to Germany fell 9.1 percent year-on-year to $57.77 billion, and imports fell by 0.3 percent to $76.43 billion.

Feng Zhongping, an expert in European studies at the China Institutes of Contemporary International Relations, says this suggests that a long period of recovery from the financial crisis.

"The performance of Germany, the largest economy in Europe, reflects that uncertainty still weighs on the economy of the EU as a whole," he says.

"The EU's expectation of its economy will largely affect the business confidence of Chinese exporters, which may lead them to turn to other markets."

Shou Lumin, deputy director of the construction and management committee of China Textile City in Shaoxing, East China's Zhejiang province, the country's largest textile industry cluster, says its member companies are making more efforts to expand in markets such as Russia, Southeast Asia and the Middle East.

"The European economy is not good, and demand from European markets is falling, so why should we stick to that?" she asks. "There are larger business opportunities in the emerging markets." Shou says many textile companies in Shaoxing are retreating from European markets.

"It is not that they don't want to do business in European markets," she says. "The uncertainty with the European economy and shrinking demand scares them."

Yu Qi, sales manager at Shaoxing Qingwu Textile, says the company is looking to markets other than Europe.

"We used to focus on the Italian market, and everybody can see what the Italian economy is like now. The risks are too high for us to remain in that market," Yu says.

Li Jian, a researcher with the Chinese Academy of International Trade and Economic Cooperation, a think tank under the Ministry of Commerce, says this attitude is likely to persist.

"Chinese exporters have no time to wait for the slow recovery of the European economy. Also, the rising trade frictions between the two regions are driving them away," he says.

Li says European countries will take steps to revitalize their manufacturing industries and increase job opportunities as they struggle to repair their economies.

"It will have a strong impact on Chinese companies there, who may be treated unfairly," he says.

In the past several months, trade friction between China and the EU has grown. As well as announcing an investigation into alleged solar panel dumping, the EU is collecting evidence relating to China's telecom equipment companies Huawei and ZTE and anti-dumping and subsidy rules.

"It seems that the European countries are making efforts to protect their own companies in industries where China is doing well in the European market, or by raising the standards of traditional industries like textiles," Li says.

"It is understandable, but harmful to the business of Chinese companies. It is smart for the companies to move their eggs to other baskets, such as the emerging markets."

According to the Ministry of Commerce, China's big traditional trade partners, the EU, the United States and Japan, now account for 56 percent of China's total trade volume. At its peak, it was about 70 percent.

In the first 10 months of this year, China's trade with Russia grew 13.4 percent year-on-year, and by 34.9 percent for South Africa and 9.4 percent for the ASEAN region.

Although China's total trade performance was better than expected, it is still a tough ask for the country to reach its 10 percent annual growth target.

"October's stronger-than-expected exports growth was probably because of the seasonal pick-up of Christmas orders and better-than-expected US demand," says Sun Junwei, an economist at HSBC.

"In fact, this trend in upside surprises is unlikely to be sustained over the coming months, considering the risks of the fiscal cliff in the US, the European crisis and still weak growth in other major economies."

Chen Demin, China's minister of commerce, also admits 10 percent growth is difficult to attain and the country is now trying to maintain its share in the global market.

yanyiqi@chinadaily.com.cn

(China Daily 11/16/2012 page19)

Today's Top News

- Xi stresses improving long-term mechanisms for cyberspace governance

- Experts share ideas on advancing human rights

- Japan PM's remarks on Taiwan send severely wrong signal

- Key steps to boost RMB's intl standing highlighted

- Sustained fight against corruption urged

- Xi calls for promotion of spirit of volunteerism